- FX – USDIndex rotates at 101.65, EUR holds at 1.0970 and JPY pushed to over 135.00 before declining to 134.50. Sterling got a big boost from the inflation data and trades at 1.2470.

- Stocks – US markets closed flat again (-0.23% to 0.03%) #US500 closed unchanged at 4154. – US500 FUTS are at 4167 and below the key resistance at 4175.

- Commodities – USOil – Futures tanked into $78.35 today following inventory decline of 4.6 million barrels and weak Asian markets, Gold – continued to slip, testing $1970, yesterday before recovering to trade at $2000.0

- Cryptocurrencies – BTC declined from the $30k level yesterday, breaking $29k today.

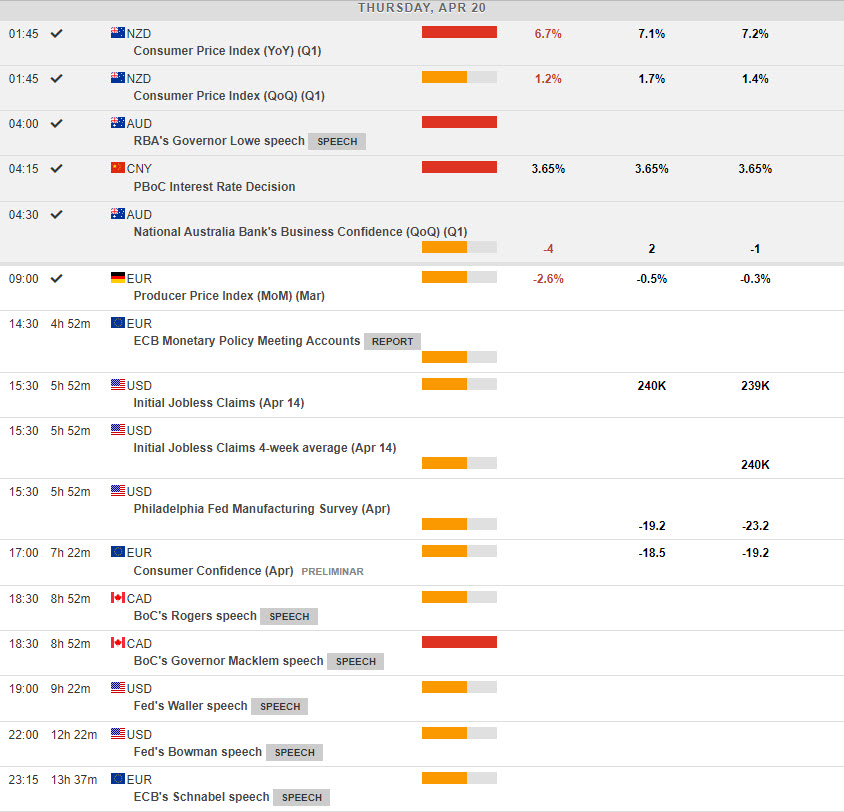

Today – US Weekly Claims, Existing Home Sales, EZ Consumer Confidence, ECB Minutes, Speeches from Fed’s Williams, Waller, Mester, Bowman & Bostic, ECB’s Lagarde & Schnabel. EARNINGS Phillip Morris, AT&T, American Express, Publicis, EssilorLuxottica, Renault & Nokia.

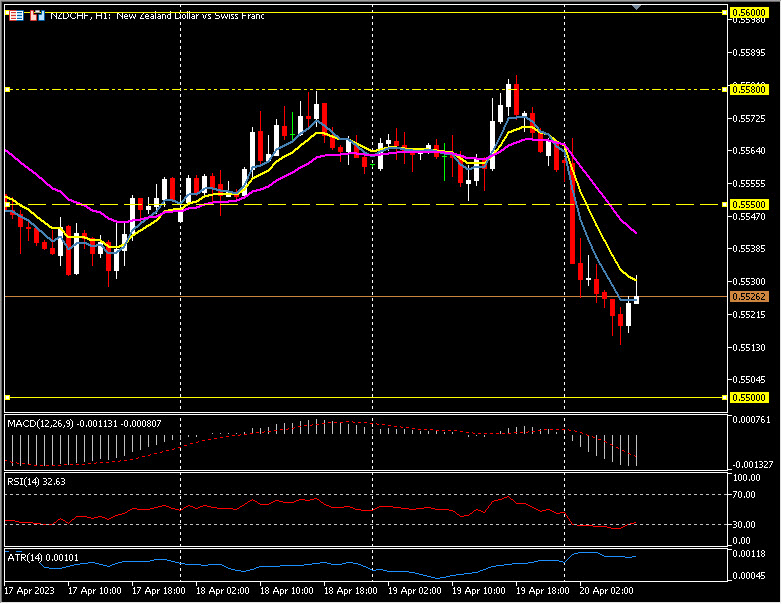

Biggest FX Mover @ (06:30 GMT) NZDCHF (-0.75%). Tanked from 2-day highs at 0.5580 yesterday to 0.5513 lows today. MAs aligned lower, MACD histogram & signal line negative & falling, RSI 33.28 & flat, H1 ATR 0.00101 Daily ATR 0.00530.

Click here to access our Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.