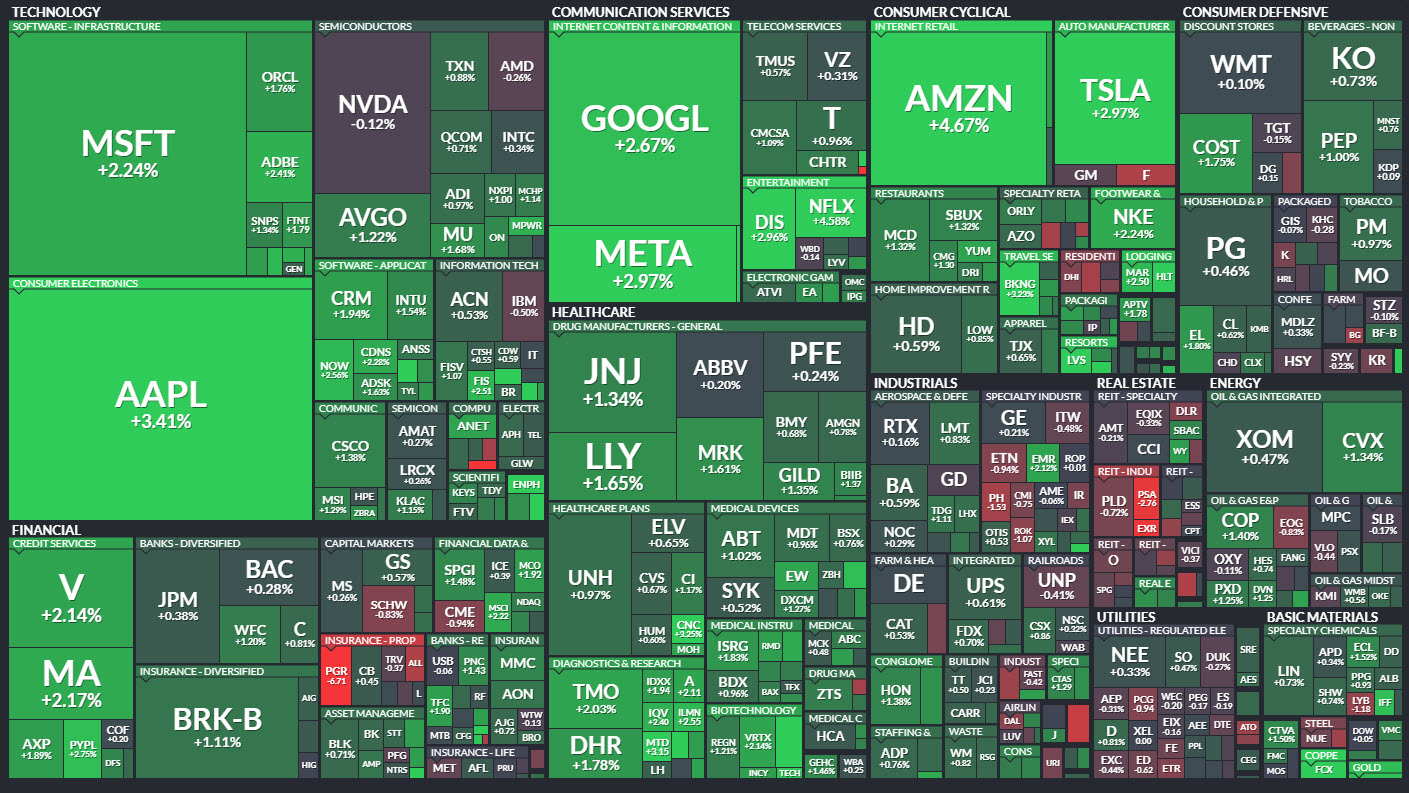

Stock trading screens turned green yesterday after cooler than expected PPI (-0.5% vs 0.0) and a bigger than expected increase in jobless claims (239k vs 228k)helped propel Wall Street to better than 1% gains. The NASDAQ surged 1.99% to top the 12,000 level again. The US500 jumped 1.33% and has been over the 4,000 mark for an eleventh straight session. The US30 was up 1.14% to top 34,000 for the first time since mid-February. Treasuries closed in the red 10yr at 3.44% and the curved is now 52 pts inverted. USD continues to decline and trades at 12-mth lows, EURUSD over 1.1070 this morning and Sterling trades at 1.2540. Asian markets cautious & flat (save NIKKEI +1.1%) & European FUT’s are firmer ahead of US bank earnings, Retail Sales and UoM Consumer Sentiment.

Overnight Data Singapore’s central bank sprang the surprise of the Asian day by halting its tightening cycle, markets were expecting more restraint. Singapore joins Canada & Australia, India & South Korea to press the pause button. They also issued a gloomy outlook.

- FX – USDIndex declined further to 100.50 and 12-mth lows and a third consecutive week of declines. EUR spiked to 1.1070 earlier and holds the bid. JPY dived from 133.00 and is testing 132.00 now. Sterling rallied to breach 1.2500 and holds this key level.

- Stocks – US markets closed with strong gains across all sectors (1.14% to 1.99%) as the rate sensitive Tech sector led the rally. #US500 closed +54 pts. at 4146. – US500 FUTS are also higher today at 4167 having tested the resistance at 4175 again. #AMZN & #NFLX gained over 4% each and #GOOG, #MSFT & #TSLA over 2% each.

- Commodities – USOil – Futures cooled from weekly highs at $83.50 to $82.30 today. Gold – holds over the $2040, level today having been to a low of $2015 yesterday. Next major resistance sits at $2050.

- Cryptocurrencies – BTC holds the $30k level spiking to $30.8k today.

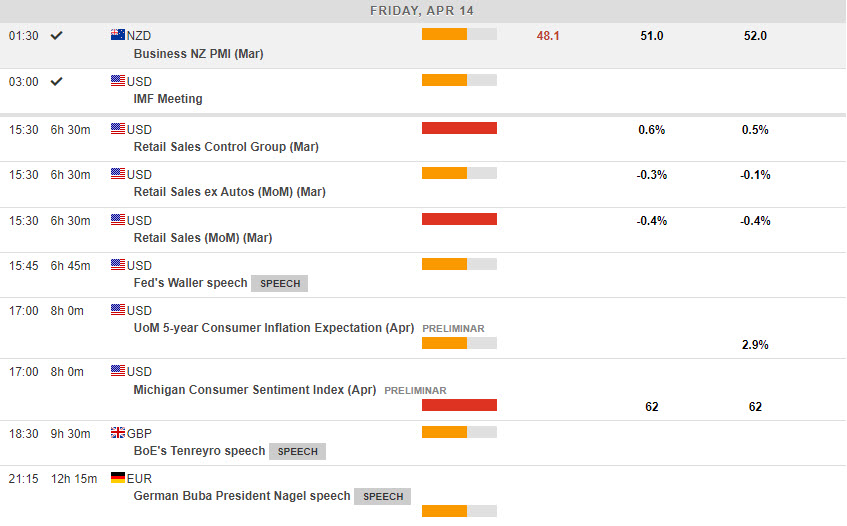

Today – US Retail Sales, US Industrial Production, US Uni. of Michigan Prelim. Survey, speeches from Fed’s Waller, BoE’s Tenreyro, Earnings from UnitedHealth, JPMorgan, Wells Fargo, Citigroup, BlackRock.

Biggest FX Mover @ (06:30 GMT) EURAUD (+0.32%). Continued to rally from under 1.6260 yesterday to test 1.6340 today. MAs aligned higher, MACD histogram & signal line negative but rising, RSI 55.00 & rising, H1 ATR 0.00161, Daily ATR 0.01377.

Click here to access our Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.