UnitedHealth Group, an American multinational managed healthcare and insurance company based in Minnesota, shall announce its Q1 2023 earnings result on 14th April (Friday), before market open. The company operates through various segments, namely UnitedHealth care (coordinates patient care, improves affordability of medical care, analyses cost trends, manages pharmacy benefits, works with care providers more effectively and creates a simpler consumer experience), OptumHealth (provides health and wellness care and serves the broad health care market place including payers, care providers, employers, government, life sciences companies and consumers), OptumInsight (focuses on data and analytics, technology and information) and OptumRx (offers pharmacy care services). As of the last records in 2022, UnitedHealth Group is ranked the second largest healthcare company, and it is also the 12th largest company worldwide based on revenue.

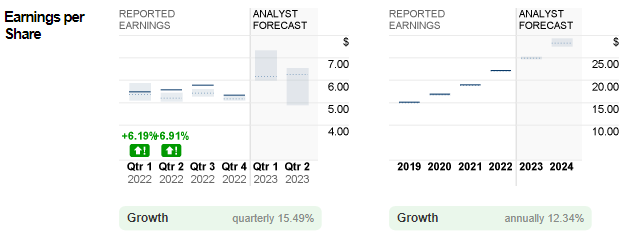

Fig 1:Reported Sales of UnitedHealth Group vs Analyst Forecast: CNN Business

Fig 1:Reported Sales of UnitedHealth Group vs Analyst Forecast: CNN Business

Sales of UnitedHealth Group were on par with analyst forecasts in FY 2022, at above $80B for every quarter. The total reported sales for the year hit $324.2B, over estimates which was $323.9B. In the coming quarter, consensus estimates for sales stood at $89.7B, up 8.33% from the previous quarter, and up nearly 12% from the same period last year.

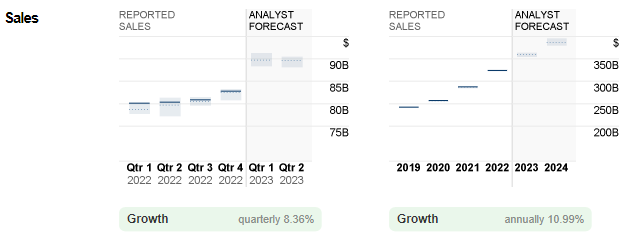

Fig 2:Reported EPS of UnitedHealth Group vs Analyst Forecast: CNN Business

Similarly, EPS beat consensus estimates in every quarter last year, between $5.34-$5.79. In Q1 2023, it is estimated that the figure shall hit $6.16, up over 15% from the previous quarter, and up over 12% from the same period last year.

Fundamentally, based on historical financial results and projected estimates, UnitedHealth Group is undoubtedly a financially stable company with positive growth prospects, despite current undesirable macroeconomic trends which are hitting companies from various sectors and the fact that healthcare stocks are being regarded as defensive in nature following an inelastic demand in the healthcare industry. All in all, UnitedHealth is rated by analysts as “Buy”.

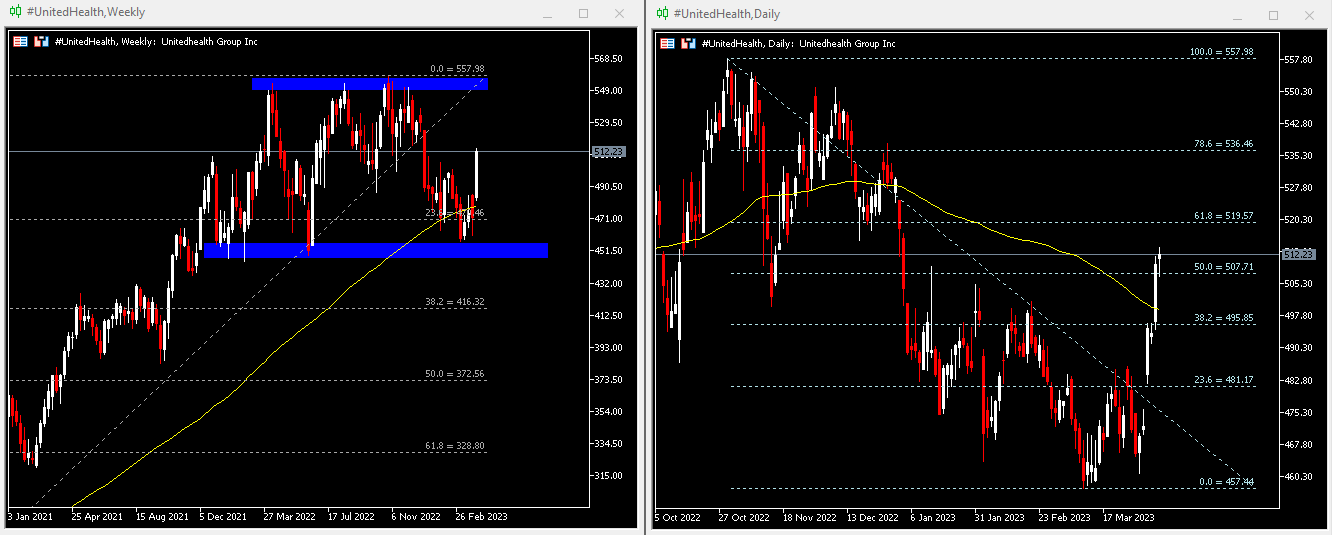

Technical Analysis:

The #UnitedHealth (UNH.s) share price been trading in consolidation in the first quarter of 2023, leaving an all time high at $557.98. Last week, it surged higher above February’s high ($504.10), closing at $512.23. The weekly gains were over 6%, driven by good news on the public health front. On the daily chart, the company’s share price remains supported above $507.70, or FR 50.0% extended from the ATH to session lows seen in February. As long as the support level remains intact, the bulls may continue testing the next resistance at $519.60 (FR 61.8%), followed by $536.50 (FR 78.6%). On the other hand, if the share price retraces and breaks the said support, the bears may test dynamic support 100-day SMA and $495.85 (FR38.2%), then $481.20 (FR 23.6%).

Click here to access our Economic Calendar

Larince Zhang

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.