The US30 on Tuesday (28/03) recorded a moderate decline with the US100 falling to a one-week low. Tuesday’s higher T-note yield weakened technology stocks. Global bond yields moved higher Tuesday as worries about the banking sector eased. The US 10-year T-note yield rose +3.0 bp to 3.560%. Also, the German 10y Bund yield rose +6.3 bp to 2.290%, and the UK 10y Gilt yield rose +9.0 bp to 3.456%.

The increase in the trade deficit in February was predicted to be the reason behind the temporary weakening of the stock index. The latest situation report on consumer confidence in March also declined. Meanwhile, house prices rose at an annual rate according to the Federal Housing Finance Agency (FHFA) and S&P CoreLogic Case-Shiller.

US30 was down 0.12% points at the close as American Express Co fell 2.40%. The US100 lost 0.49%, while Lucid Group Inc. fell 7.25%. The US500 fell 0.16% as Humana Inc. fell 4.74%. Bank stocks steadied for a 2nd day, as hopes for more support from US authorities lifted sentiment. USOIL’s rally to a 2-week high on Tuesday also boosted energy stocks.

Techincal Analysis

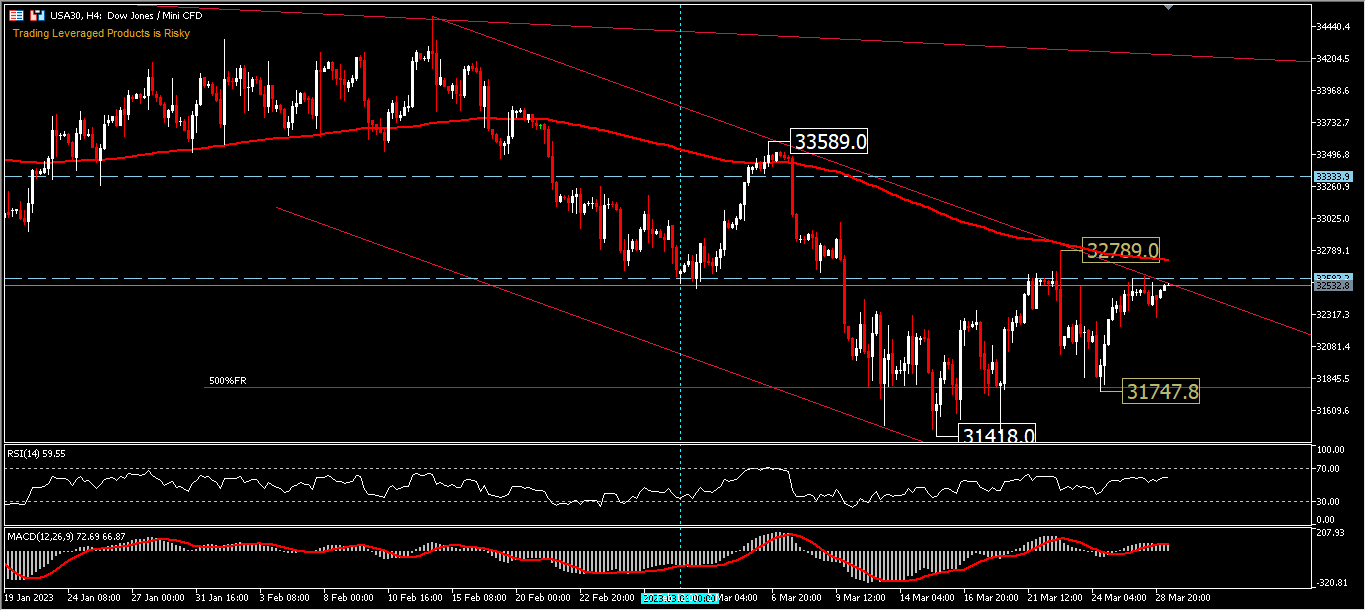

Throughout March, US30 was traded in the range 31,418-33,589. Until the close of trading Tuesday, US30 was down only -0.6% in March and just over -2.5% as of January open 2023. Technically, the price of the index is below the 200-day EMA, breaking the 32,467 support in early March in reaction to SVB’s failure which led the index to land at a 5-month low of 31,418. However, the government’s support to stabilize the banking sector has implications for USA30 which is rebounding again towards the opening price in March, temporarily forming a monthly Doji candle with a long lower and upper shadow. The RSI has departed from the oversold area, approaching the median line 50 again. MACD is still in the sell area and has not validated any significant price changes.

Minor resistance is seen at 32,789, and a move above this level followed by a break of the 200 EMA to the upside could test 33,589. As long as the price moves below the EMA, the downside risk remains. Minor support is seen at 31,747, and a move below this price level could test the 31,418 support. However there doesn’t seem to be any significant movement to close March, other than the consolidation reflected in the recent price overlapping, unless the PCE report offers anything.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.