The Dollar rolls into midweek flexing its muscles against its peers on the back of upbeat US Jobs data.

Dollar

Midway through the week and the Dollar finds itself nearing a one-month high. Factors driving this renewed buying interest can be attributed to firmer US employment data, as well as president Biden and Treasury secretary Yellen pushing back firmly on recession fears and backing the Fed’s hawkish stance on monetary policy ahead of their next move. That being said, the three day rally took a breather as investors digested Powell’s speech yesterday at the Economic Club of Washington where he said the FED didn’t expect such a strong jobs report for January, but nevertheless, they wouldn’t be expecting to cut rates anytime soon, however there seems to be a good path being carved out and they are accomplishing what they intended with their monetary policy stance.

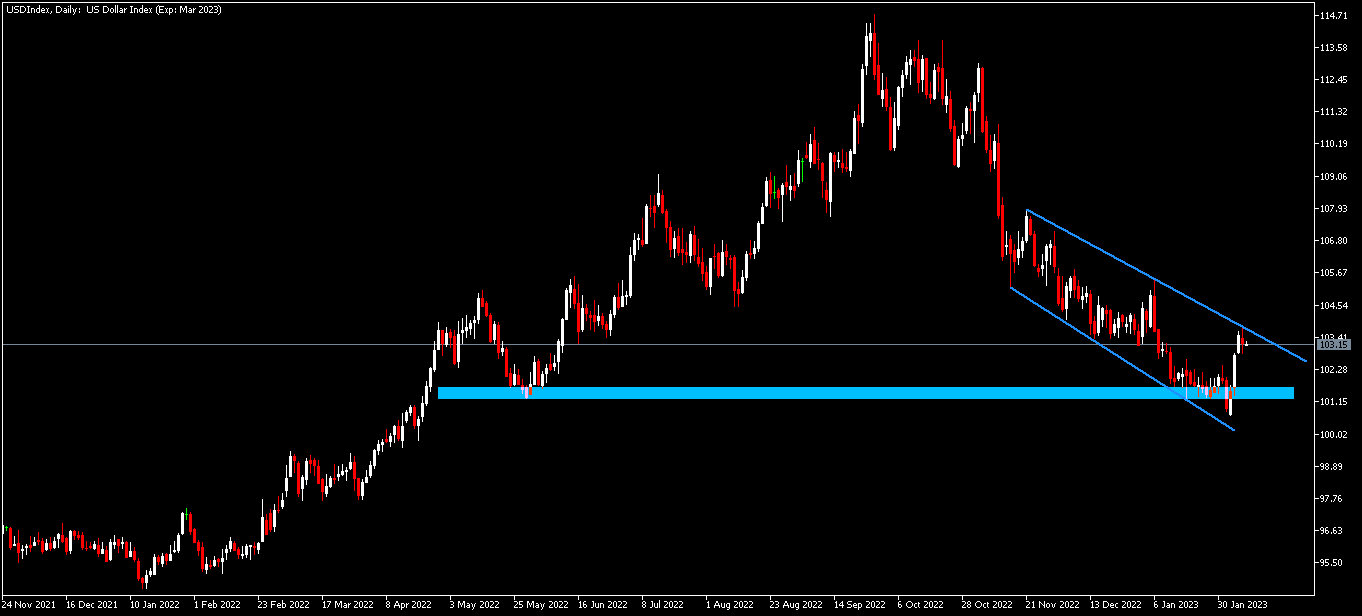

Technical Analysis (D1)

In terms of market structure, price briefly broke through the key 101.15 area where the previous higher-low was formed in June 2022. The nuance to be noted however, is that price came back above the key support area and is approaching this area in a corrective nature in the form of a descending channel which could turn out to be a potential reversal pattern. If bulls can defend this area, the narrative could still remain bullish for the long term, however the opposite applies if the area is invalidated by sellers in an impulsive break of structure.

Euro

The Euro rolls into the middle of the week under pressure from dollar dynamics as it retreats from a 10-month high. Factors driving this selling interest can be attributed to mixed comments emanating from ECB officials where a hawkish stance was kept on their next rate decision, but no commitment to any additional policy action thereafter failed to pique the interest of investors in the European common currency. Going into the remainder of the week, investors will be eyeing central bank speak for any hints on further rate increases in May, which could cause the Dollar to continue to gather strength at the expense of the Euro.

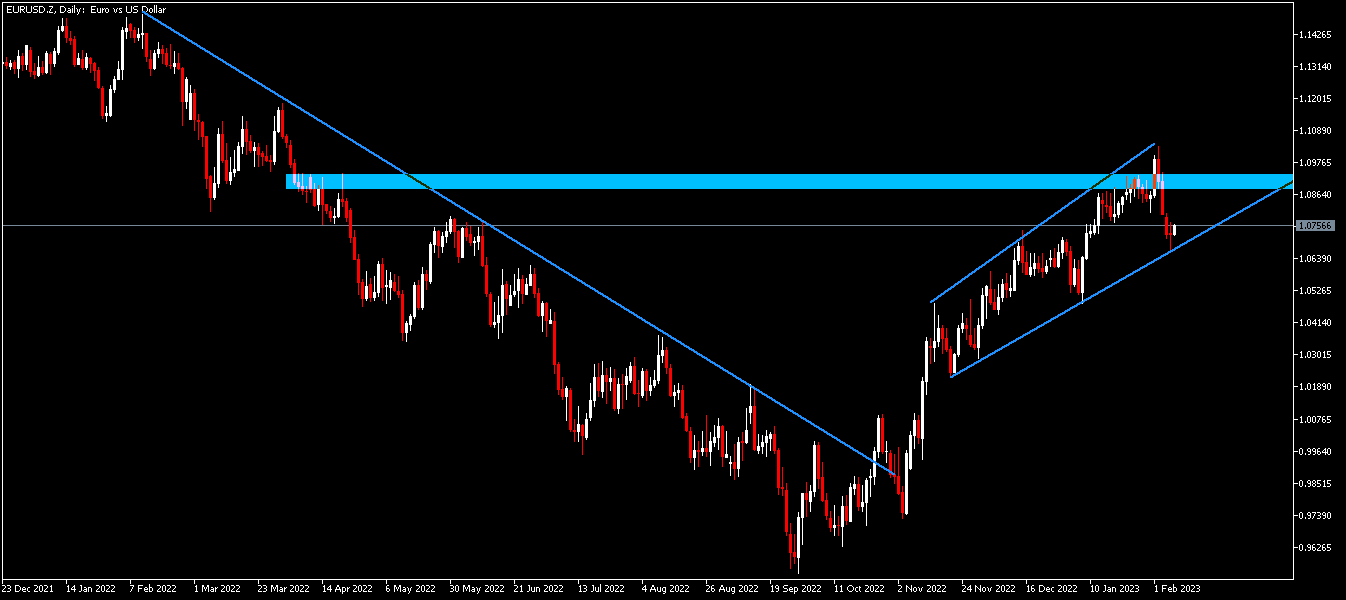

Technical Analysis (D1)

In terms of market structure, the current price has briefly pierced the key the 1.092 area, but retreated back below the resistance area. The way in which price approached this area in the form of an ascending channel gives bears the possibility of validating this reversal pattern and if defended by the bears, price could potentially reverse. Conversely if the bulls can sustain the pressure, price could break above the level and continue the uptrend if it invalidates the resistance area in an impulsive wave.

Pound

The Pound heads into the middle of the week under pressure from the bears as it reaches a one-month low. Factors driving this renewed selling interest can be attributed to dollar dynamics as well as mild expectations that the BoE could be nearing the end of its current rate-hiking cycle. This dovish sentiment comes on the back of BoE Governor Andrew Bailey remarking that inflation is set to fall rapidly in the second half of 2023, and this influenced investors with a bullish bias to hold back on placing aggressive bets on the British currency. Looking into the rest of the week, the Pound will be driven by dollar dynamics as investors await the BoE’s monetary policy report on Thursday.

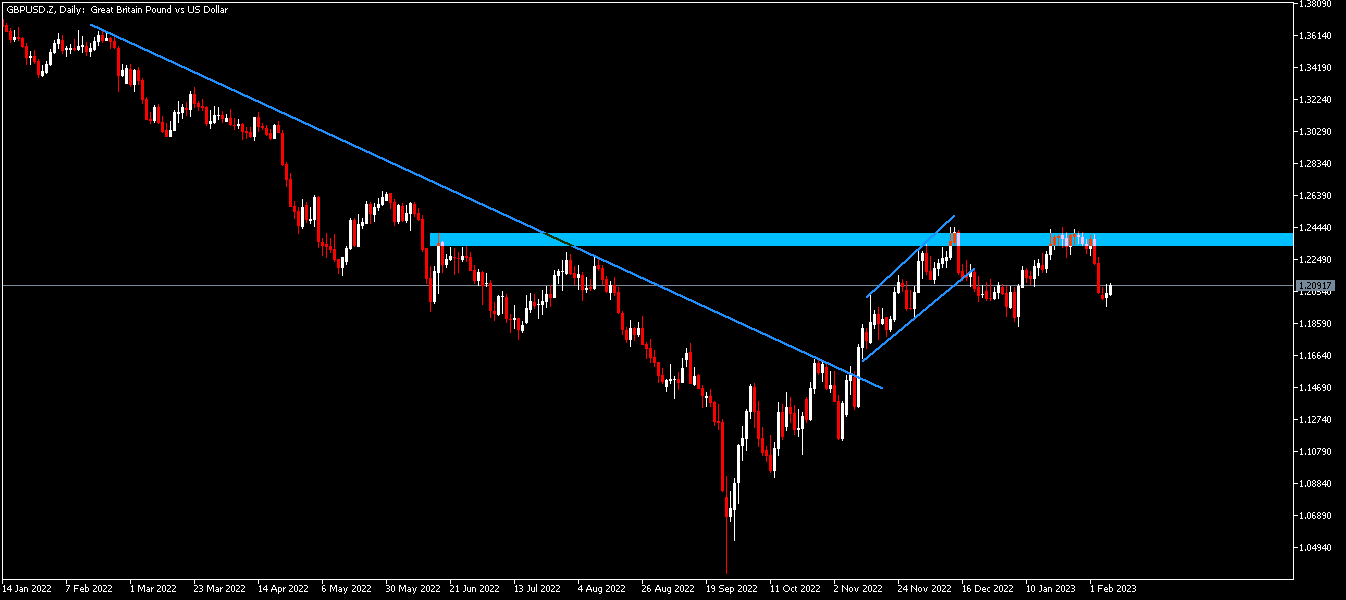

Technical Analysis (D1)

In terms of market structure, the downtrend has been broken and the bulls have been in control of the narrative since then, moving price to test the key 1.244 level before it pulled back forming a potential bearish double-top. As price retests this peak formation again, two scenarios present themselves. Namely, If the area is defended by sellers it could result in the potential reversal pattern being validated. Conversely, if buyers break above the area, price will continue to remain bullish in the near term.

Gold

Gold heads into the middle of the week finding support around the $1 859 level, on the back of a sell-off triggered by upbeat US jobs Data. Factors driving this mild recovery midweek can be attributed to FED chair Powell’s speech at the Economic Club of Washington, where his comments on disinflation prompted a sell-off in the Dollar, which benefited the yellow metal. Current sentiment on the back of the speech have spurred on investor sentiment about the disinflationary process, with hopes leaning in favour of the US central bank slowing their pace of interest-rate hikes further down the line. Heading into the remainder of the week, investors will be focusing on speeches from FED officials for new guidance on the central bank’s monetary policy outlook.

Technical Analysis (D1)

In terms of market structure, Gold has broken out of the outer trendline on the downtrend, and since then, bulls have been in control of price. Currently price action has slightly breached a significant resistance at the $ 1 949 area creating a new high before retreating into the range. If sellers can defend this area price could move back below the new High and validate the potential reversal pattern forming in the form of an ascending channel, however if buyers maintain their interest, price could break above and remain bullish towards the $1 998 level, which represents the previous lower-high.

Click here to access our Economic Calendar

Ofentse Waisi

Financial Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.