Activision Blizzard (named after the merger between Activision and Vivendi Games in 2008) is known as the largest US gaming company by market capitalization (currently over $57B). The company engages in delivering content through premium and free-to-play offerings, generating revenue from full-game and in-game sales, subscriptions, and by licensing software to third-party or related-party companies that distribute Blizzard products.

Fig.1: Top Gaming Companies by Market Capitalization. Source: Statista

While the trading volume of the US stock market remained thin last week in accordance with the Thanksgiving holidays, the share price of Activision Blizzard plunged over 4% as there was a report that the US Federal Trade Commission (FTC) is likely to file an antitrust lawsuit, thereby halting Microsoft’s acquisition of Activision Blizzard that is worth $69B. The stock ended up as one of the worst intraday performers in the US100 index.

According to Zacks Research, the video game industry has been doing exceptionally well during the Covid pandemic, with overall sales revenue rising 26% and hitting a record high at $191B. However, sales growth began deteriorating since 2022 as more entertainment options became available following economic reopening. In addition, soaring inflation continued to hurt spending on discretionary items. Nevertheless, market participants expect the video game industry to steadily bounce back later in Q4 2022 as sales start picking up. There will be multiple title releases in the coming year, which could serve as a short-term positive catalyst for sales growth.

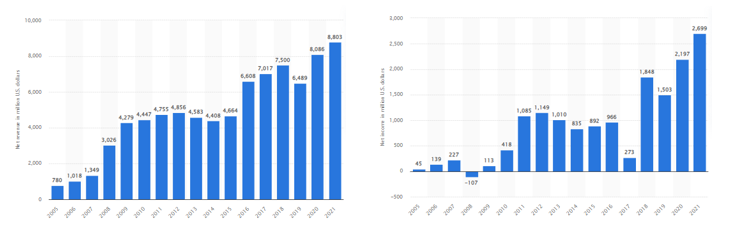

Fig.2: Activision Blizzard’s Net Revenue and Net Income. Source: Statista

Last year, Activision Blizzard’s net revenue reached $8.8B, up over 8% from a year ago. Nearly 74% of the revenue was generated from in-game, subscription and others, while the rest was generated from product sales. On the other hand, net income hit $2.7B, which was also the highest record ever achieved.

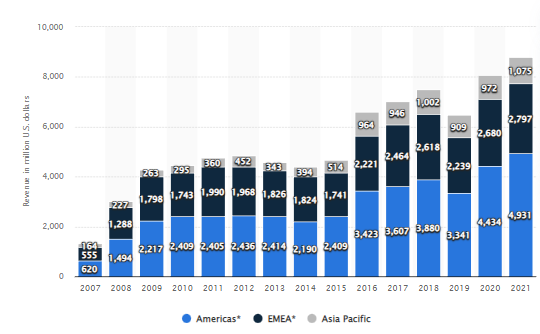

Fig.3: Activision Blizzard’s Net Revenue, by region. Source: Statista

Fig.3: Activision Blizzard’s Net Revenue, by region. Source: Statista

At least 3% of Activision Blizzard’s net revenue derived from China, the world’s biggest market for online games. Recently, the company announced suspension of its services in China beyond January 2023 following failure in extending licensing agreement with local firm NetEase. Coupled with age and playing time restrictions imposed by the Chinese government, the gaming company’s revenues may be adversely affected.

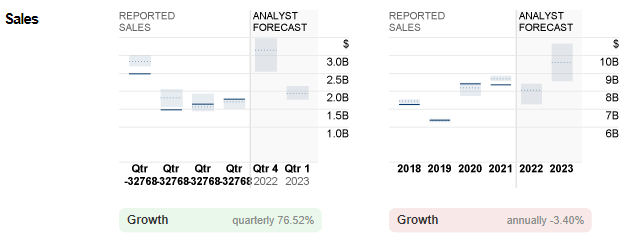

Fig.4: Reported Sales of Activision Blizzard versus Analyst Forecast. Source: CNN Business

Activision Blizzard shall report its earnings for Q4 2022 on 9th February next year. Consensus estimate for sales stood at $3.1B, up over 70% from the previous quarter and 24% from the same period last year.

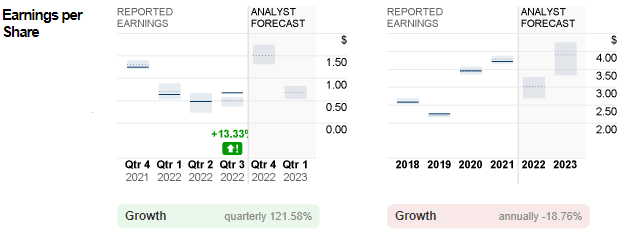

Fig.5: Reported EPS of Activision Blizzard versus Analyst Forecast. Source: CNN Business

EPS is expected to hit $1.51, more than double the previous quarter. In Q4 2021, the figure was $1.25. All in all, reported sales and EPS for the year are expected to hit $8.1B and $3.02 respectively, below those printed in 2020 and 2021.

Technical Analysis:

Fig.6: Activision Blizzard Historical Price. Source:Google Finance

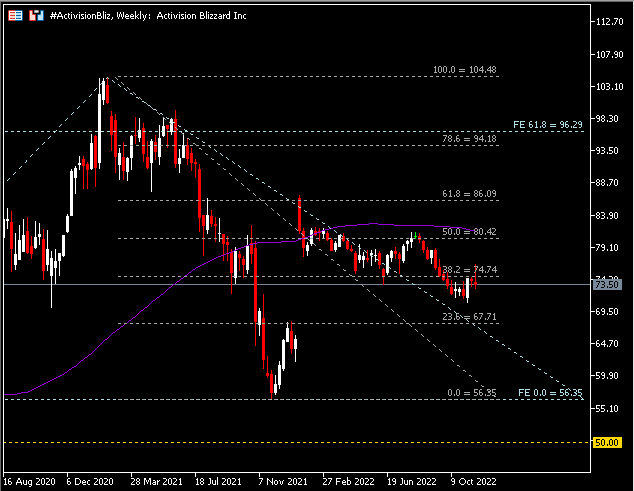

The #ActivisionBliz (ATVI.s) share price has been riding on a strong bullish trend after gaining support from the pivotal retrace in September 2018. It hit an all-time high in February 2021, at $104.48, before undergoing a massive sell-off throughout 2021 to hit a new low since 22nd March 2020 at $56.35. The asset once again rebounded higher from Dec 2021-Jan 2022, but since then has remained capped below $86.

Technically, #ActivisionBliz last closed below $74 (FR 38.2%). The FR 50.0% ($80) and the 100-week SMA serves as the next resistance. On the contrary, as long as the asset price remains pressured below $74, support levels to watch include $68 (FR 23.6%), $56.35 (2021 low) and psychological level $50.

Click here to access our Economic Calendar

Larince Zhang

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.