FX News Today

- 10-year Treasury yields are up 0.5 bp at 2.693% and JGB yields lifted 1.2 bp to -0.0013%.

- Stocks were supported by trade talk hopes as US President Donald Trump’s suggestion that he could see letting the March 1 deadline on China tariffs slide a little if the two sides were close to a complete deal helped to underpin sentiment.

- The negative sentiment that dominated much of the last months of 2018 continues to unwind, but markets will ultimately have to see permanent solutions and real results, otherwise they remain at risk of sliding back again.

- For now though markets are mostly in a positive mood and while the ASX closed with a loss of -0.26%, Topix and Nikkei rallied 1.06% and 1.34% respectively. The Hang Seng is up 1.21%, China’s blue chip index CSI is up 2.1% and the Shanghai Composite 1.92%.

- US futures are equally moving higher, as are European futures.

- Oil prices have also come back from the lows seen early in the week and the front end WTI future is trading at USD 53.64 per barrel.

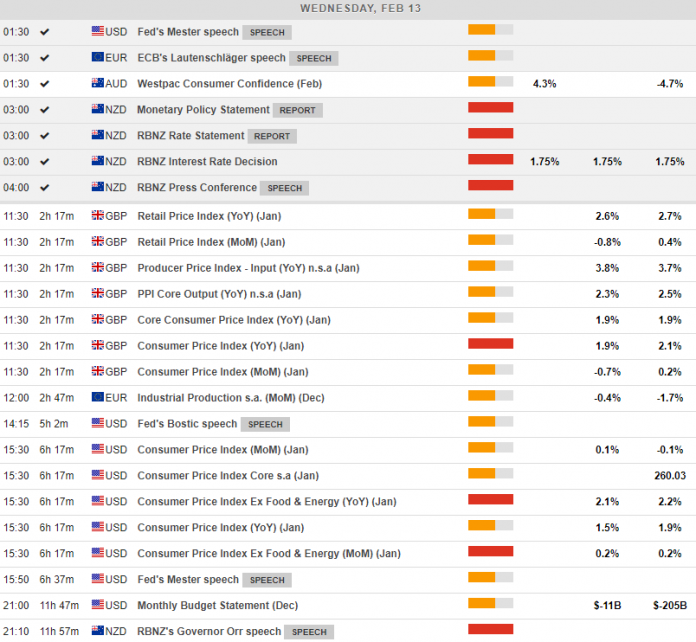

- The calendar today has inflation releases for the UK and the US, with the Riksbank meeting not expected to post any surprises.

Charts of the Day

Main Macro Events Today

- UK Price Indices – The UK’s Price Indices are expected to continue close to their December levels, however at mixed outcomes. The Retail Price Index is expected to stand at 2.6% y/y compared to 2.7% last month, the PPI to increase to 3.8% y/y compared to 3.7%, while the CPI is expected to have stood at 1.9% compared to 2.1% in December.

- EU Industrial Production – Industrial production in the European Union is expected to continue its decline albeit at a slower pace, with a reduction of 0.4% m/m expected in the December data, compared to a 1.7% reduction in November.

- US CPI Inflation – Inflation is expected to have declined in the US, in association with the prevailing understanding of a slowdown in the economy, with the CPI expected to have increased by 1.5% y/y, compared to 1.9% y/y in December. Core CPI is expected to have increased by 2.1% y/y compared to 2.2%.

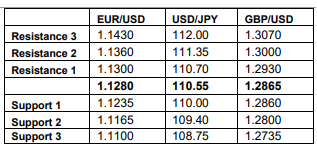

Support and Resistance

Click here to access the Economic Calendar

Dr Nektarios Michail

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.