- USDIndex – Slumped to under 111.00 to 110.75. Weak Housing, the Richmond Manu. Index and Consumer Confidence, added to the outlook, initiated on Friday that rapid rate rises are beginning to have an impact and thus Fed funds futures continue to pare expectations for the terminal rate. From a 5.1% rate as soon as March early last week, implied rates have eased and are showing a 4.88% rate in May, 4.73% in September and hitting 4.50% by December.

- Stocks rallied (NASDAQ +2.25%) for a third consecutive day and weighing on yields but US10yr still holds over 4.0%. Rishi Sunak confirmed as new UK PM, lifting GBP, Gilts & UK100. MSFT & Alphabet both missed Earnings after hours. Asian markets hit 2.5 year lows again but remain positive. (Nikkei +0.80% Hang Seng 0.86%), European FUTS also higher. AUD CPI hit a 32-yr high at 7.3%.

- EUR – leaped over 100 pips from 0.9850, lows yesterday to 0.9978 now ahead of an expected 75 bp rate hike from the ECB on Thursday.

- JPY – Cooled from yesterday’s pivot at 148.85, through 148.00 to 147.85 now, again ahead of the BOJ rate announcement later this week.

- GBP – Sterling rallied strongly (over 230 pips) yesterday to test the key 1.1500 psychological level as Sunak became PM and ruthlessly implemented his own cabinet.

- Stocks – Wall Street rallied again yesterday (+1.07-2.25%) SNAP a further +15.52% after Fridays drumming, TSLA +5.29% & TWTR +2.45%, (Musk said the deal to be done by Friday). MSFT & GOOGL both -6.75% after hours. US500 closed at 3859, FUTS trades at 3830 now.

- USOil – from $83.00 lows again yesterday to test $85.50 after inventories showed draw downs, back to $84.70 now.

- Gold – dipped to $1640, yesterday before breaching $1660 to test $1665 resistance.

- BTC – rallied from $19.2k support to breach the important $20k to trade at $20.1k now.

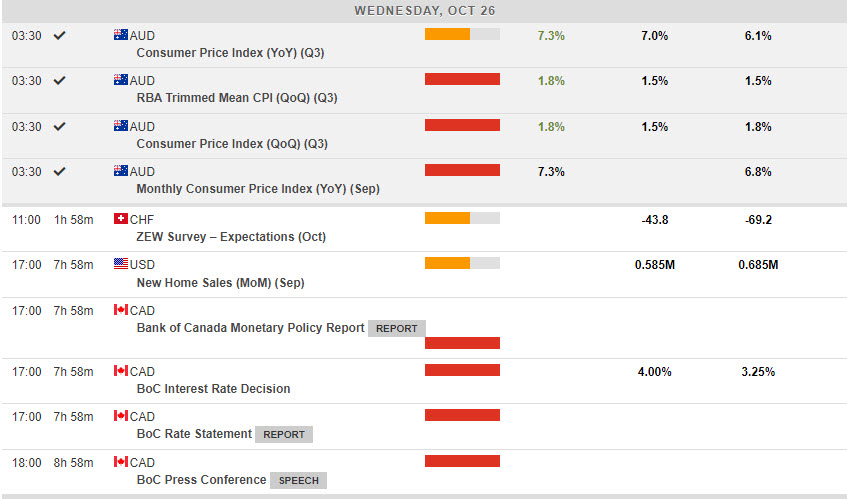

Today – EZ M3, US New Home Sales, BOC Announcement. EARNINGS – Meta, Boeing, BASF, Deutsche Bank (beat), Mercedes-Benz (profits significantly higher), Standard Chartered (beat) Barclays, and more.

Biggest FX Mover @ (06:30 GMT) AUDUSD (+0.56%) Rallied from 0.6300 yesterday to 0.6435 now following surprise rise in AUD CPI, next resistance 0.6450. MAs aligned higher, MACD histogram & signal line positive & rising, RSI 72.82, OB but still rising, H1 ATR 0.00165, Daily ATR 0.01100.

Click here to access our Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.