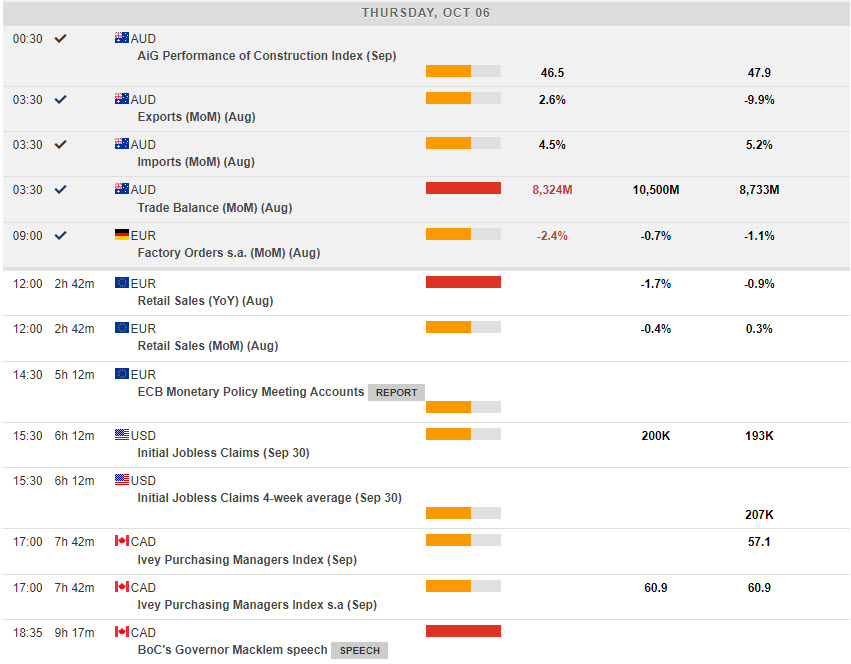

- USDIndex – Rallied from a test of 110.00 peaking at 111.50 following weak Services PMI data in UK & Europe, and a beat for US data; ADP (208k vs 200k) and ISM Services PMI (56.7 vs 56). Closed lower and trades under 111.00 now at 110.83. Fed’s Mary Daly says the Fed is resolute in raising rates to curb inflation and that market anticipation of interest-rate cuts next year is misplaced. Stocks closed flat, yields dipped again and Oil rallied following OPEC+ announcement. AUD Trade slipped and German Factory Orders tanked (-2.4% vs. -0.8%). Asian & European stocks are mixed following the stall on Wall St.

- EUR – A brief test of Parity at 1.0000, reversed all the way to 0.9833 before USD recovered and the pair trades at 0.9915 now.

- JPY – Rallied from lows yesterday at 143.60 and trades at 144.50 now.

- GBP Sterling remains volatile with the new PM under pressure. 260+ pip range yesterday, from 1.1495 to 1.1226. Cable trades at 1.1325 now.

- Stocks – US stocks, were heavy all day but closed flat (-0.2%), US500 -7.65 at 3783. TWTR -1.35%, TSLA -3.46% XOM +4.04%.

- USOil rallied again to $88.40 after OPEC+ agreed 2.0 million barrels per day production cuts, provoking major rebuke from the US.

- Gold – declined from initial test of $1725 yesterday before testing $1700 support and now back to $1725 again.

- BTC – dipped below the key $20k yesterday ,but now back to $20.2k.

Today – EZ/UK Construction PMI, EZ Retail Sales, ECB Minutes, Weekly Claims & Speeches from Fed’s Waller, Evans, Cook & Mester and BOC’s Macklem.

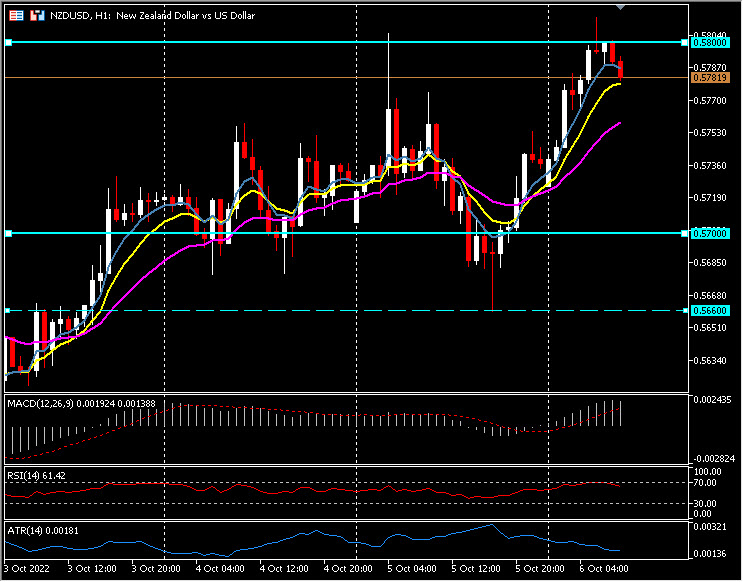

Biggest FX Mover @ (06:30 GMT) NZDUSD (+0.84%) Rallied from yesterday’s low at 0.5660 to 0.5800 resistance today. MAs aligned higher, MACD histogram & signal line positive & rising, RSI 61.20 & rising, H1 ATR 0.00181, Daily ATR 0.01096.

Click here to access our Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.