The recent mini-budget presented by Finance Minister Kwasi Kwarteng has sparked a significant sell-off in the UK bond market as investors grow increasingly anxious about rising interest rates and a possible credit rating downgrade. To stop more economic chaos, the Bank of England had to step in and inject liquidity into the bond market. The mini-budget blunder appears to have saved Barclays’ share price, but it is a preview in the short term as the UK struggles with a new administration and rising cost of living.

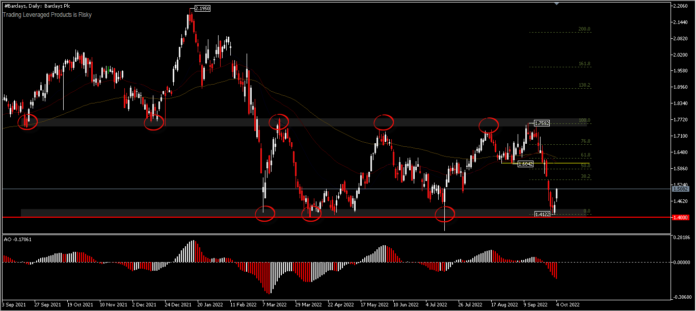

Barclays share price rose more than 4% to close yesterday’s trading session at 1.5082 but has retraced to the 1.4600 zone today. The increase is a continuation of the rebound of 1.4122 from Monday’s low.

The current bullish impetus coincides with growing anxiety about the state of the UK economy. However, the banking sector appears to have benefited from the steps taken to address these concerns, which may have led to the recent price hikes in the Barclays market. For example, the recent increase in interest rates by the Bank of England will have a significant effect on the profitability of the banking sector.

Barclays’ stock price fell to the low seen around April 2022 during the early trading session of the week, before closing with a second straight day of gains. The current price movement is more likely a price retracement of the decline to the continued peak of 1.7582 than a price reversal. A further rebound is possible to test the 38.2% (1.5442) level if there is a rally today and if it is strong it will be limited below the 1.6042 neckline.

Meanwhile, on the downside it will remain limited to support from this week’s low at 1.4122. Broadly speaking, the downward trend from the peak of 2.1950 (Jan’2022) is probably not over yet, as the price movement is indicated to be still below the daily moving average and the histogram oscillations are still on the sell side. A drop back to lower support will provoke the bulls to re-enter the market, should there be a decline in the coming days.

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst – HF Educational Office – Indonesia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.