- USDIndex – breaks range and tops at 114.63. Economic data on confidence, durables, home sales, and the Richmond Fed index were stronger than expected, while home prices declined and broke a long string of gains.

- Yields: A tweet from DoubleLine Capital’s Gundlach that he was buying Treasuries provided some support along with dip-buying and safe haven demand. The 10-year Treasury yield ended over 5 bps higher, testing 3.99% after having dropped over 10 bps to a low of 3.797%.

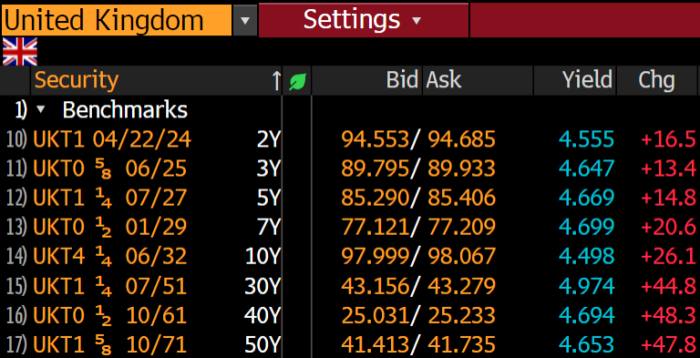

- GBP in a renewed selling, UK bonds sold off sharply, yields on US bonds higher and US stocks to the lowest level since 2020. 10-year gilt on Tuesday rose 26% to hit a 14-year high of 4.5% after the Bank of England’s chief economist Huw Pill said the loosening of fiscal policy announced last week would “require a significant monetary response”.

- Kwarteng met the heads of companies including Aviva, Legal & General, Royal London, BlackRock, Schroders and Fidelity, to reassure them that his economic strategy would work after days of turmoil in financial markets. Later he spoke to Conservative MPs to calm fears that the government had lost control of the economic situation.

-

IMF criticize Britain’s new economic strategy, saying the proposals are likely to increase inequality. Moody’s warned that unfunded tax cuts were credit negative.

- EUR – fresh low at 0.9540.

- JPY traded at 144.70.

- Stocks: closed mixed with the US100 managing a 0.25% gain, while the US30 declined -0.42%, with the US500 sliding -0.2% to 3647.

- USOil steady at $77. The energy crisis in Europe intensified as European authorities investigated what Germany, Denmark and Sweden said were attacks which had caused major leaks into the Baltic Sea from two Russian gas pipelines.

- Gold – drifted to $1619.97.

- BTC – slide back to $18K area, as stocks fell deeper into a bear market. Ether was also down by less than 1%. – “crypto winter”?

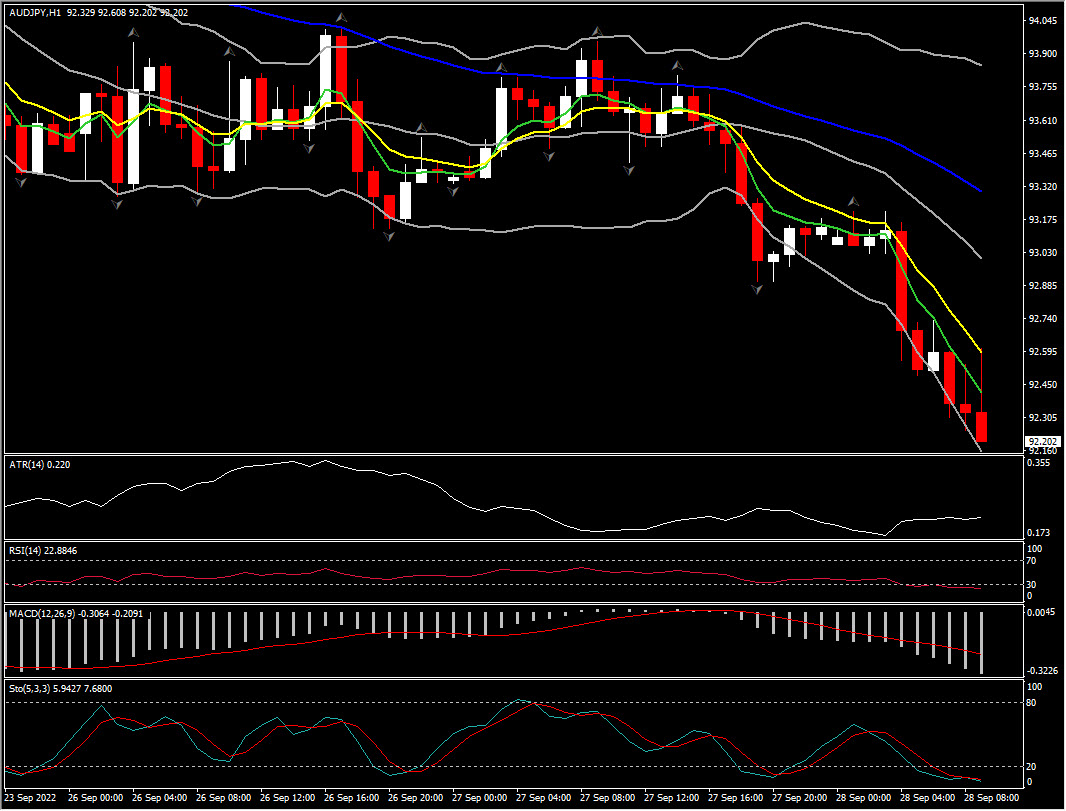

Biggest FX Mover @ (06:30 GMT) AUDJPY (-0.77%) extends outside daily BB. Intraday fast MAs aligning lower, MACD histogram & signal line are negative, RSI at 23, H1 ATR 0.218, Daily ATR 1.166.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.