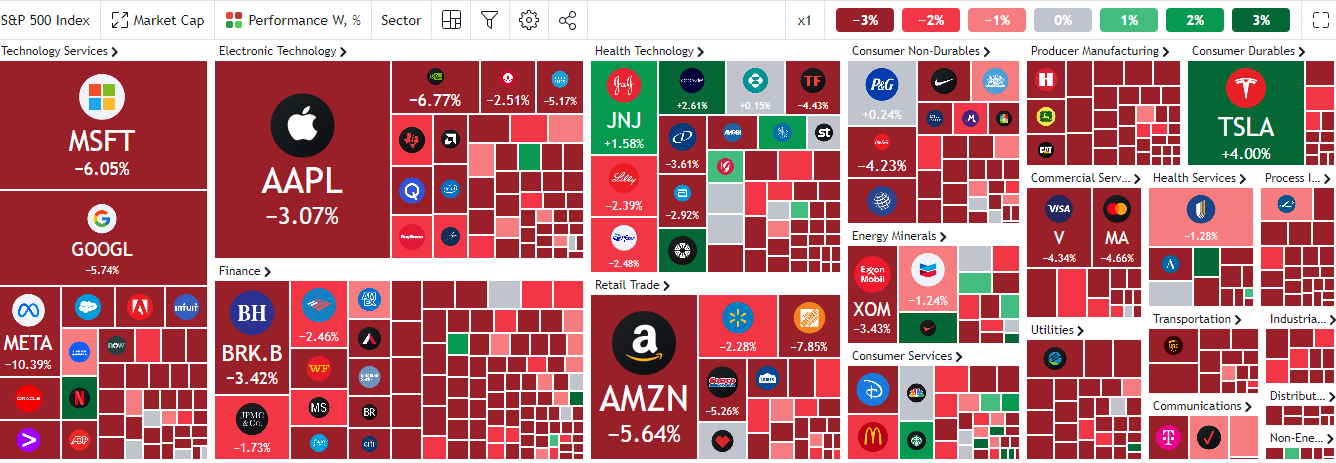

The major US indices ended the week in red, following inflation concerns, expectations for aggressive rate hikes and mounting recession fears. The S&P 500, Nasdaq and Dow Jones plunged to two-month lows.

Fig.1: S&P 500 Stock Heatmap. Source: :Tradingview

Among companies that suffered losses in the previous week, there were a few which closed with gains. One of them was the Tesla, Inc, an electric vehicle behemoth which is also the world’s 6th most valuable company by market cap, at $943.72B. The company share price ended the week with +4% gains.

Fundamentally, the Tesla share price is currently traded at a fairly cheap level, following its 2nd stock split last month (1st stock split was two years ago). It hit its lowest at $265.71, a level not seen since October 2019.

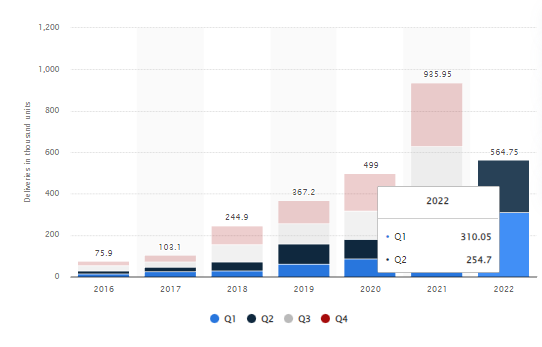

Fig.2: Number of Tesla Vehicles Delivered Worldwide. Source: Statista

Fig.2: Number of Tesla Vehicles Delivered Worldwide. Source: Statista

Tesla’s vehicle delivery worldwide in Q2 2022 was just shy of the previous quarter (254,700 vs 310,050). According to the management, the main reasons for softer growth were supply chain issues with semiconductor chips and parts shortages, as well as China’s Covid restrictions which slowed down its factory production. Nevertheless, the automaker stated that the recent factory upgrade which was completed in August will soon reverse the current situation and the production capacity of electric vehicles could ramp up to 1 million per year.

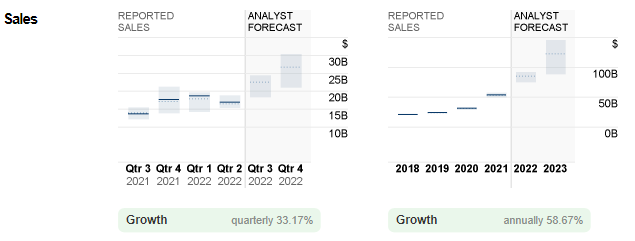

Fig.3: Reported Sales versus Analyst Forecast for Tesla. Source: money.cnn

Sales of Tesla are growing at a steady pace. Last year, reported sales stood at $53.8B, up over 70% from previous year. This year, its sales hit $18.8B and $16.9B for Q1 and Q2, both above consensus expectations. Outlook for total sales this year was set at $85.4B.

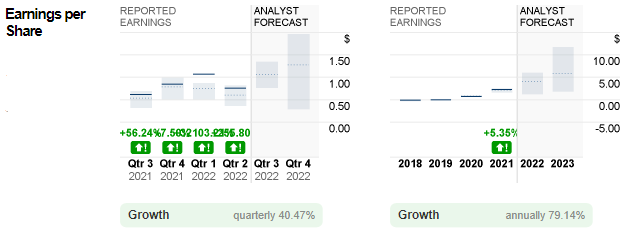

Fig.4: Reported EPS versus Analyst Forecast for Tesla. Source:money.cnn

Likewise, earnings per share (EPS) is also growing steadily. Last year, the company’s EPS doubled from the previous year to $2.26. In 2022, Q1 and Q2 hit $1.07 and $0.76 respectively, both above consensus estimates. Sentiment for the latter half of the year remains positive, with EPS for the full year being expected to reach $4.05, up nearly 80% from a year ago.

Tesla, Inc. shall deliver its Q3 2022 financial report on 19th October. Before that, all eyes will be on Tesla’s AI day which is set for 30th September. Investors and market participants shall focus on the new innovations (eg. Tesla Bot Optimus, Dojo microchip, Robotaxi, Fully Self Driving Beta) that Elon Musk plans to bring to the world. The event can be watched live via Tesla’s website, or its official Youtube channel, at 12am GMT.

Considering the prospect of the possibilities and continued benefits from the Inflation Reduction Act, Wall Street sees more upside potential for Tesla, with ‘2023 as a pivotal year’.

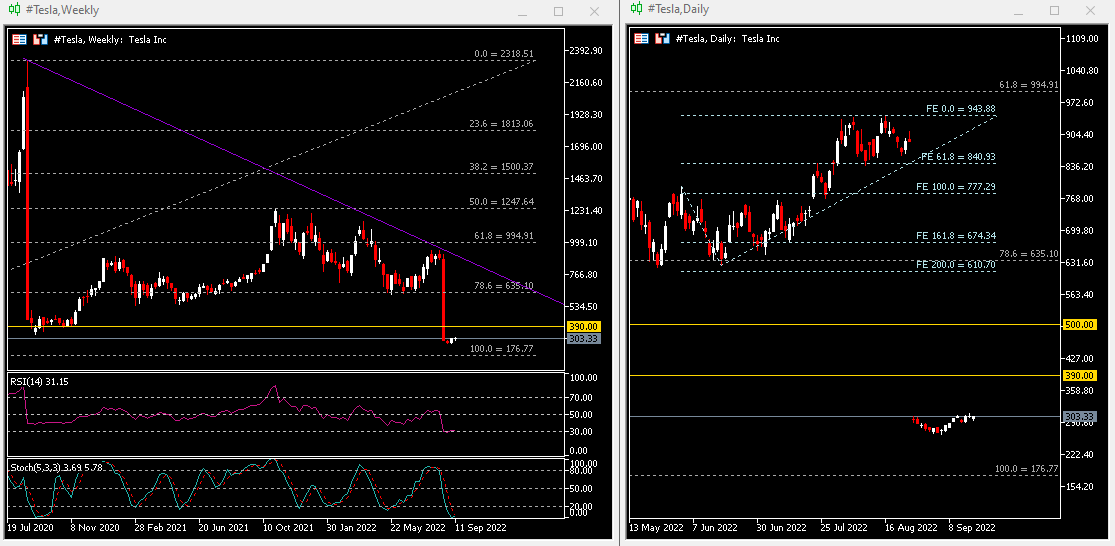

Technical Analysis:

The #Tesla (TSLA.s) share price was traded above the lows seen in Q4 2018 ($247.48). It was 8.5% below the median estimate of analysts ($329.17). This should serve as minor resistance. Breaking above this level may indicate the bulls continuing the momentum towards the next psychological level at $500, followed by the next resistance zone $610.70-$635.10. On the other hand, recent lows at $265.71 serve as the nearest support, followed by $247.48 and $176.77. Weekly RSI is at 31.15 while Stochastic Oscillator is below 20.

Click here to access our Economic Calendar

Larince Zhang

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.