The Australian Dollar is often used as a proxy for China’s economic growth. The AUD briefly rose 0.7% against the USD in Wednesday’s Asian trading to 0.6903 as the relief rally after the latest Chinese factory activity was not as bad as feared, although output contracted for the second month in a row. However the rally in the AUDUSD pair did not last long and soon dropped back to the daily opening price range. The AUDUSD pair ended August sharply lower by around 1.8% due to aggressive central bank rate hikes and slowing growth in China.

China’s official manufacturing Purchasing Managers’ Index (PMI) for August edged up to 49.4 from 49 in July. Activity took a hit from the zero COVID policy, electricity rationing amid the worst heatwave in decades, and a struggling property sector. ANZ on Wednesday lowered its 2022 GDP forecast for the Chinese economy to 3% from 4%, citing weaker demand.

Meanwhile, Australia’s Q2 construction output unexpectedly fell 3.8% on a seasonally adjusted quarter-on-quarter in the three months to June 2022, missing market expectations for a 0.9% gain. This was the second straight quarter of decline in construction activity and the steepest pace since the September 2016 quarter.

Technical Overview

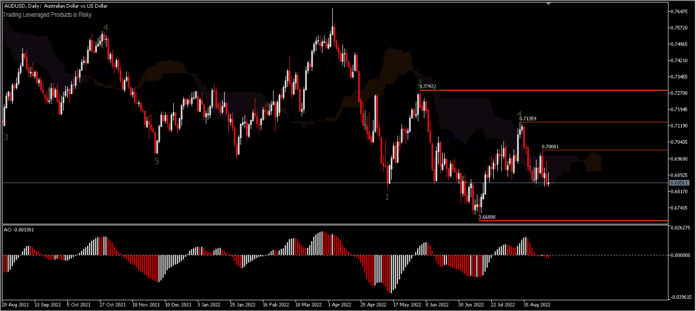

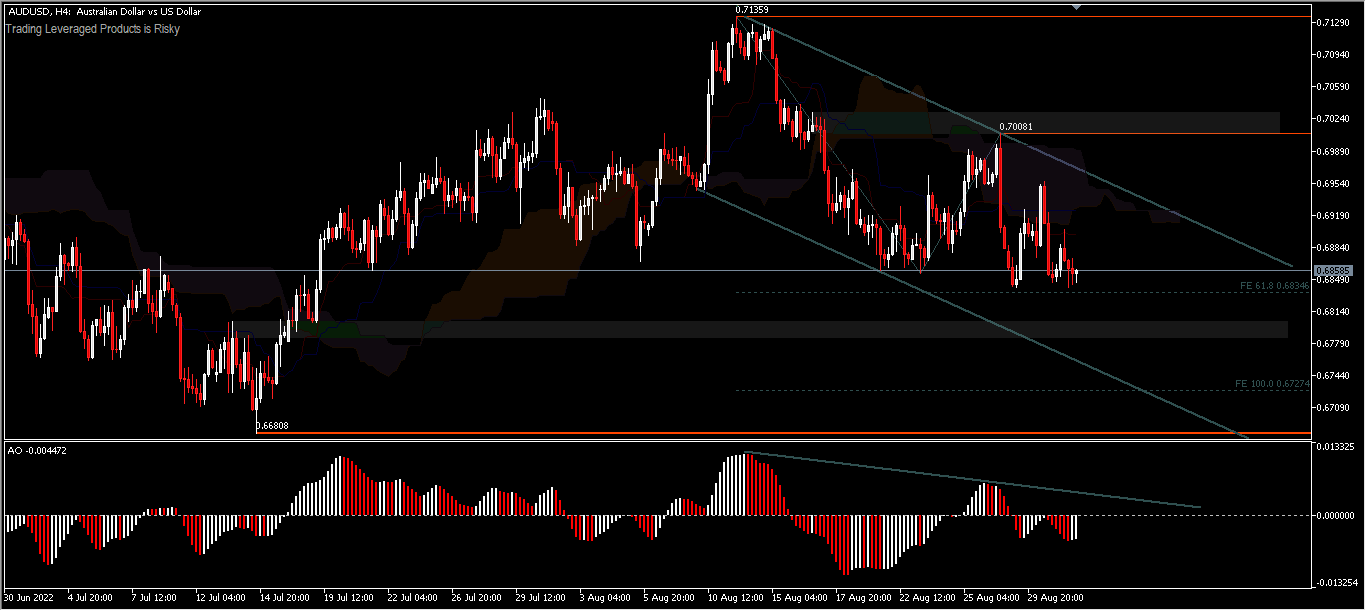

The overall picture remains bear-dominated and further declines are expected to continue as long as the 0.7008 resistance remains intact. In Wednesday’s trading, the pair only moved slightly, around 60 pips, probably as the market will digest developments in the US jobs report. A move to the downside is likely to test the 0.6680 low. However, a move above 0.7008 will change the bias back to the upside for the 0.7135 resistance.

Technical indicators in the H4 period are still validating the downside movement, with the price below the Tenken-sen and Kinjun-sen below the Kumo and the AO histogram still in the sell zone. Markets expect the RBA to increase its benchmark interest rate by 50bp next week, taking the cash rate to 2.35%.

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst – HF Educational Office – Indonesia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.