Nvidia Corp. is a multinational giant and world leader in the development of visual technologies such as GPU graphics cards and integrated circuit technologies for computers and a video game specialist, with a capitalization of 446.23B. Nvidia is scheduled to report fiscal quarter-end July 2022 earnings results this Wednesday, August 24, after the market close.

The company and the semiconductor market have had headwinds this year with the company’s shares down -42.1%, well underperforming the broader market, the USA500, at -11.0%.

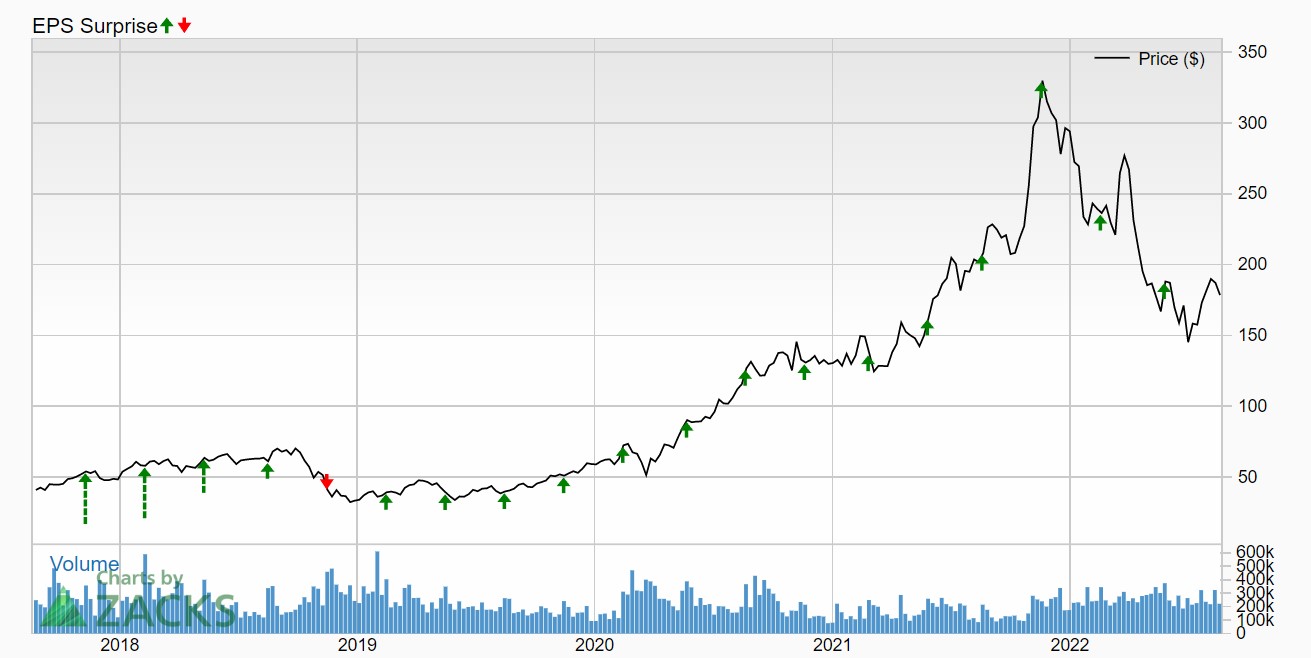

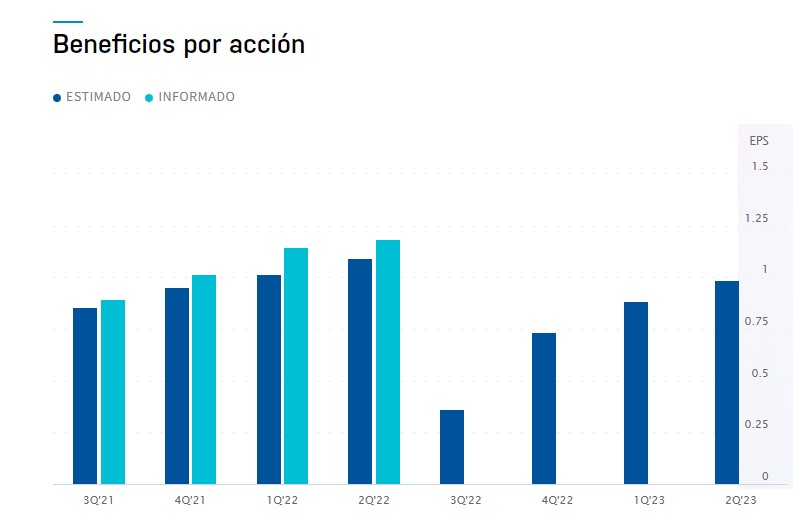

Zacks positions NVIDIA Rank #4 (Sell) in the Top 29% (#74/252) of the Semiconductor-General industry. EPS of $0.59 is expected for this report (although for Nasdaq it is $0.36) with -13.18% ESP, which would be a growth of -43.27% y/y compared to $0.89 in the same quarter last year. A Revenue of $6.70B is expected. The company has a P/E ratio of 44.53 and a PEG ratio of 3.41. The estimate has had 0 upward revisions and 8 downward revisions in the last 60 days. The company has exceeded expectations 18 times out of the last 19 reports.

In the last quarter the company announced an EPS of 1.18 and earnings of $8.29B (+46.41%.)

Management announced that it expects disappointing results for this fiscal quarter, mostly due to losses in the gaming sector, mentioning that it would have decreased by -44% QoQ (-33% YoY) to $2.04B thanks to decreased chip demand. Data center revenues could reach 3,810M, which would be an increase of 61% YoY, and the automotive sector to 220M, an increase of 45% YoY. In April 2022, global semiconductor sales reached 50.92 billion.

“Our projections for direct sales of gaming products decreased significantly as the quarter progressed. As we expect macroeconomic conditions affecting direct sales to continue, we have taken steps with our gaming partners to adjust channel pricing and inventory.”

– Jensen Huang, Founder and CEO

In its fiscal year 2022, gaming revenue rose to $12.46 billion (last quarter to $3.42 billion), data centers to $10.6 billion (last quarter to $3.26 billion), computing and networking rose to $11.05 billion and the graphics business segment to $15.87 billion . Its global assets were at $44.19 billion and net income at $9.75 billion vs. $4.33 billion last year mainly from Taiwan, with operating income at $10.04 billion , according to Statista.

The headwinds for the company are not only on these figures; since the macro environment is not good at a global level, a general low performance is expected, as other companies in the sector have reported, because they have been equally affected by issues such as the problems in the supply chain, the closures in various parts of China as a continuation of the pandemic, and the change in consumer spending focusing on basic things of life thanks to the increase in inflation due to the Russian-Ukrainian war. This is expected to continue for the next quarter.

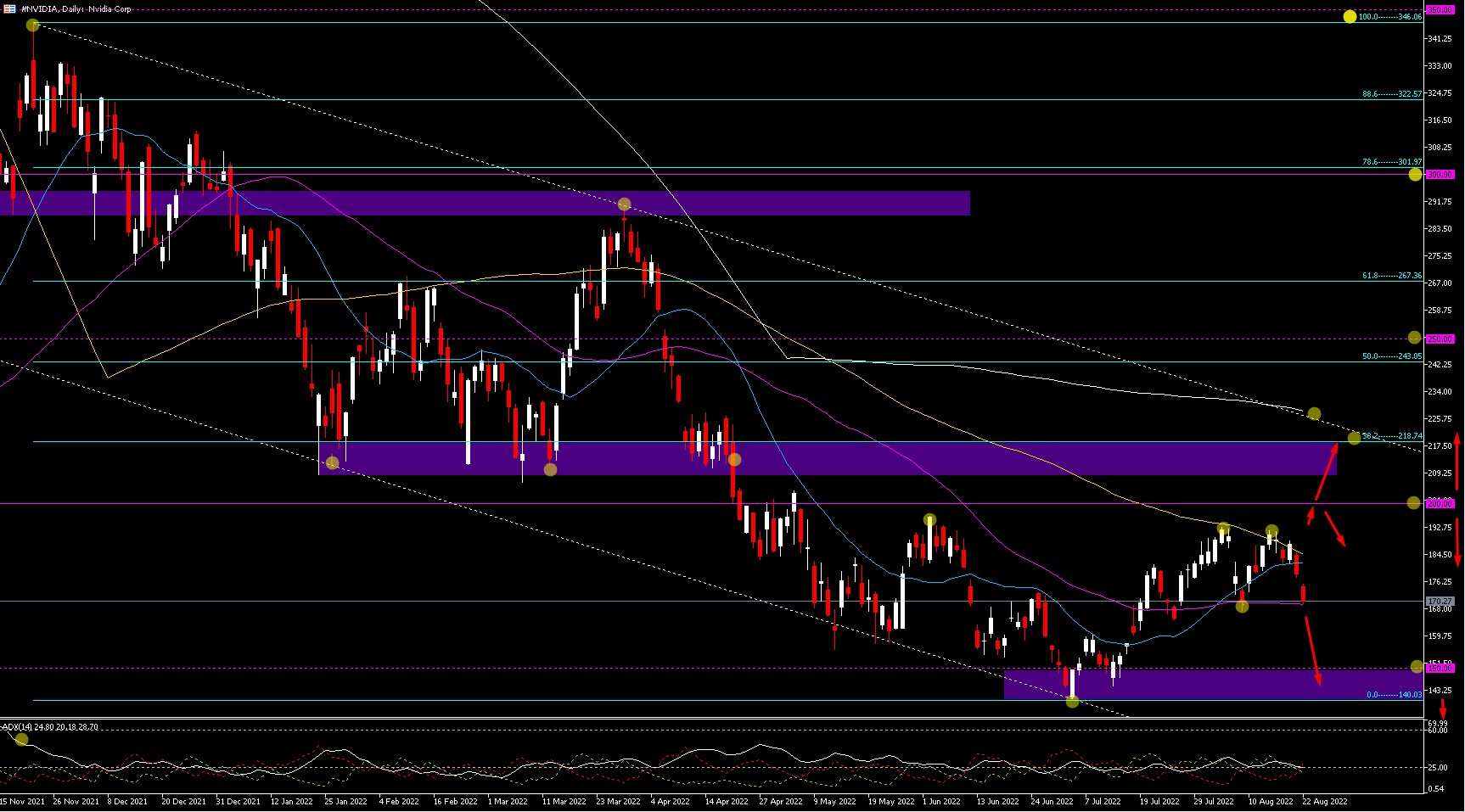

Technical Analysis – Nvidia D1– $170.27

After the 4-1 stock split of #NVIDIA stocks, its share price rallied to highs at 346.06 followed though by a bearish channel to a psychological support at 140.00 by July. By the end of July it recovered to 192.69 highs retesting the 100-day SMA prior to settling back to month lows and 50-day SMA at 169.24. If the asset breaks this level it could attract further selling pressure up to the 140-150 support zone, and in the case of breaking lower it would fall to the support range at 120-133 lows of 2018.

On the flipside, resistance holds at the 20- and 100-day SMA and the psychological level at 200. If the bearish channel is broken to the upside, further bullish bias could breach Q1 support at 213 and the area between the 200-day EMA and 61.8% Fib. level from the March downleg, at the 229-238 area. In the meantime ADX is at 24.80, -DI cross at 28.70 above +DI at 20.18. Possible downtrend resumption.

Click here to access our Economic Calendar

Aldo Zapien

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.

Sources:

- https://www.zacks.com/stock/quote/NVDA

- https://www.zacks.com/stock/news/1970029/nvidia-nvda-to-report-q2-earnings-whats-in-the-cards?art_rec=quote-stock_overview-zacks_news-ID04-txt-1970029

- https://www.nasdaq.com/es/market-activity/stocks/nvda/earnings

- https://www.nasdaq.com/press-release/nvidia-gtc-to-feature-ceo-jensen-huang-keynote-announcing-new-ai-and-metaverse

- https://www.barrons.com/articles/nvidia-demand-neutral-rating-analyst-51661183315?siteid=yhoof2

- https://www.statista.com/statistics/1120484/nvidia-quarterly-revenue-by-specialized-market/

- https://www.statista.com/topics/7123/nvidia/#topicHeader__wrapper