USDIndex firmed to 106.82 on Fed outlook and solid data before sliding to 106.38 at the close. Yields spiked on top of the heavy losses Tuesday (10yr 2.51%), then slipped again on strong factory orders data, with an eye on Friday’s NFP which will partly determine the magnitude of the Fed tightening (10yr 2.7191%). US Stocks supported by good earnings news, and gains accelerated after solid data, shrugging off the jump in bond yields as the Fed funds futures market repriced for a 50-50 potential for a 75 bp September rate hike. European FUTS also higher. Oil dipped to $90.35 after OPEC+ disappointed and agreed to a “very small increase” in September output of 100k barrels per day – the smallest output increase in its history. Gold holds at $1770. Today – BOE expected to hike by 50 bp but stresses data dependency of further tightening moves.

Overnight: US ISM-NMI services index rose to 56.7 from a 2-year low, US factory orders beat estimates and climbed 2.0%. The rise joins big declines for the ISM, Chicago PMI, Dallas Fed and Philly Fed, but gains for the Richmond Fed and Empire State, to leave an 8-month producer sentiment pull-back from robust November peaks. Surging interest rates and a flattening in real household spending as prices rise are aggravating the downtrend, though sentiment also faces support as businesses continue to restock.

- USDIndex is holding above 106 at currently 106.30.

- Equities – USA30 rose 1.29% (32.74K), USA500 rallied to 1.59% (4.15K) and USA100 surged 2.59%.

- Yields 10-year lifted 2.5 bp to 2.73% and rates are also higher in Japan and Australia. The 10-year Bund yield is down -0.5 bp at 0.863% though after another contraction in German manufacturing orders flagged recession risks for the region.

- Oil – dipped to $90.35. OPEC+ disappointed and agreed to a “very small increase” in September output of 100k barrels per day – the smallest output increase in its history.

- Gold – supported by pullback in yields at $1770.

- FX Markets – EURUSD looks weak, dipped to 1.0163 and Cable is at 1.2147. USDJPY has lifted to 134.20 as recent haven flows into the Yen recede. AUD and NZD regained some ground as global risk sentiment improved a little and a record Australian trade surplus underlined the natural inflows supporting the currency.

Today – BoE expected to hike by 50 bp but with a stress on the data dependency of further tightening moves. Front loading the tightening cycle also may also make sense in light of the leadership contest, with Liz Truss, the favorite to succeed Johnson, mulling a shake up of the BOE. Investors are also waiting for details on the BOE’s plans for gilt sales. Governor Bailey previously indicated that the balance sheet will shrink at a pace of GBP 50-100 bln in the first year – including redemptions.

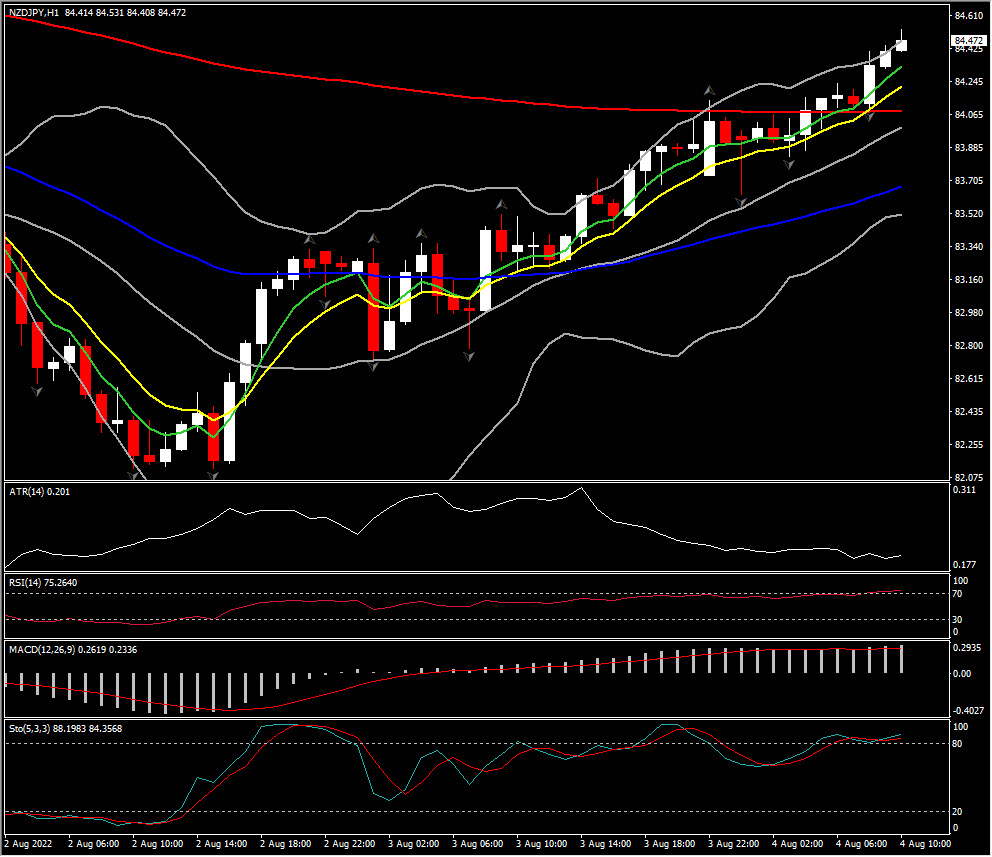

Biggest FX Mover @ (06:30 GMT) NZDJPY (+0.99%) reverted the week’s losses and currently at 84.47. MAs aligned higher, MACD lines rising, RSI 76. H1 ATR 0.202, Daily ATR 0.993.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.