FX News Today

- US-Sino trade talks will continue later this month with the March 1 deadline for tariff hikes coming ever closer. Both sides sounded cautiously optimistic

- Stock markets traded mixed in Asia. Topix and Nikkei closed with a gain of -0.18% and a marginal gain of 0.07% respectively.

- China’s manufacturing PMI decline dropped to the lowest level since February 2016. This revived concerns about the country’s economic strength.

- Earnings reports continue to come into the mix and banks were the biggest drag on Japanese benchmarks, while electronics makers gained.

- European stock futures are moving higher and US futures are now also mostly up as the focus shifts to US jobs data.

- The WTI rallied as much as 2%, peaking at two-plus month highs of $55.32 before falling back to the current $53.80.

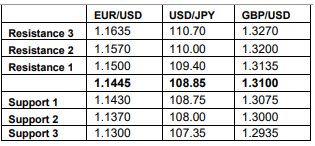

- EURUSD eased from 3-week highs, back to 1.1440 area. USDJPY is above 2-week lows and currently retesting 109.

Charts of the Day

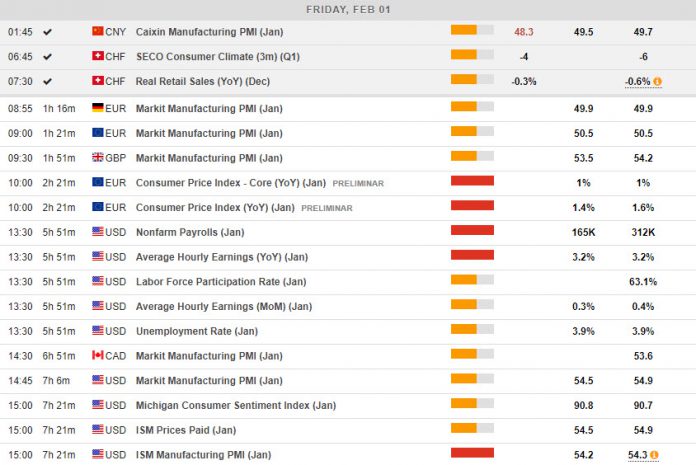

Main Macro Events Today

- Eurozone Manuf. PMI – Expectations – January Eurozone Manufacturing PMI will likely be confirmed at just 50.5 from the preliminary print, dropping from December’s 51.4, with confidence data adding to concerns that the slowdown will be more protracted than initially expected.

- Eurozone’s CPI – Expectations –Eurozone preliminary CPI reading for January should be at just 1.5% y/y, down from 1.6% y/y at the end of 2018.

- US Nonfarm Payrolls and ISM Manu. PMI – Expectations – January nonfarm payrolls are expected to increase by 200k, with a 195k private payroll gain. The ISM is expected to slip to a new 2-year low of 54.0 in January from 54.3 in December, versus a 14-year high of 61.4 in August.

Support and Resistance

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.