NZDUSD

The Australian dollar along with New Zealand Dollar have be the biggest movers in Asia session today, showing gains versus the Greenback and Yen, and a 0.9% advance against the Swiss franc. Swiss Franc was the biggest loser yesterday out of the major currencies.

AUDUSD earlier printed a 3-week peak, at 0.7119, and NZDUSD has also ascended into 3-week high terrain, at 0.6825.

Both antipodeans had fallen following the release of much weaker than expected inflation data out of China yesterday, which fed narratives about slowing demand in the trade-war afflicted Chinese economy, which is Australia’s biggest export customer.

However both of them still met strong demand from the lows, despite global stock markets and commodity prices turning lower.

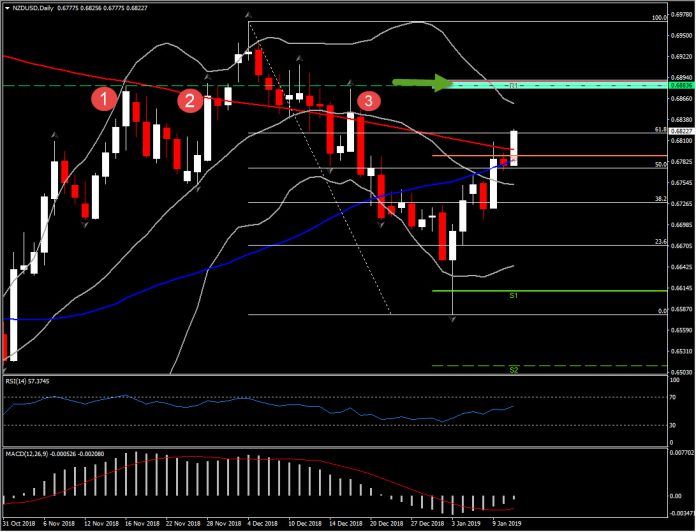

The NZDUSD remains above 0.6800 level, into European open, after breaking the significant 200-day SMA It is currently retesting the 61.8% Fibonacci retracement form since he reversal seen by the beginning of December.

Kiwi is in an uptrend for 7 days now, suggesting that bulls persist on moving Kiwi higher, even if there as overbought risks as pair is moving above the 3rd resistance of the day and the 61.8% Fib retracement which traditionally could be treated as a barrier.

However intraday momentum indicators just reached overbought barrier without crossing it. This along with the fact that the asset holds above the 0.6800 for the 3rd consecutive hourly session, suggest that upside movement has not run out of steam yet, as there is further space to be covered to the upside in the near-term thought. Immediate resistance is at 0.6825 for the day. A break of the latter could reiforce positive sentiment and could alert a move towards next Resistance, which holds at 0.6880-0.6890 area. This area coincides with 3 daily up fractals, 76.4% Fib. level. Support remains at 0.6780-0.6800 area.

The key risk event for today will be US December CPI. A strong outcome could confirm FED’s views for patients and will rise expectations for a possible pause on rates. This outcome could boost NZDUSD higher.

In the long term however, the continuation of uptrend is unlikely. NZDUSD has been trending lower for 9 months now, from levels above 0.7500, though with the Fed shifting out of a tightening bias, one fuel source of the trend has dissipated. Much will now depend on the Chinese economy and global stock and commodity market sentiment, which the high beta Aussie and Kiwi dollar will be directionally sensitive to.

Click here to access the HotForex Economic Calendar

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.