USD moved higher (USDIndex 102.78), Stocks also higher into close (NASDAQ 0.40%) but Futures rocked (-0.60%) by a surprise 50 bps hike from the RBA (25-40 bp expected) and noises that there will be more to come. Yields rallied (US 10yr over 3.00%), Asian markets have mostly slipped, (Nikkei +0.10%) and YEN has tanked (USDJPY at new 20-year high). UK PM Johnson survives no confidence vote (211 vs 148) 41.2% of his own MPs want him out UK Gilts rally GBP sinks. Oil slips but holds on to gains, Gold pressured by rising yields.

- USDIndex rallied to 102.82 ahead of ECB on Thursday & US CPI on Friday.

- Equities – USA500 -12 (-0.31%) at 4121, US500FUTS at 4096 now. More worries, following aggressive RBA, TWTR -1.5% after MUSK suggested he could walk away from the deal, AMZN +2% after 20 for 1 stock split. DIDI +23% & BABA +6%, Chinese regulators are reported to have concluded DIDI investigation.

- Yields 10-year yield higher (2.987% at close), trades at 3.064% now.

- Oil & Gold had weaker sessions – USOil slipped from $120.00 handle to $119.36, Gold sank as Yields rallied from over $1858 to $1840 now.

- Bitcoin rally over $30K was short lived, from $31.8K yesterday to trade at $29.4K now.

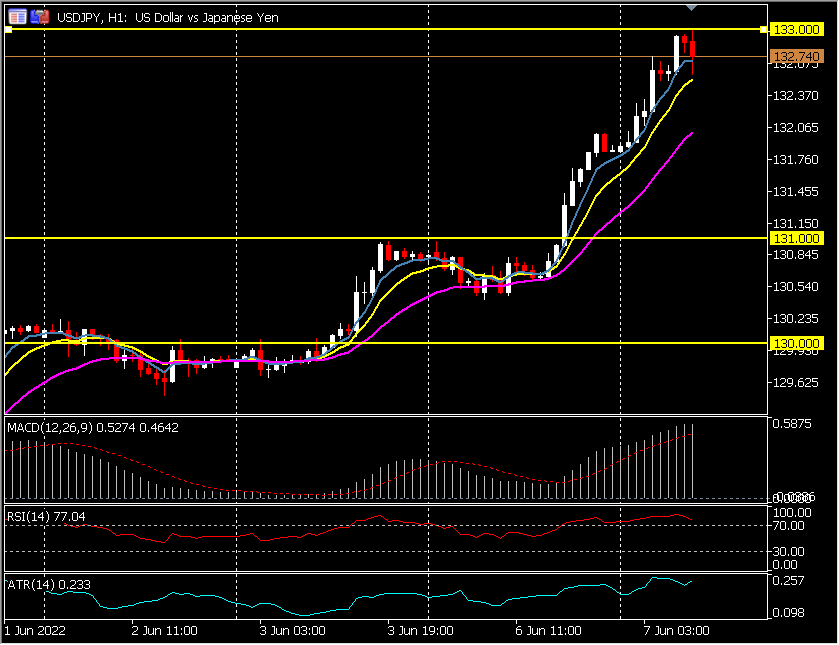

- FX markets – EURUSD at 1.0680, under 1.0700 again, USDJPY tested 133.00 zone and holds 132.60, Cable trades down at 1.2430,following political upheaval in UK.

Overnight – Mixed data from Japan, Weak UK Housing data and German factory orders missed significantly (-2.7% vs -0.4%)

Today – UK Composite/Services PMI (Final), Canadian Trade Balance

Biggest FX Mover @ (06:30 GMT) USDJPY (+0.67%). Rallies to new 20-yr highs and within a smidge of 133.00 from sub 130.00 on Friday. Next key resistance 134.00 form the Weekly Chart. MAs aligning higher, MACD histogram positive, RSI 77, OB & rising, H1 ATR 0.233, Daily ATR 1.18.

Click here to access our Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.