FX News Today

- The sell-off in stock markets continued during the Asian session after another slide in US shares.

- Signs of fresh tensions in US-Sino relations, the risk of a partial government shutdown in the US and general angst about the health of the world economy, added further pressure in stock markets.

- Topix and Nikkei lost -1.91% and -1.11% respectively as a stronger Yen added to pressure.

- WTI is trading at just $46.21 per barrel.

- EURUSD has settled in the mid 1.1400s.

- Sterling has become directionally dormant following recent Brexit-related volatility, with the UK Parliament now in recess until the new year and London interbank markets thinning out into the Christmas break.

- German consumer confidence unexpectedly held steady at 10.4 in the advance January reading, despite all the negative headlines and the turmoil on markets.

- French GDP was unexpectedly revised down while outlook deteriorates

Charts of the Day

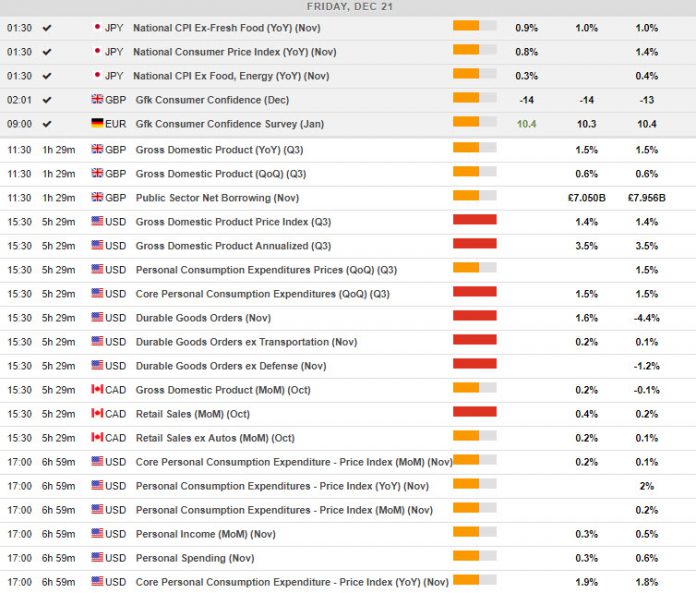

Main Macro Events Today

- UK GDP – The 3rd and final release of Q3 GDP is expected the latter unrevised at 0.6% q/q.

- Canadian Retail Sales and GDP – Retail sales are projected to grow 0.5% in October after the 0.2% rise in September. The ex-autos sales aggregate is projected to gain 0.1% after nudging 0.1% higher. GDP is anticipated to rebound 0.1% in October after the 0.1% drop in September.

- US Personal Spending – November personal income is expected to rise 0.3% after a solid 0.5% pace in October. Consumption is expected to rise 0.3% , half of the 0.6% October gain.

- US Durable Goods and Final GDP – November durable goods orders should rebound 1.7% in November, after a 4.3% October drop. The third reading on Q3 GDP growth is expected unchanged at a 3.5% rate, though slower than Q2’s 4.1% clip.

Click here to access the HotForex Economic Calendar

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.