FX News Today

- The stock rally continued during the Asian session – Nikkei gained 0.99%.

- Chinese markets outperformed as markets are growing more confident about the future of US-Sino trade relations amid reports of the first major soya bean purchases from China in a while.

- Also there are signs that Chinese authorities may scale back its push for high-tech industrial development, which could be the first step towards honouring US demands for stronger protection of US intellectual property rights.

- UK PM May survived the leadership battle, although that doesn’t mean of course that she will be able to ratify her Brexit deal.

- GER30 and UK100 futures are trading narrowly mixed – PM May heads to Brussels to try and get more concessions that would help her get the hated Withdrawal Pact past lawmakers.

- WTI crude settled in lower $51.0s after ebbing from upper $52.0s yesterday.

- USDJPY has remained buoyant amid backdrop of reviving risk appetite.

- EURUSD has been oscillating in mid-to-upper 1.1300s.

Charts of the Day

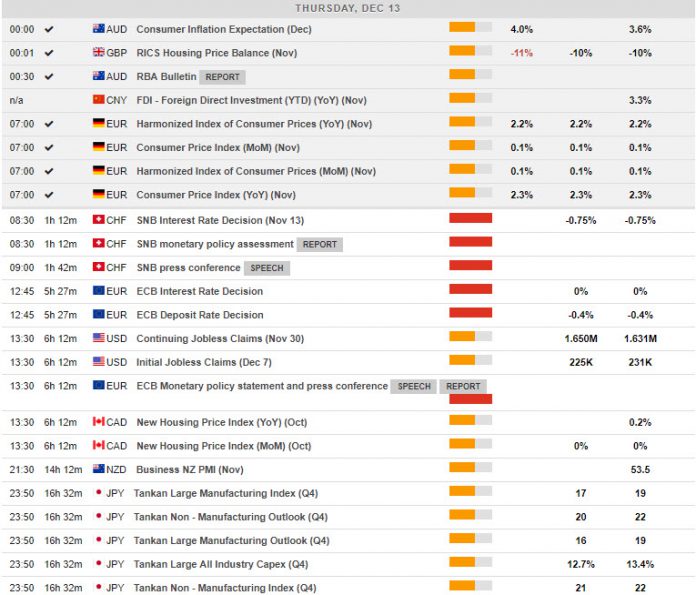

Main Macro Events Today

Main Macro Events Today

- SNB Rate Decision and Conference – The central bank is expected to leave policy unchanged and to repeat that the situation remains fragile as the currency remains “highly valued”. SNB continues to tread carefully amid heightened uncertainty, geopolitical risks and protectionist threats.

- ECB Rate Decision and Conference – ECB is set to confirm the future of QE and the re-investment schedule amid ongoing market turbulence and mounting political risk in Europe. ECB is expected to hold out for phase-out of QE by the end of the year, as planned.

- US Unemployment Claims – Expectation – Initial jobless claims are estimated to decline 6k to 225k in the week ended December 8, after falling 4k to 231k in the week of December 1.

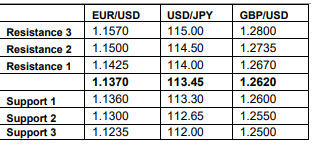

Support and Resistance

Click here to access the HotForex Economic Calendar

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.