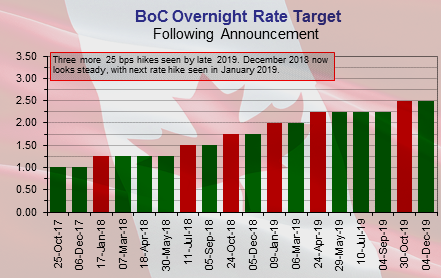

The Bank of Canada announcement is center stage this week, with no change in the current 1.75% setting for the overnight rate widely expected.

BOC policy outlook has been upended by the sharp pull-back in Oil prices over the past 8 weeks. The drop-off in oil price seems sufficient to keep the BoC on the sidelines at the December 6 announcement, reduces the chances for a rate hike in January and has trimmed the anticipated rise in the policy rate next year in general.

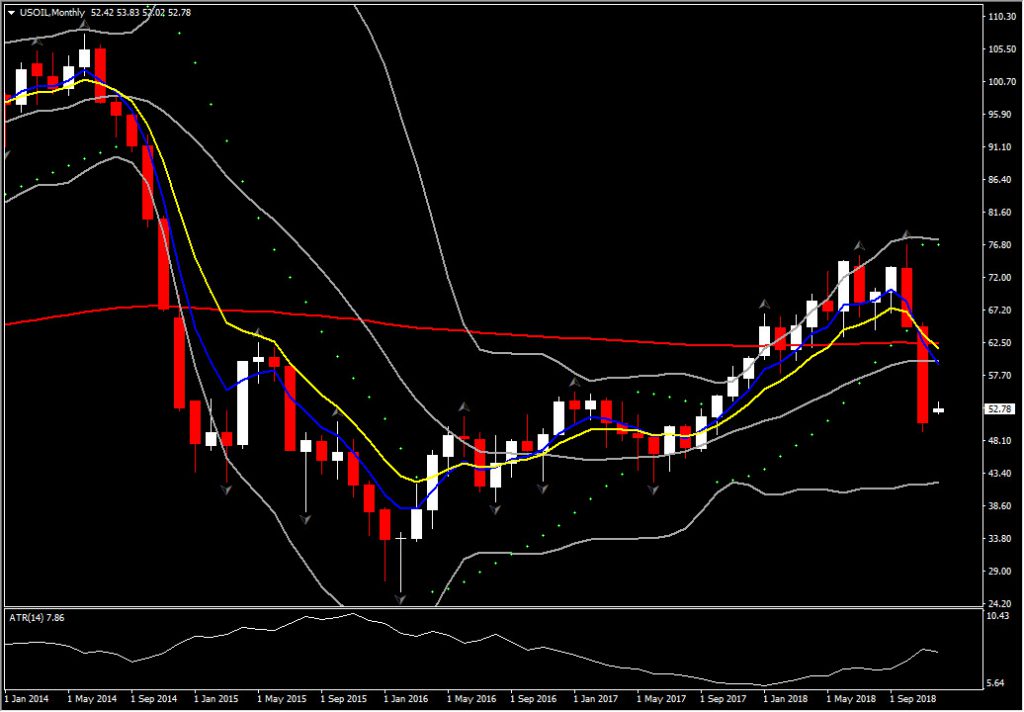

Currently, USOIL is at $53.99, and was showing a near 6% gain in making a 10-day high at $54.55 so far this week. News that Russia affirmed it would continue to cooperate with Saudi Arabia to manage output has been the principal driver, while the US-China trade war truce has also been a positive lead for oil markets. However USOil prices still remain 15.9% lower from month-ago levels and at 14-month prices.

Two more 25 basis point rate increases are pencilled in for April and October of 2019, leaving the setting for the policy rate at 2.50%, or the lower bound of the Bank’s 2.50%-3.50% range for the neutral rate.

How could BoC’s Projected Policy Path be altered by the Oil price plunge?

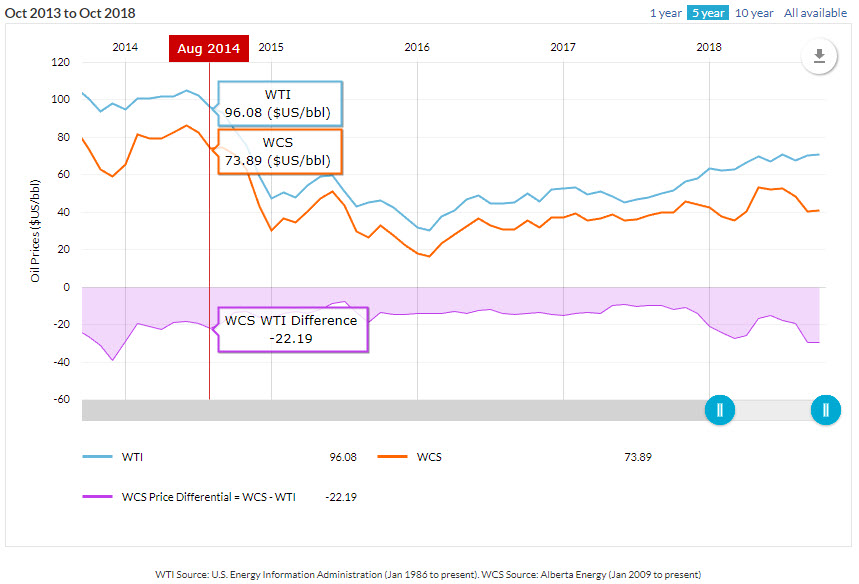

The importance of large Oil price swings to the policy outlook are shaped by the 2014/15 collapse in the price of Oil as given in the figure below from ActionEconomics.

BOC applied an easing monetary policy during 2015, which was mainly driven by the negative effect of low Oil prices for Canada’s resource intensive economy. The Bank proceeded with a total 0.50% reduction, with 2 rate cuts during 2015. As shown below, in the 2nd half of 2014, WTI crude oil faced an extremely sharp decline from $106.00 to $52.50 by the end of the year, which is reflected by the 51% dive. Western Canada Select (WSC) fell from $87 in June of 2014 to a cycle low of $13.80 by February of 2015, an 84% tumble.

This year, we have seen a drop of up to 35%, with USOil price bottoming to $49.40 from nearly $77 top.

But, how does the current drop in Oil prices compare to the policy-triggering 2014/15 experience?

Oil does not have a direct impact on BOC’s decisions. The price and volatility however of Western Canadian Select (WCS) and the spread between Western Canadian Select (WCS) and West Texas Intermediate (WTI), and the change of the country’s GDP and CPI data, are factors that may influence the path of interest rates.

However, let’s take a look at the situation from the beginning.

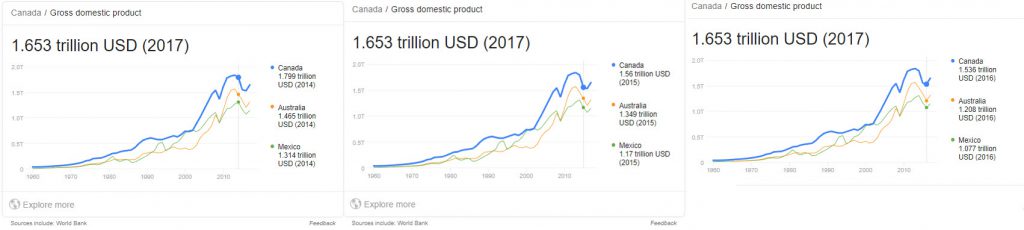

Canada is the fourth largest producer and fourth largest exporter of oil in the world, exporting nearly 99% to the US. Meanwhile, Oil and gas extraction accounts 7% for Canada’s GDP, an even larger share than the country’s finance and insurance sectors combined, according to data released in July 2018 by Statistics Canada. This is considered to be the highest proportion of economic output from fuels since 1998 of a GDP measure by industry.

Therefore, the Oil prices seem to affect the Canadian economy, negatively and positively, as the national total CPI number and Canadian GDP growth could be reduced/increased due to the gasoline, fuel, oil or even transportation costs. For instance, the lower the oil prices are:

- The lower the cost of production is, there is a larger variation of oil products, oil producers gain deducted revenues, pay less taxation than before, reduce the number of employees, and interrupt or cancel investment plans.

- The higher the consumer consumption is, as gas and utility bills have been reduced and households are spending less of their disposable income – raises non-energy products demand.

- The higher the possibility of higher unemployment rates, lower incomes and therefore there is the risk of a drop on house prices.

- The lower the net exports to US might be, despite the possibility of a depreciated Canadian Dollar against US Dollar. However, a weak currency could encourage exports other than oil.

- The higher the global demand could be, as the deducted oil price could push development in oil importers countries.

Back to the 2014/15 experience, and based on the above negative and positive effects of Oil to the Canadian Economy, BOC evaluated in the Appendix to the January 2015 MPR the base case scenario that:

“The sharp drop in global crude oil prices will be negative for Canadian growth and underlying inflation…..Lower oil prices reduce overall demand in the Canadian economy, leaving output lower by 1 to 1.8 per cent and putting downward pressure on core inflation”.

Hence, as BOC concluded in the January 2015 MPR, a permanent decline in Oil prices, could imply steady interest rates or even a cut in interest rates, as Canadian GDP growth declines by the drop of Oil prices. Similarly, BOC suggested in its October Monetary Policy Report that, a drop in the terms-of-trade related to the drop in oil prices relative to their previous projections, would lower Canadian GDP growth by about “1/4 of a percentage point” in 2015.

The 2014/15 experience

This actually explains what happened during 2015, where the sharp decline of oil between 2014-2015, created a huge gap between WTI and WCS prices, boosting global demand for WCS due to its lower price, lowered net exports to US, pushed Canadian GDP lower and lastly boosted BoC to cut rates in January 2015 (based on 2014 oil performance) and again in July 2015, due to the fresh fall in oil during the 1st quarter of 2015.

WCS is normally highly correlated to the global benchmarks, with a correlation to WTI of over 90%. A widening in the WCS-WTI differential is a result of rising production and pipeline constraints, as the WCS represents the prices that many Canadian producers will receive for their heavy oil production. Therefore they have a direct impact on the earnings and cash flow for Canadian oil companies.

In August 2014, the differential between Western Canadian Select ( the benchmark for western Canadian Oil) and West Texas Intermediate (WTI), had risen to $22.19, with WTI at $96/bbl and WCS at $73.89/bbl. By January 2015, WTI had fallen by 55% while WCS had fallen to $30.43/bbl – a 64% drop. This drop was much higher than WTI’s decline.

WTI crude has seen a smaller decline, falling to $51 currently from the year high $76 seen at the beginning of October — a 33% drop. But WSC has fallen from a year peak of $58 in the middle of May 2018 to almost $18 currently — a 69% contraction. WSC was $38 per barrel at the beginning of October, a 52% decline to the current $18 level.

Given the importance of oil price swings to monetary policy, the rapid and sizable contraction in Oil prices seems to have an impact on near term policy. Notably, the plunge in WSC Oil has been much more pronounced relative to WTI this year, consistent with a larger impact on Alberta’s economy than would be implied by focusing on WTI prices.

Hence, the net decline from the year high to the current year low for WSC Oil is 69%, with the $18 per barrel level seen this week matching the low seen in 2015. But while the Oil price pull-back this year has left WSC at lows not seen since 2015, the economic backdrop is not the same as in 2014 and 2015. Indeed, the economy is running at full capacity while underlying inflation is around the BoC’s 2% target.

CPI accelerated to 3.0% y/y as recently as July before slowing to 2.2% in September and ticking higher to 2.4% in October. Meanwhile, core inflation is expected to hold around 2%, as the economy runs near full capacity through year-end. The core inflation measures held around 2% through October, suggestive of little change in underlying inflation pressures.

But while inflation and growth appear to have come in close to BoC projections through Q3 and early Q4, there is no denying that the tumble in Crude Oil prices presents a headwind to domestic growth.

Meanwhile, the domestic housing market has clearly cooled amid less accommodative policy, realizing a goal of the BoC’s normalization quest. Interestingly, a similar end to the housing and refinancing boom in the US adds to the headwinds for Canada’s economy, via a reduced demand for Canadian lumber. Of course, lower Oil prices are a net positive for the US, which is in turn good news in broad terms for US demand for Canada’s exports.

In conclusion, the drop-off in Oil price is more than sufficient to keep the BoC on the sidelines at the December 6 announcement and reduces the chances of a rate hike in January.

Click here to access the HotForex Economic calendar

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.