USOIL

USOil closed on Friday at 13-month lows of $50.40. Despite talk of OPEC cutting production when it meets in Vienna early next month, prices have continued to slide as demand growth forecasts continue to be cut, and as non-OPEC production, mostly from US shale output, continues to rise. Saudi Arabia has called for a 1.4 mln bpd cut in output, though this may not be enough to support prices going forward.

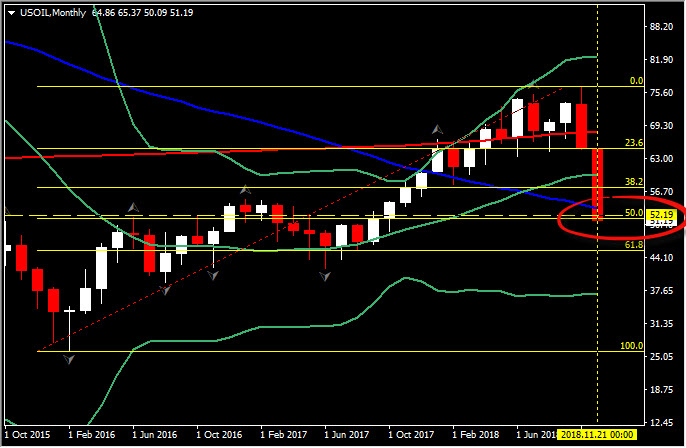

So far today, a 1%-plus rebound has been seen in Oil prices, as there is a broader revival in risk appetite in global markets, which helped the Canadian currency and other Dollar bloc currencies find a footing. Despite the slight improvement, on Friday the asset broke another key level in its 2-year performance. The $7’s drop seen last week pulled the asset below the 200 week SMA but notably below the midpoint of the rally from the $26.00 bottom. Hence, in nearly 2 months, the asset reversed 50% of the gains achieved within 32 months.

As demonstrated on November 20 post, the next Support for USOIL was at the 50% Fib. retracement level set since February 2016. As the asset however reached and broke this barrier, the price action now looks decisive to continue the “free fall”.

With the asset trading just a breath above the psychological $50 level, any intraday or in general any near-term correction, seems incapable of propping up the USOil prices. Hence as the overall picture remains strongly negative, the next medium term Support is around the 3-month lows during 2017 (May-July) and the 61.8% Fib. level, at $43.50-$45.50 area.

On the near-term basis, Support remains at the key $50 level and Resistance is set at $53.80 (midpoint of 1-week performance).

Nevertheless, as oil prices continued to dive to fresh 13-month lows, they contributed to a taming of inflation concerns. Hence the 20%-plus plunge in Oil prices over the last month, should ensure that the keeping the BoC on hold at its December-5 policy meeting, and this backdrop should keep the Loonie a sell-on-gains trade.

Click here to access the HotForex Economic calendar

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission