FX News Today

Asian Market Wrap: 10-year Treasury yields are up 3.8 bp at 3.168%, 10-year JGB yields jumped 1.2 bp to 0.121% as Asian shares rallied on trade hopes. Bloomberg reported that Trump is seeking to reach a trade deal with China at the G20 meeting in Argentina later this month and has asked officials to begin drafting potential terms, with other reports suggesting that intellectual property rights are a key sticking point. Apple warned that sales for the crucial holiday quarter may miss expectations, but this was shrugged off amid hopes of a trade deal, which together with yesterday’s pledge from Chinese officials to support demand saw Topix and Nikkei gaining 1.64% and 2.56% respectively. The Hang Seng outperformed and was up 3.66% as of 6:08 GMT. The CSI also rose 3% and Shanghai and Shenzhen Comp gained 2.20% and 2.86%. US stock futures are also higher and oil prices reached a high of USD 63.95 per barrel, before falling back to now USD 63.81.

FX Update: The Dollar and the Yen have traded generally weaker against most other currencies amid a backdrop of strongly-rebounding global stock markets. An ease between the US and China on trade, along with overall decent corporate earnings, mostly firm US data this week, and a plethora of stock-boosting measures by Beijing, have collectively elicited a rebound in stock markets. USDJPY has recouped to the 113.00 area, though Yen crosses have generally rallied by bigger magnitudes. The biggest percentage gainer has been AUDJPY, which has gained over 0.7% in what is now its sixth consecutive up day. EURUSD has rallied a third consecutive up day, posting a 9-day high of 1.1440 so far. The AUDUSD pegged a 5-week high at 0.7250, and USDCAD descended to an 8-day low at 1.3053, despite another sharp leg low in oil prices yesterday, which sent WTI benchmark prices to 7-month lows near $63.00.

Charts of the Day

Main Macro Events Today

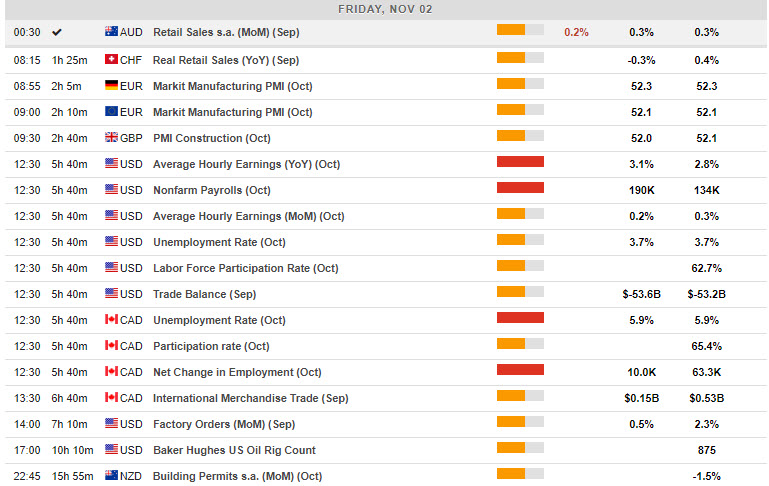

- Euro Manufacturing PMI – Expectations – Eurozone PMI is expected to remain unchanged.

- UK Construction PMI – Expectations – The October Construction PMI is expected to slip slightly by 52.00 after the 52.1 expansion seen in September.

- Canadian Employment Change and Trade Balance – Expectations – The employment should post a 15.0k gain in October jobs, following the 63.3k rise in September. The pace of wage growth is expected to slow further. The trade surplus is anticipated to narrow slightly to C$0.4 bln in September from C$0.5 bln in August.

- US Non-Farm Payrolls – Expectations – The October US employment expect to see a 194k headline for the month with a 195k private employment figure and unemployment holding steady at 3.7% for a second month. No disruption is expected from the landfalls of hurricanes Michael and Florence but the timing of these two events means that the impact on October payrolls will likely be offsetting.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2018/11/06 13:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.