FX News Today

Asian Market Wrap: 10-year Treasury yields are up 1.3 bp at 3.136%, the 10-year JGB yield is up 0.5 bp at 0.115%. BoJ left policy unchanged and kept the 10-year bond yield target at about zero as the revised forecasts show inflation below target for years to come. Inflation came in lower than expected in Australia, and China’s manufacturing activity is feeling the strain of the trade war with the US and the manufacturing PMI fell back to just 50.2, effectively signalling stagnation. Despite this Asian stock markets moved mostly higher and are bound to end the month on a more positive note, although this is still to be the worst month for global equities in more than 6 years. China’s overnight Repo rate surged amid official efforts to stem bets against the Yuan. Earnings reports remain in focus ahead of Apple results and Friday’s US jobs reports. Buyers may be attracted by cheaper valuations, but trade concerns continue to cloud over sentiment. Topix and Nikkei are up 2.15% and 2.16% respectively, the Hang Seng gained 0.99% and Shanghai and Shenzhen Comp are up 1.26% and 1.48%. The ASX underperformed, but is also up 0.43%, as are US stock futures.

European Fixed Income Outlook: December 10-year Bund future opened at 160.20, down from a close of 160.44 yesterday. The 10-year cash yield is up 1.1 bp at 0.378% in opening trade, despite weaker than expected German retail sales data at the start of the session. BTPs are coming back from yesterday’s slump and the reversal of safe haven flows are adding to the general trend of rising yields at the long end as stock markets seem intent on ending a disastrous month on a more positive note. Treasury and JGB yields also moved higher, UK stock futures are rising with US futures after a largely positive session in Asia. Today’s calendar still has Eurozone inflation and labour market data as well as ECB speakers and Spanish GDP numbers.

Charts of the Day

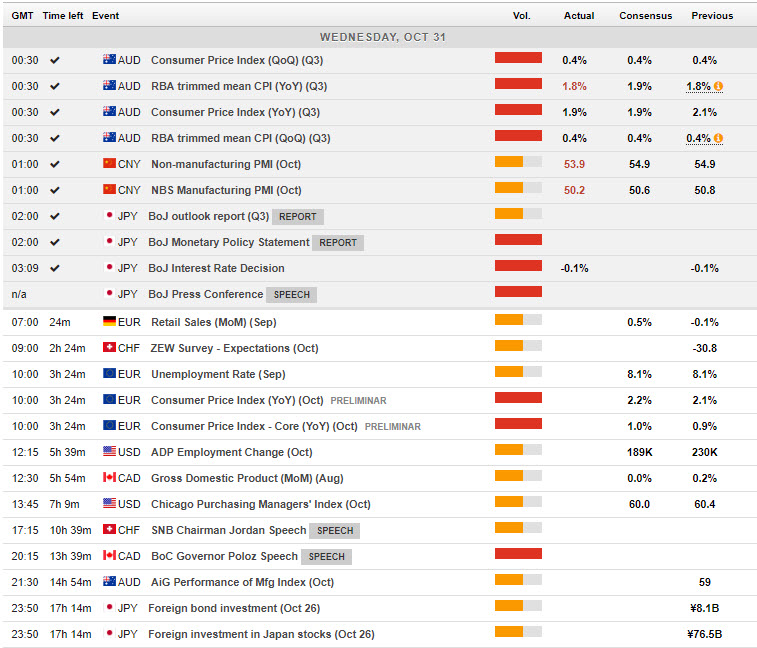

Main Macro Events Today

- Euro CPI and Core – Expectations – Eurozone HICP seen lifting to 2.2% y/y from 2.1% y/y in September. Underlying inflation is also expected to rise as base effects from changes to education charges in Italy that have kept the Italian rate low over the past year, will finally fall out of the equation with the October number.

- Canadian GDP – Expectations – The August GDP is expected to expand 0.1% (m/m, sa) after the 0.2% gain in July.

- Crude Oil Inventories – Expectations – It is expected to fall to 3.6M barrels from 6.3M last week.

- US ADP Employment Change – Expectations – The ADP employment survey is seen +215k for October vs +230k and the Employment Cost Index (ECI) is expected to rise 0.8% in Q3, shifting up from a gain of 0.6% in Q2. Chicago PMI is seen in a holding pattern near 60.5 in October.

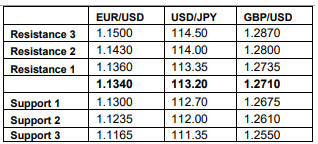

Support and Resistance Levels

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2018/10/31 13:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.