FX News Today

European Fixed Income Outlook: 10-year Bund yields are up 0.4 bp at 0.379% in opening trade, in tandem with but outperforming the rise in long rates in the US and Japan. BTPs continue to outperform at the start of the session. Stock market sentiment picked up in Asia, and US futures are moving higher, although UK futures are heading south and there is still plenty, from Brexit to Italy’s budget spat to the risk of political instability in Germany to cloud over sentiment, although a very busy economic calendar today will also demand attention. Already released French GDP came in at 0.4% q/q, leaving the overall Euro Area number today on course to also come in at 0.4% q/q, unchanged from Q2. German jobless numbers, as well as preliminary HICP inflation are also due, as is the ESI economic sentiment indicator, the Swiss Kof leading indicator and the UK CBI industrial trends survey.

Asian Market Wrap: 10-year Treasury yields are up 1.5 bp at 3.10% and 10-year JGB rates climbed 1.2 bp to 0.108% as stock market sentiment improved. Comments from US President Trump, who spoke about a “great” deal with China helped to dampen concerns about earlier reports that the US is preparing to put tariffs on all imports from China. Trump also told Fox news that he didn’t think that Beijing was ready for a deal yet, and the Yuan dropped to the lowest level since May 2008 after the PBC cut its daily fixing and amid concerns of a further escalation of the trade war. Shanghai and Shenzhen managed to recoup early losses and charge higher, with indices currently up 1.30% and 1.24% respectively. The Hang Seng underperformed and fell back -0.24%, while Japanese markets got a further boost from a weaker Yen, with Topix and Nikkei up 1.46% and 1.44% respectively. The ASX gained 1.34% and US stock futures are also broadly higher. Oil prices are little changed and the front end Nymex future is trading slightly above USD 67 per barrel.

Charts of the Day

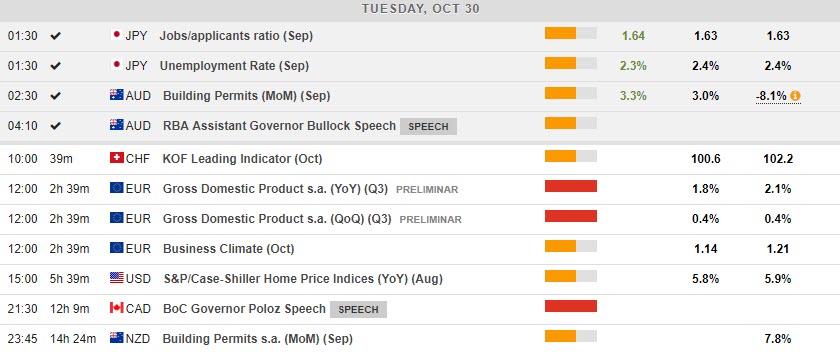

Main Macro Events Today

- Euro Area Real GDP – Expectations – The most important figure of the Euro Area economy is expected to come out at 1.8% y/y, down from 2.1% last quarter on account of higher uncertainty about Italy’s budget, but still very robust.

- Conference Board Consumer Confidence – Expectations – The CB Index is expected to come out at 136.3 compared to 138.4 last month, suggesting a weak deterioration, albeit still remaining at high levels.

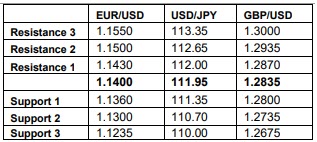

Support and Resistance Levels

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2018/10/30 14:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Dr Nektarios Michail

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.