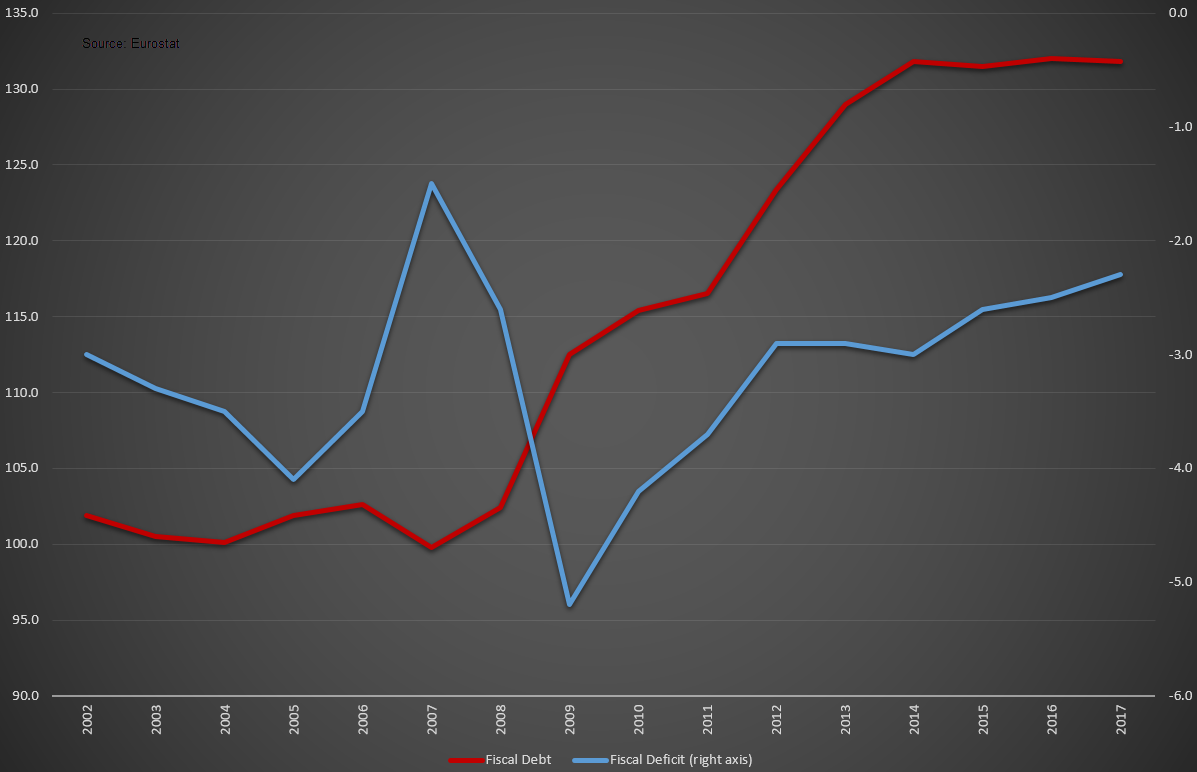

Italy’s budget problems, known to markets since at least 2011, appear to have resurfaced with a vengeance. In fact, according to Eurostat, Italy’s government debt has climbed to 132% of GDP, the second highest in Europe after Greece. Ironically, Italy’s debt current stands higher than Greece’s GDP at the start of its long recession period, at 126% of GDP.

Greece’s problems were more or less limited to it, given that most European banks did not have large exposures to the country. Despite the potentially wrong way European authorities approached Greece and the subsequent lost decade during which the economy shrunk by more than 25%, problems were more or less contained within the geographical boundaries of the country. Despite its relatively small size, council meetings regarding the future of Greece’s debt programme, as well as tensions between the country and EU authorities had a significant impact on the Euro.

In contrast, Italy is the third-largest economy in the Euro Area and the 8th largest in the world, suggesting that the pressure on the Euro will be much higher if the country faces deeper issues. The issue is that, as the Chart above suggests, Italy’s debt burden (red line) has been increasing, while its budget deficit (blue line) does not appear to be able to move to positive territory. The worst part is that overall GDP growth is less than the deficit suggesting that the debt-to-GDP ratio will continue to increase.

The issue with rising debt levels is that it takes a lot more to repay them than before. At the moment, just to repay interest, Italy needs to spend about 3.8% of GDP. Note that at this point in time, policy rates are very low and hence countries can borrow cheap. However, as interest rates are expected to rise as soon as September 2019, the interest burden should also rise, making it harder for the country to continue to repay its creditors. Problems with the country are expected to be reflected in the monetary union as well, given that a potential default (unlikely but not impossible) could trigger renewed fears about the common currency’s future. The current budget plan, which estimates a budget deficit of approximately 2.4%, has naturally displeased the European Commission, which appears to have sent a letter citing “unprecedented” breach of EU fiscal rules and is expected to reject it.

In light of this news, the Italian 10-year bond yield surged from 2.9% in late September to 3.7% today, making other European bond yields increase along with it. As we noted earlier this week, higher deficits tend to increase yields which in turn make the cost of debt higher and create a vicious cycle of increasing deficits and higher yields. Unfortunately, the only way to deal with this issue is to push structural reforms through and slash government spending, similar to the case of Greece. Fortunately, Italy is registering positive growth rates at the time which should assist it in avoiding a full-blown recession as it can take measures to slowly reduce its deficit in the coming years. This, associated with the potential increase in GDP should bring debt burden back to sustainable levels.

An interesting question deals with the debt threshold: why does a debt burden of 132% of GDP make a difference while a 180% debt level for the case of Japan appears to have very little impact to investors? The first part of the answer is that Japan has its own exchange rate and can choose to depreciate it at whichever point it wants and thus reduce its debt burden, while Italy, as part of the monetary union does not possess that ability. However, the second and most important part of the answer has to do with a country’s ability to repay debt. For example, when interest payable increases by more than the money a country can raise from taxation it means that either taxation has to be increased to repay debt or spending has to drop. Both naturally have a negative effect on the economy, albeit what matters is whether the country can continue to repay its debt without hurting its residents, with either spending cuts or tax increases. Italy is, unfortunately, at that point where either spending needs to be slashed or taxation needs to be increased. Fortunately, as discussed above, the change does not need to be that large, albeit the country’s politicians do not appear to have been able to push these through: five government formations in the past five years have actually worsened the country’s macroeconomic outlook. What is left now is to see whether EU pressure can be intense enough to make a difference.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2018/10/23 14:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Dr Nektarios Michail

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.