GBPCAD, H4

UK August trade data revealed a bigger than expected deficit, of GBP 1.3 bln in the total trade figure, with the visible goods deficit coming in at GBP 11.2 bln. In the 3 months to August, the ex-inflation total trade deficit narrowed GBP 6.1 bln to GBP 0.8 bln, which was driven by both a narrowing in the goods deficit and an expansion in the services surplus. Meanwhile, UK August production data came in mixed today, with the broad industrial output headline slightly exceeding expectations with 0.2% m/m and 1.3% y/y growth while the narrower manufacturing production measure underwhelmed somewhat with an unexpected 0.2% m/m contraction.

More timely September surveys, such as the PMI reports, have painted a relatively dimmer picture, with Brexit-related uncertainty taking a toll on confidence and crimping new investment. Even though the cloud of uncertainty over Brexit weighs on Sterling, today’s Brexit news boosted Sterling higher. A London Times article claimed that 30 Labour party MPs would reportedly back Prime Minister May’s Brexit plan at the last minute, if needed, to avoid a no-deal Brexit scenario, suggesting that there could be enough votes for the plan to pass a parliamentary vote, as this would offset Tory party rebels who are planning to vote against it.

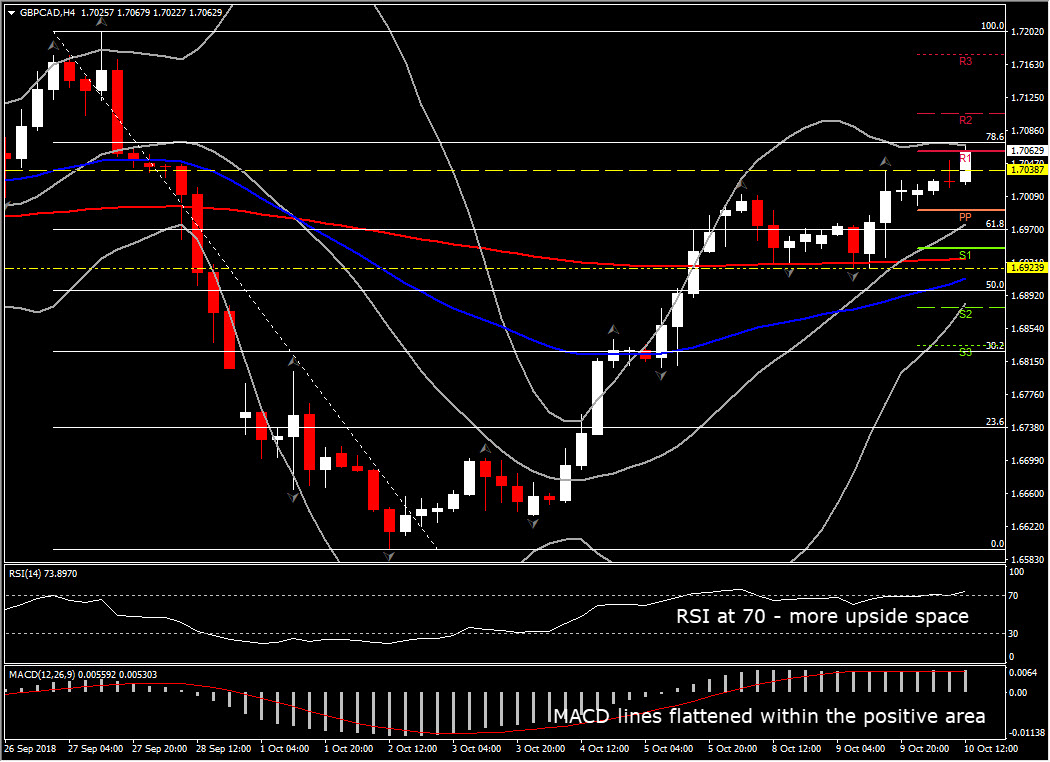

Cable managed to eke out a 2-week high at 1.3185, 15 pips below upwards handle as mentioned in yesterday’s post. As the Pound remains on bid since the news release and in contrast with the mixed economic data front, most of the sterling crosses present the same performance. GBPCAD for example is currently retesting the immediate intraday Resistance level at 1.7060, which is just few pips below the 78.6% Fib level since the dive from 1.7200. The pair remains above 20- and 50-day SMA, for the fourth consecutive day.

However, our focus turned on GBPCAD today, on the break of the 1.7038 level. Interestingly, this level coincides with the 2 consecutive upper fractals in the 4-hour chart but also with the 38.2% Fibonacci retracement level since July’s decline from the 1.7771 high. This along with the fact that the pair moves within the upper Bollinger band pattern and 20-period SMA crossed above 200-period SMA, added further positive bias in the near future.

Technically, the same bullish picture is seen in momentum indicators, as RSI just crossed 70 barrier, indicating that there is further space to the upside. MACD presents a positive to neutral picture as MACD lines are flattened within the positive area, something that implies short term consolidation or weak momentum.

Based on the positive outlook that GBPCAD presents so far, further upside movement is anticipated, with next Resistance levels at the round 1.7100 and 1.7165 level (200-day SMA). Immediate Support holds at the confluence of the 20-period SMA and 61.8% Fib. level, at 1.6975. Medium term Support level is set at 1.6920-1.6930 area (200-period SMA and 2low fractals).

In the alternative scenario that bears push GBPCAD lower, only a closing into the lower daily Bollinger Band pattern, below the 1.6950 level, could drive the price to the 1.6830 Support level reached on Friday. Such a break could confirm the possibility of significant losses and it will alert the retest of the 2-month triple bottom at 1.6595.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2018/10/11 15:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.