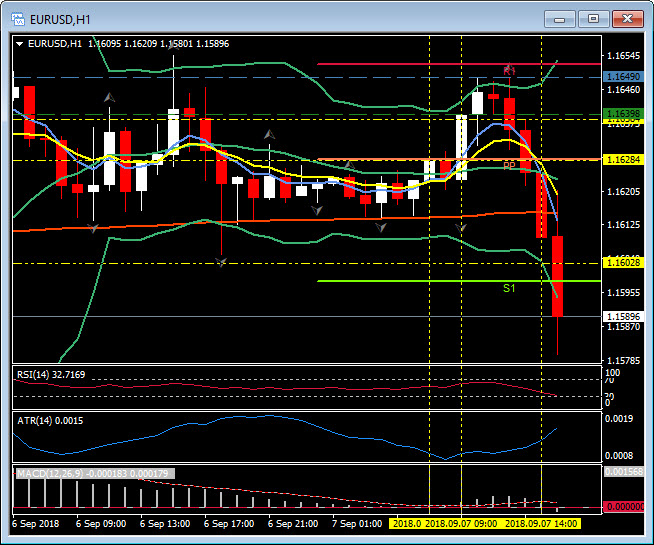

EURUSD, H1

US August non-farm payrolls rose 201k, while the unemployment rate was 3.9%. The 157k increase in July jobs was revised down to 147k, with June’s prior 248k jump revised to 208k (net -50k). There was no revision to the 3.9% July unemployment rate. Average hourly earnings increased 0.4% versus 0.3% previously, and climbed to 2.92% y/y versus July’s 2.73% (revised from 2.70% y/y). The workweek was unchanged at 34.5. The labour force participation rate fell to 62.7% versus 62.9%. The guts of the report showed the labour force dropping 469k from a 105k gain previously, with household employment tumbling 423k versus the 389k rise. Private payrolls increased 204k last month (ADP was 163k). The goods producing sector added 26k, with construction up 23k and manufacturing shedding 3k. Employment in the service sector increased 178k. The government lost 3k workers. The rise in earnings may be the focal point of the report and weigh on bonds. Moreover, the report seals the deal on a Fed hike later this month (not that there was much question).

The Dollar rallied following the jobs report, where the NFP print came in at 201k, versus consensus for a 190k reading. Hourly earnings were better than expected, though the participation rate slipped some. The unemployment rate was unchanged at 3.9%. EURUSD slid to 1.1582 from 1.1620, as USDJPY rallied to 111.04 from near 110.80. Equity futures remain underwater, while yields edged higher.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2018/09/05 14:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Stuart Cowell

Head Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.