FX News Today

FX Update: The Dollar managed to find a footing during the Asian session after posting fresh lows against most currencies during the New York PM session yesterday following news that two former associates of President Trump had been convicted of various crimes, including fraud (with Trump’s ex-long serving personal lawyer, Michael Cohen, directly implicating Trump in campaign finance violations). The main exception was the case against the New Zealand Dollar, which rallied by over 0.5% after a stronger-than-expected reading on New Zealand Q2 retail sales, which rose 1.1% q/q, nearly triple the median forecast for 0.3% q/q growth. In response, NZDUSD posted a two-week high at 0.6722. EURUSD, meanwhile, settled to narrow range trading in the upper 1.1500s, below the two-week high that was seen yesterday at 1.1601. USDJPY lifted back toward 110.50 after meeting demand into 110.00 during the Tokyo session. Yesterday’s eight-week low at 109.77 has remained unchallenged. Both the Canadian Dollar and the Mexican Peso came off their respective highs after both the Mexican and Canadian government’s denied a Politico report that the had been a “handshake” NAFTA deal. Stock markets in Asia have put in mixed performances. China is down after a two-day run higher, and USA500 futures are showing modest declines.

Asian Market Wrap: Treasury yields are down -0.5 bp at 2.824%, while 10-year JGB yields are up 1.2 bp at 0.088%, as Japanese bourses moved higher, amid an overall mixed performance on Asian markets. Trump’s former associates being found guilty put some pressure on US stock futures which are heading south. Japanese stocks are moving higher and Topix and Nikkei are posting gains of 0.75% and 0.57% respectively. The Hang Seng is up 0.37%, but Chinese markets are down – the CSI 300 -0.50% and the Shanghai Comp -0.60%. The ASX is down -0.38%. Investor focus is now turning to Fed minutes ahead of the Jackson Hole symposium later in the week.

Charts of the Day

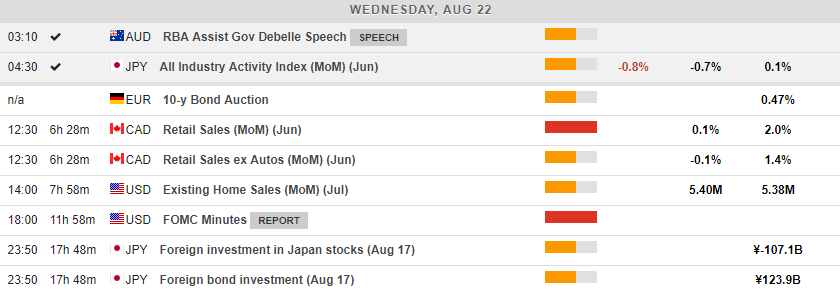

Main Macro Events Today

- Canadian Retail Sales (CAD, GMT 12:30) – Consensus forecast is that retail sales should grow by 0.1%, compared to 2.0% last month.

- FOMC Minutes (USD, GMT 18:00) – The Federal Open Market Committee meets 8 times a year and reviews economic and financial conditions. The detailed report offers in-depth insights to the conditions which have influenced the Federal Reserve’s members as to where the interest rates should be set. Currency response depends on the minutes’ content. Probably the most important event for the USD this week.

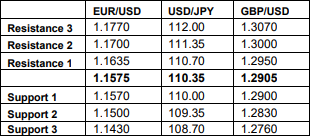

Support and Resistance Levels

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2018/08/22 14:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Dr Nektarios Michail

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.