FX News Today

Asian Market Wrap: 10-year Treasury yields are up 1.8 bp at 2.880%, 10-year JGBs up 0.7 bp at 0.094% as of 05:35GMT, as stocks move up from early lows on trade talk hopes. Asian sold off early in the session amid concerns over global growth and particularly China, after a Sino-related tech slump saw Wall Street heading south yesterday. Reports that China and the US are preparing a low level round helped to put a floor under markets, however, and mainland China bourses managed to move higher, while other indices are up from early lows. Topix and Nikkei are down -0.78% and -0.21% respectively. The Hang Seng is still down -0.395, but CSI 300 and Shanghai Comp are now up 0.61% and -0.20% respectively. The Kospi slumped -0.87% after returning from holiday and the ASX 200 is down -0.035. Meanwhile, US futures are moving higher with Chinese markets. Oil prices are slightly up from lows and the September US oil future is trading at USD 65.10 per barrel.

FX Update: The Dollar and the Yen have both weakened, giving back recent gains amid an improvement in risk appetite. The US and China have agreed on a new round of trade talks, while Turkey has managed to halt the rout of the Lira and secure major investments from Qatar and China’s Alibaba. The USDIndex (DXY) is showing a 0.3% decline, at 96.44, heading into the London interbank open, while EURUSD is concurrently showing a 0.3% gain, earlier printing a two-session high of 1.1397, putting in some space from yesterday’s 13-month low at 1.1316. USDJPY has settled in the upper 110.00s after printing a low in Tokyo at 110.46. AUDJPY, viewed as a forex market proxy on risk appetite in global markets, is showing the biggest move with just over a 0.5% gain. Over the near-term, the Dollar and the Yen will likely remain apt to weaken before settling as developments on the latest phase of Sino-US negotiations are awaited.

Charts of the Day

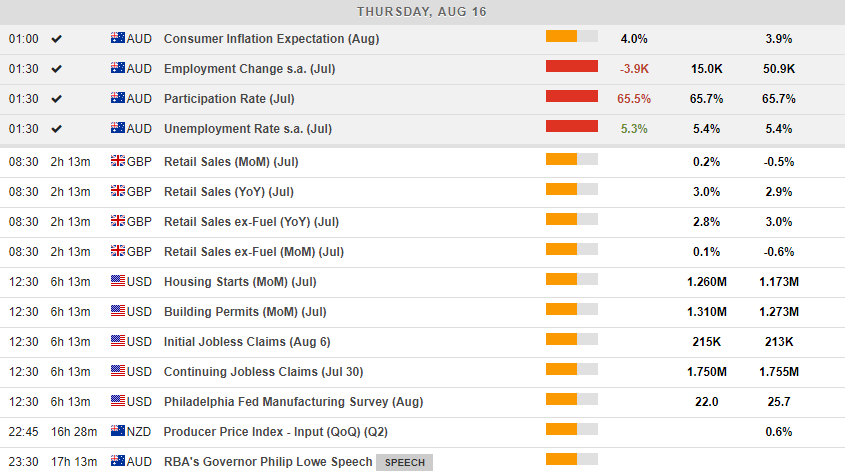

Main Macro Events Today

UK Retail Sales – expected to grow by 3% YoY in July.

US Housing Starts – expected to increase to 1.26 mln in July, compared to 1.17 mln in June, with building permits also expected to increase breaking the 1.3 mln barrier.

US Initial Jobless Claims – stabilisation to approximately 215,000 slightly up from 213,000 from last week. Continued jobless claims are expected to decrease slightly to 1.75 mln from 1.755 mln last week.

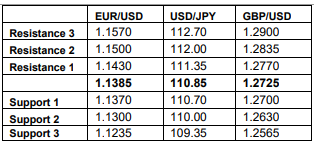

Support and Resistance Levels

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2018/08/21 14:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Dr Nektarios Michail

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.