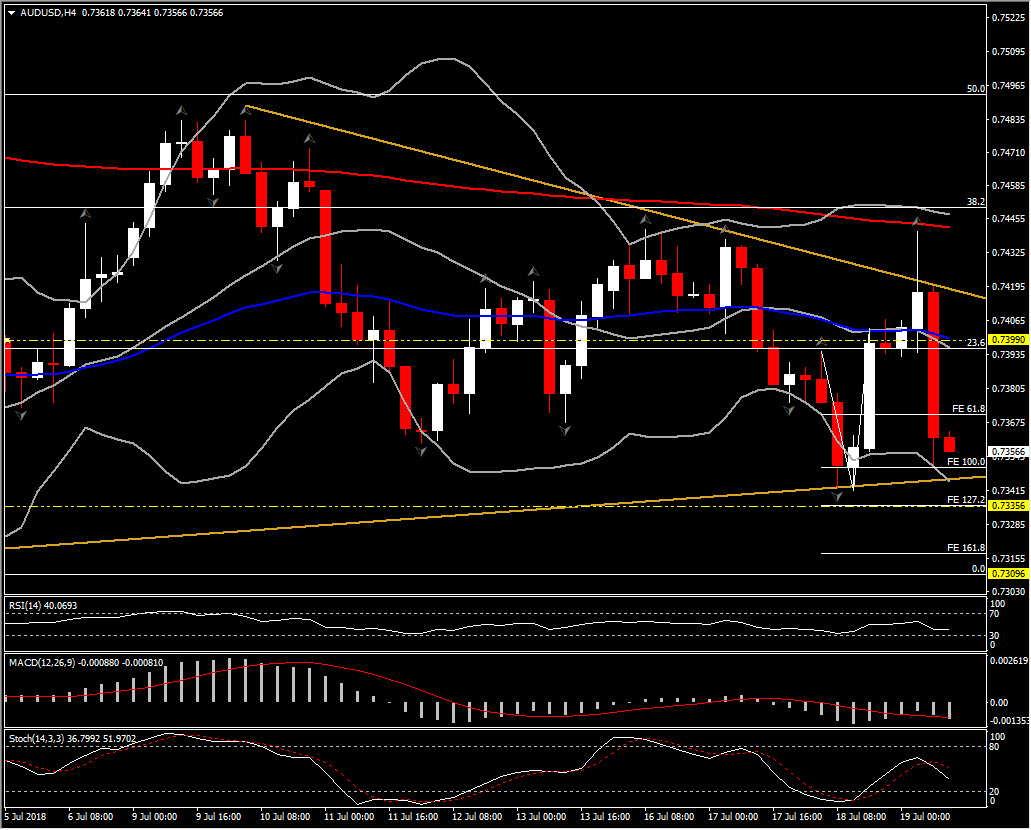

AUDUSD, H4 and Daily

The Dollar was bid up from the London interbank open, tracking a rise in US Treasury yields. The Australian Dollar rallied on a stronger than expected Australian jobs report, which showed employment rising 50.9k in June from an upwardly revised 13.4k gain in the previous month.The report was strong, but it is unlikely to persuade the RBA to raise rates anytime soon given still non-threatening underlying inflation growth and concerns about downside risk to China’s outlook. USDCNY, meanwhile, posted a near one-year high, amid rising trade concerns over China retaliation risks and, on the plus side due to PoBC reports that showed signs intervening.

Australia and China are two closely correlated countries economically, hence the return of trade risks affected Aussie as well. AUDUSD jumped to 0.7441 on the surprisingly strong job gain, from about 0.7400, before slipping slightly to 0.7410. However, on London Open it broke below the 23.6% Fibonacci retracement level of the decline from 0.7676 to 0.7309, around 0.7400 barrier and it is currently trading around 0.7350 area.

This week, the AUDUSD is reporting lower lows after forming on Tuesday an Evening Star pattern in the daily chart. This suggest along with the negative picture out of the technical indicators, that selling pressure has been reinforced and is likely to reach 5-month lows.

Despite the formation of a Falling wedge in July (Bullish pattern), today’s aggressive selling the last 4-hours suggests that the bearish outlook holds up. In the 4 -hour chart, the momentum indicators confirmed the decrease of the positive momentum intraday. RSI is pushing towards 30 and Stochastic is moving lower. MACD lines are still in the negative territory, increasing to the downside.

Therefore, as the technical picture looks bearish, a break above the FE 100.0 (set on yesterday’s rebound) at 0.7350 should suggest further downwards movement. Next immediate Resistance levels come at the confluence of latest fractal and FE127.2, at 0.7335 and at month’s bottom at 0.7309.

On the upside, only a break above the round 0.7400 level which coincides with 50-period EMA and 23.6% Fib. level could turn the short term outlook positive. However the AUD remains overall, in a bearish picture since the general bullish view of the Dollar remains, as it is rooted on the strong US economy and the Fed’s course to further rate hikes.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2018/07/19 15:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.