FX News Today

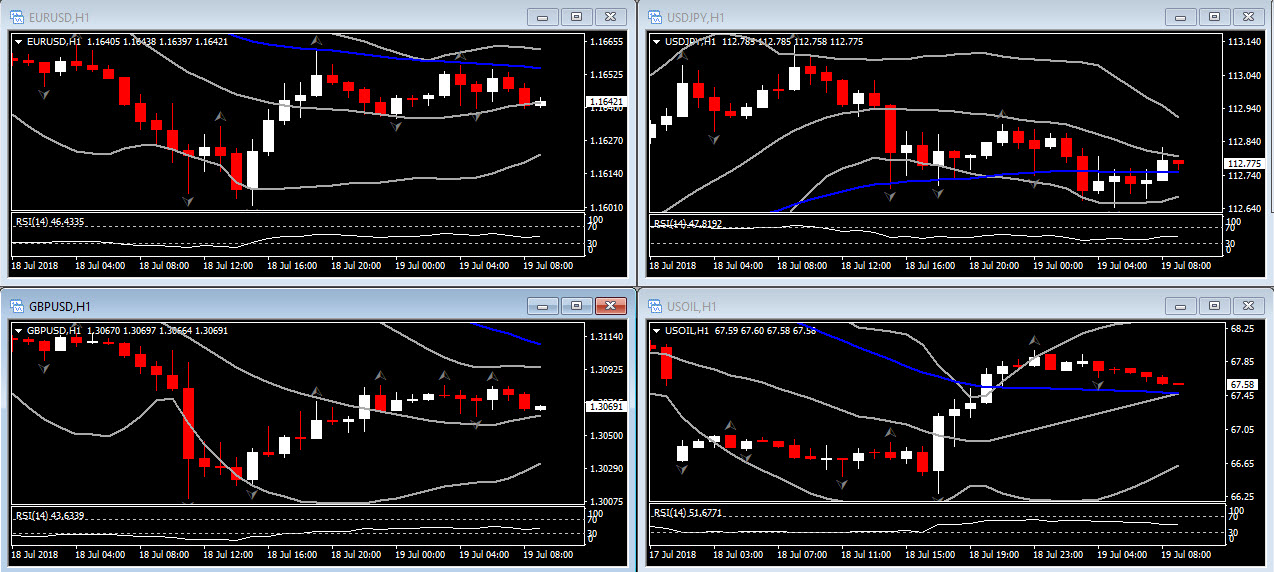

Asian Market Wrap: Bond as well as stock markets traded mixed during the Asian session. 10-year Treasury yields rose 1.7 bp to 2.886%, after Fed Chairman Powell’s hearing did little to derail rate hike expectations. 10-year JGB yields meanwhile dropped -0.3 bp to 0.031%, as BoJ cut back its purchases of longer-maturity bonds for the first time since January. Australian 10-year yields surged 3.3 bp as Australia’s employment surged, thus underpinning expectations for wage growth, inflation and a rate hike further down the line. Stock markets are narrowly mixed, with Topix and Nikkei up 0.03% and down -0.06% respectively. The Hang Seng is down -0.12%, the CSI 300 down -0.09%. The ASX 200 is up 0.36% after the strong employment numbers, but US stock futures are also trading narrowly mixed. Oil prices are marginally higher on the day with the WTI future trading at USD 68.78 per barrel.

Australia employment surged 50.9k in June, well in excess of expectations following the 13.4k rise in May (was +12.0k). The details were upbeat, as full time employment rose 41.2k after a 19.9k drop (was -20.6k). Part time jobs grew 9.7k after a 33.4k gain (was +32.6k). The unemployment rate was 5.4% in June, matching May. The participation rate rose to 65.7% from 65.5%, restraining the unemployment rate. This report is strong, but it is not likely to persuade RBA to raise rates anytime soon given still non-threatening underlying inflation growth and concerns about downside risk to China’s outlook. Moreover, the July meeting minutes saw the Bank observing that there is likely ongoing excess capacity in the labour market. AUDUSD jumped to 0.7435 on the surprisingly strong job gain, from about 0.7400, before slipping slightly to 0.7425.

Charts of the Day

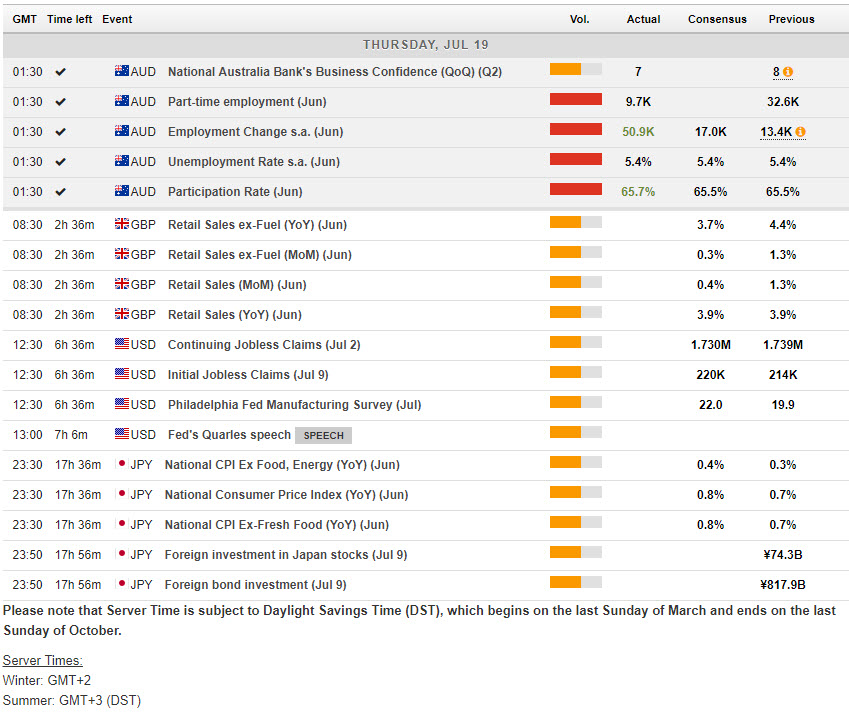

Main Macro Events Today

- UK Retail Sales – Expectations – growth of 0.3% m/m in June is anticipated, down from the strong 1.3% m/m growth that was posted in May.

- US Philly Fed Manufacturing Index – Expectations – Expected to rise to 21.0 in July, after falling to a 19-month low of 19.9 in June.

- US Jobless Claims – Expectations – estimated to be rising to 220K, following the 214K last week.

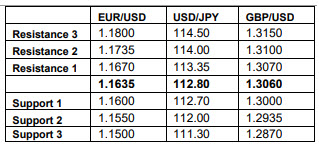

Support and Resistance Levels

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2018/07/19 15:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.