EURGBP and GBPUSD, H1 and Daily

UK June CPI came in below expectations, with the headline reading unexpectedly holding unchanged at 2.4% y/y. The median forecast had been for an uptick to a 2.6% y/y clip. Core CPI fell to 1.9% y/y from 2.1% y/y in May, contrary to the median expectation for an unchanged reading. Price rises for motor fuels and domestic gas and electricity were the largest upside drivers of headline CPI, though these were more than offset price declines in clothing and game, among other, categories.

The data will reduce the odds for BoE to tighten at the August MPC meeting, and UK yields and the Sterling have duly dropped quite sharply. One of the central supporting arguments behind BoE’s guidance for gradual tightening is that a tight labour market and low productivity growth will conspire to drive wages and consumer prices up, though this clearly hasn’t been transpiring yet. Aside from the dip in headline and core CPI readings, yesterday’s labour market report showed average household earnings to be rising at just 0.1% y/y in real terms (in the 3 months to May, ex-bonuses).

Meanwhile, last night, the British Prime Minister survived a key vote on a Brexit-related bill by the skin of her teeth, although lost one concerning the regulation of medicines after Brexit, but the Brexit process is looking borderline disorderly. Yesterday, BoE Governor Carney warned of “big economic consequences” to the economy in the event of a no-deal exit from the EU, although he stressed that it would be “premature” for the Central Bank to make judgements on the government’s recently published policy document on Brexit, and he also emphasized that the UK banking sector was appropriately capitalised for a cliff-edge Brexit scenario.

Regarding BoE, the outlook remains on a 25 bp hike in the repo rate to be announced on August 2, which would take the rate to 0.75%. However, this has become a tentative call given the sharpening in Brexit-related tensions in UK politics and today’s miss of inflation data.

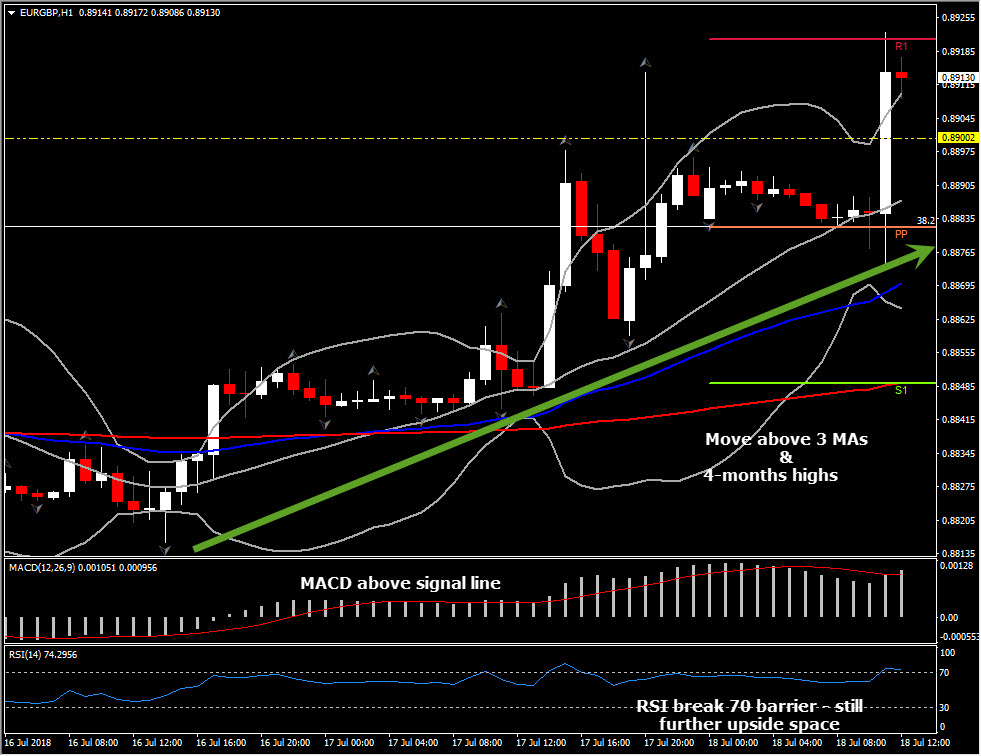

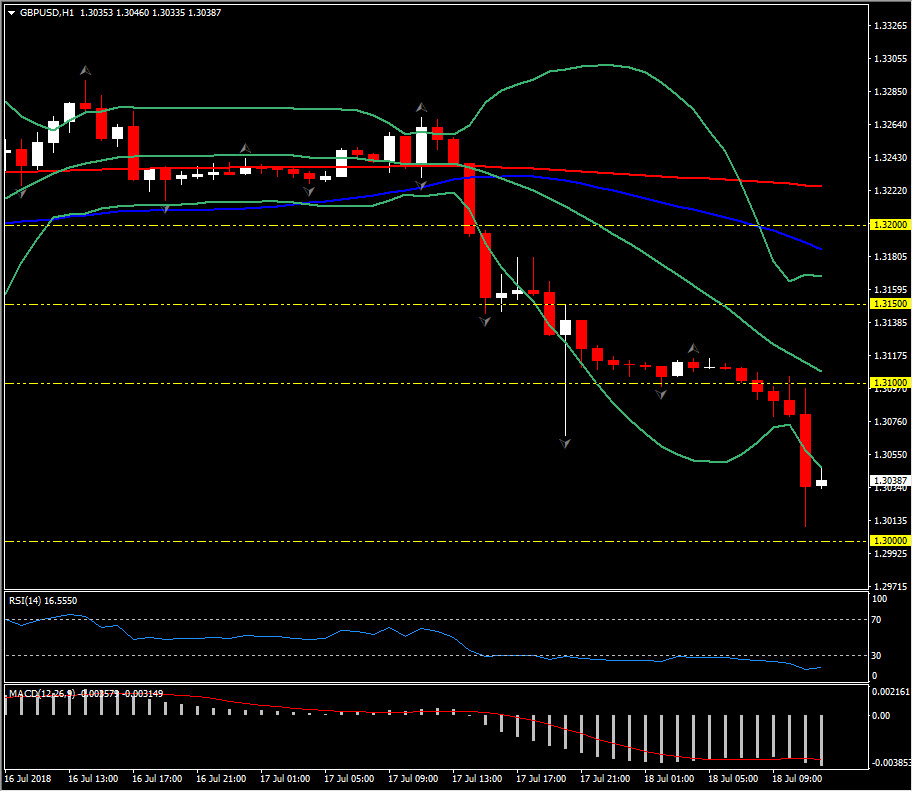

The Pound has come under new pressure after the data announcement, with the Cable posting a 14-month lows of 1.3009 while EURGBP has printed 4-month highs above 0.8922.

Hence EURGBP is likely to remain in the positive outlook after breaking above the weekly and daily upper Bollinger Bands pattern along with the 38.2% Fib. retracement level since 2017’s decline. The pair is trading above all 3 DMAs the last 17 days, while momentum indicators remain positive. MACD, RSI still advancing, whilst any intraday pullback remains a chance to buy.

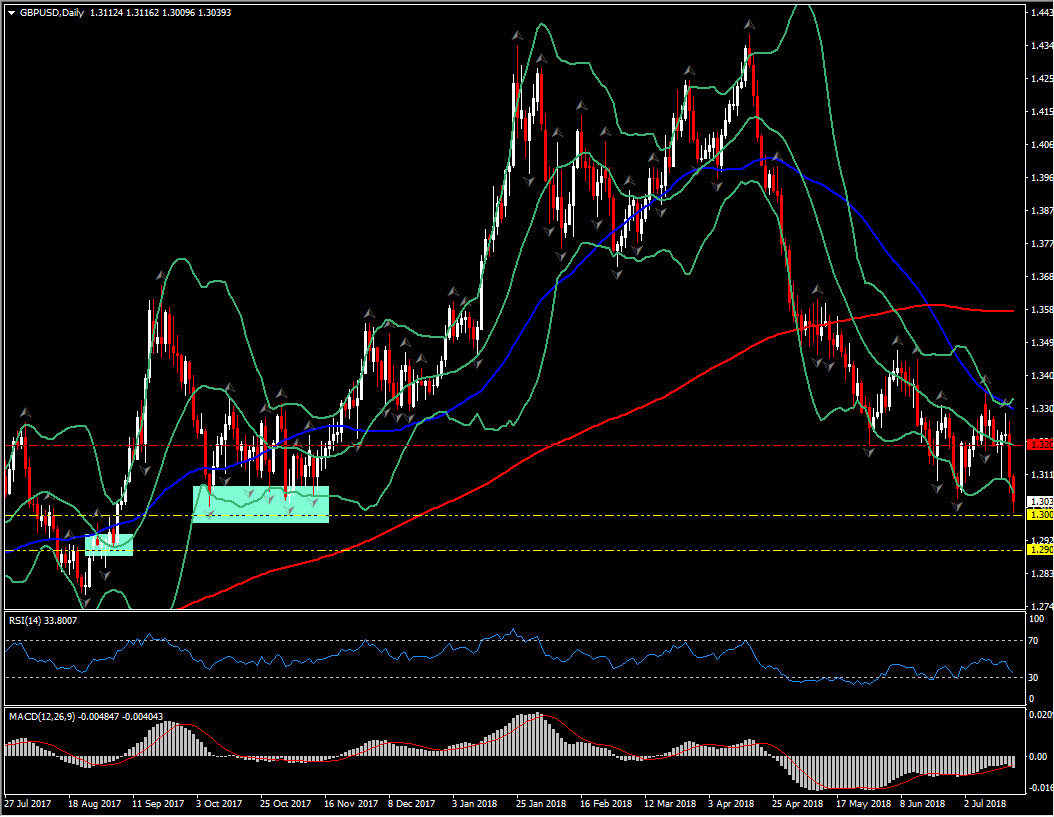

The same story holds for GBPUSD as it is facing 2 of the worse declines of the year. The sharp drift seen since yesterday broke below 1-year Support at 1.3050 and hence it is currently traded at September 2017’s levels. Intraday and daily momentum indicators are signifiantly negative, with the daily RSI sloping lower just a breath away from 30 barrier. MACD oscillator increases in negative area above signal line, while lower Bollinger Bands is expanding further to the downside.

Hence, pressure is likely to continue, with next Support at the round 1.2900 level. To the upside, only a decisive move above the 20-day MA 1.3200 could revert the negative outlook of the asset.

Intraday Support and Resistance levels:

EURGBP

Support: 0.8880, 08850, 0.8808

Resistance: 0.8920, 0.8950, 0.8992

GBPUSD

Support: 1.3000, 1.2935, 1.2900

Resistance: 1.3085, 1.3100, 1.3150

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2018/07/18 14:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.