FX News Today

Asian Market Wrap: Long yields continue to climb and 10-year Treasury yields are up 0.7 bp at 2.864%, 10-year JGBs up 0.6 bp at 0.032% as Stock Markets remained in risk on mode during the Asian session. Nikkei gained 1.09% after a strong close on Wall Street and with the earnings season starting to overshadow lingering trade jitters – at least for now. A weaker Yen added Support. The Hang Seng is up 0.36%, but CSI 300 and Shanghai Comp are down -0.20% and -0.11% respectively after their biggest rally in more than 2 years and as Inflation numbers came in higher than anticipated, but also reflecting lingering trade war concerns ahead of the next round of US tariffs due to be confirmed on July 20. Many expect markets to remain volatile ahead of July 20 – the date for the next set of US levies on Chinese imports. US stock futures are higher, however, and oil prices are up and the WTI future is trading at USD 74.29 per barrel.

FX Update: USDJPY has broken above recent range highs and printed a 7-week high at 111.14. EURJPY and other Yen crosses are also up, with EURJPY trading in 7-week high terrain and AUDJPY making 1-month highs. The driver of the yen’s underperformance is the continued rebound in global Stock Markets, although Chinese shares continue to underperform. The solid US jobs report last Friday and expectations for a strong corporate earnings season have been buoying equities, and while the shift toward trade protectionism remains at the top of the worry list of investors, the level of implemented tariffs so far is small in the scheme of things. BoJ Governor Kuroda yesterday repeated that the central bank will remain committed to ultra-accommodative monetary policy, including yield-curve control, until inflation hits the 2% target. USDJPY has Support at 110.88-90 while the May-21 high at 111.39, which is the highest level seen since mid January, provides an upside waypoint.

Charts of the Day

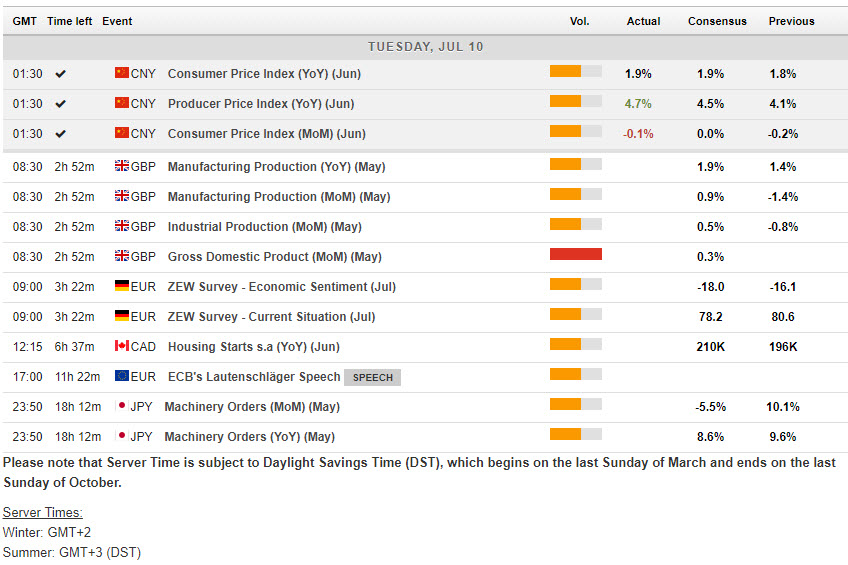

Main Macro Events Today

- UK Production Data – Expectations – Industrial production expected to rebound by 0.5% m/m after contracting by 0.8% m/m in the month prior, while we see the narrower manufacturing output figure rising 0.8% m/m after declining by 1.4% m/m in April.

- UK Trade Balance – Expectations – expected to fall to 11.9B from 14.0B last month .

- German ZEW – Expectations – July investor sentiment reading anticipated at -18.0 down from -16.1 in June, confirming that pessimists still outnumber optimists.

- Canadian Housing Starts – Expectations – expected to rebound to a 210.0k pace in June after falling to 195.6k in May from 216.8k in April.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2018/07/10 14:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.