GBPAUD & GBPCAD, Daily

Sterling is back on an underperforming path, showing a 1.3% decline versus the dollar over the last week, and respective falls of 1.0% and 0.7% against the Yen and Euro. Cable has pegged a fresh 7-month low at 1.3065, while the next immediate Support comes at 1.3000 and the next longterm one sits at the 61.8% Fibonacci retracement level set on 2017 ‘s rally, at 1.2900.

The increasingly urgent and ever fraught Brexit process, with major and minor businesses (including Airbus), warning the government to get a move on with regard to assuring that there will be a smooth post-Brexit customs border, has been weighing on sentiment. Things are coming to a head into EU leaders’ summit. There have been reports that many EU nations have been intensifying work on contingency plans for a no-deal scenario. Danish PM Rasmussen said yesterday, for instance, that “it is the first time we are saying clearly to the British that we can end in the worst scenario” with no deal. The BoE has long since caveated that its relatively upbeat prognosis of the UK economy hinges on a smooth Brexit.

As Brexit risks come into focus into EU leader’s summit, Pound weakness has been noticed against all major currencies. A slew of UK data are due in the final part of the week, including Consumer Confidence, 3rd release Q1 GDP and current account figures.

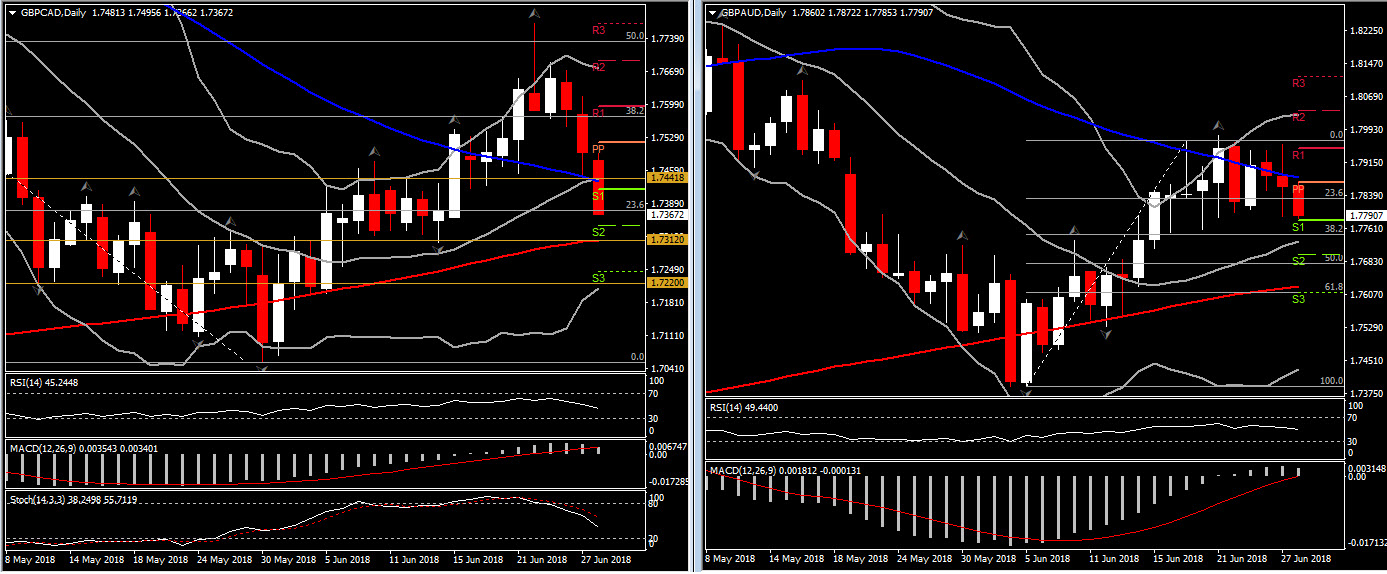

A big drop has been also noticed against Aussie and Loonie. GBPAUD has dropped by 173 pips since Friday, below the 23.6% Fibonacci retracement level set from the 1.7390 low posted on June 5. The pair is ranging within 1.7965-1.7750 range for 9 consecutive days, with the latest 3 Daily candles increasing possibilities of a correction lower. The pair is currently trading below 50-Day MA, while momentum indicators are looking neutral.

Meanwhile,despite neutral pictures from momentum indicators and the small body candles in the latest 3 sessions, the long down wings suggest that there is a lot of negative bias. Hence the question is whether this latest move will imply an ending of the recovery. A reversal of June’s uptrend could be possible if the pair manages to break below the 38.2% Fibonacci level and the 20-Day MA, at 1.7730-1.7750 area. Such breakout could spell a rally for 1.7610 barrier.

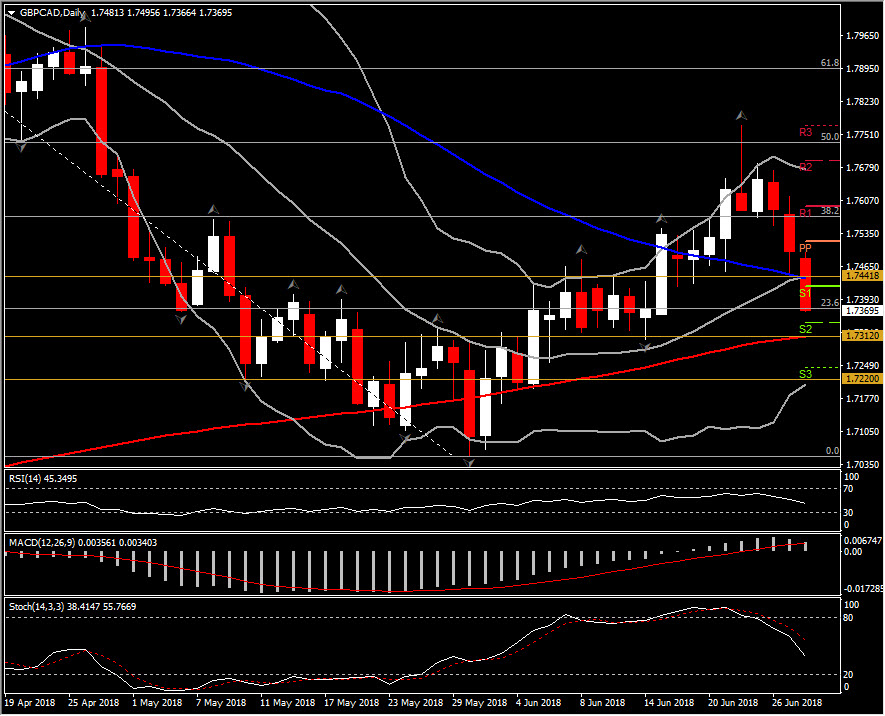

Another cross that triggered my attention was GBPCAD. GBPCAD moved in the same way as GBPAUD within 2018, however it has been sharply driven by the bears for the last 3 consecutive days.

Today, GBPCAD crossed into the lower Bollinger Bands pattern after breaking the 50-DAY MA. This breakout along with the retest of 23.6 % Fibonacci level since May’s decline, indicate that sellers are gathering momentum of the pair. Therefore the next Support level is at the confluence of the 200-Day MA and the latest down fractal at 1.7312.

The market has been supported well by the 200-Day MA during June therefore it should be considered as a key Support level. A closing today below 23.6% Fib. level and hence a closing breach of 1.7312 barrier would encourage the market for further correction to the down to 1.7220.

In contrast to Aussie, momentum indicators here are deeply negatively configured with Stochastic sloping towards negative territory, whilst RSI crossed below neutral zone and MACD is configuring neutrally however below its signal line.

The hourly RSI just crossed 30 barrier, Stochastic is moving towards oversold territory and MACD oscillator is increasing into the negative area below its signal line, suggesting that momentum is turning from neutral to negative. The hourly chart shows immediate Support at 1.7340 and the next one at 1.7250 for today’s session. The latest down fractal at 1.7440 could now become the next Resistance level, however a move to PP level at 1.7517 remains preferred.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2018/07/03 14:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.