The US Dollar has strengthened to a 20-year high against the Japanese Yen. Meanwhile, the Dollar is trying to break its strongest level against the Euro in two years. The dollar index, which measures the performance of the Dollar against six major world currencies, exceeded the 101.00 level for the first time in two years. This strengthening of the Dollar has had the greatest impact on the Japanese Yen, which has jumped to its highest levels since May 2002 due to differences in monetary policy. The Dollar closed yesterday with an increase of +1.5% against the Yen. In European trades, today, the Dollar has cooled but remains Bid in higher time frames.

Meanwhile, the Euro is relatively stable against the US Dollar. The EURUSD is currently moving in the range of 1.0800-30, above the two-year low recorded at 1.0757. The Euro is backed by European government bond yields, which are causing interest rate differences. The yield on the German 10-year bond rose to a 6-year high of 0.956% on Tuesday.

The application of lower interest rates by the ECB and the BOJ continues to provide benefits for the strengthening of the US Dollar, and expectations that the Federal Reserve will raise interest rates continue to support the strengthening of the Dollar.

Japan, meanwhile, reported a trade deficit of $412.39 billion in March 2022, compared to a market consensus of $100.8 billion, and reversed a surplus of $615.63 billion in the same month last year. The latest figure marked the eighth consecutive month of trade decline, as exports rose 14.7% year on year to 8,460.9 billion, while imports rose 31.2% to 8,873.3 billion. In the first three months of the year, Japan had a trade deficit of 3.274.2 billion, compared to a surplus of 464.4 billion in the same period in 2021.

Technical Overview

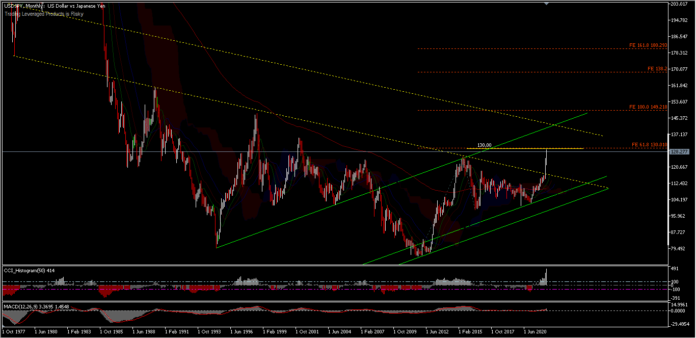

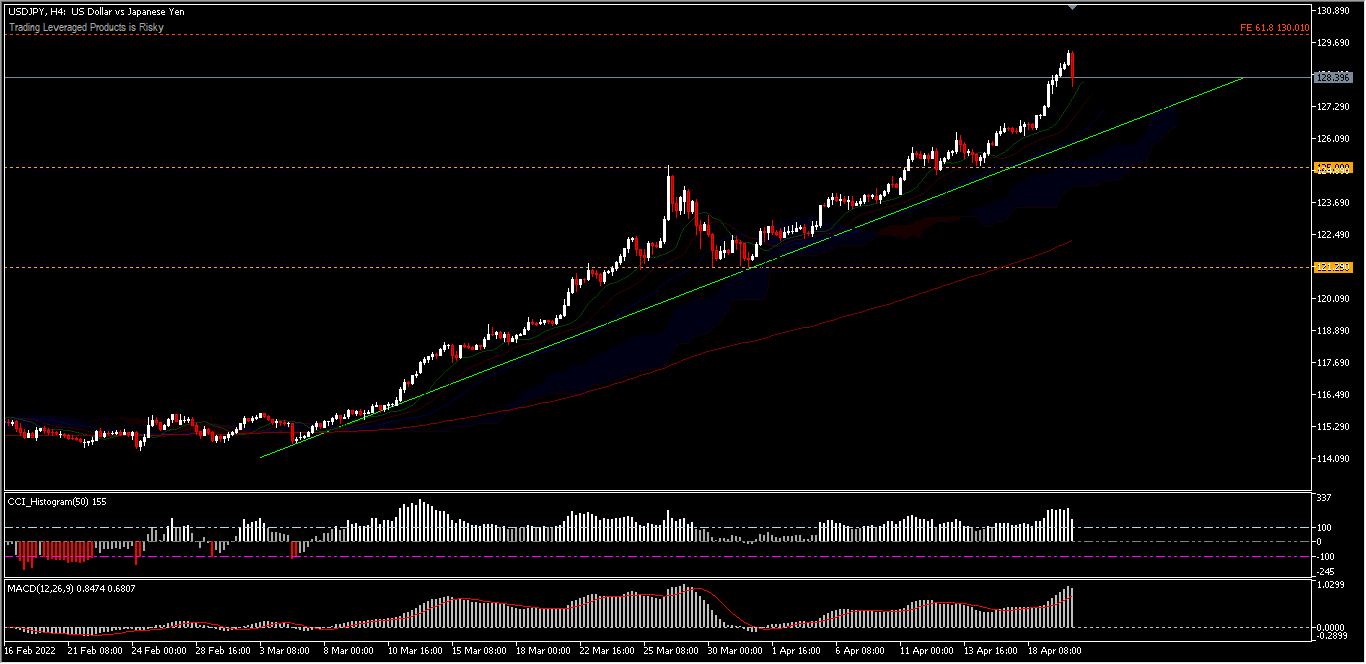

USDJPY recorded the strongest gains in the G10 group. For the first quarter of 2022 it increased by 5.7% and for the month of April it increased by more than 5% with a total increase of ± 11% this year. The difference in monetary policy and interest rates is the main reason for the strengthening of the pair. The current continuation of the main trend will target the peak of 2002 in the zone of 135.00, after the pair broke the key peak of 2015 (125.85) in April.

At the moment, the currency pair is closed in the forecast of FE61.8 (from a low of 75.57 to 125.85 and 98.93) recording an intermediate high at 129.39 today. In current trading in Asia, the pair appears to be down more than 140 points (over -1%). The inability of the pair to break the 130.00 limit with a round shape will reduce the correction to 125.00 (resistance becomes support). In general, however, the pair remains in the dominance of the bulls and a move above 130.00 should reaffirm the continuing upward trend.

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further dist