USD, Yields & Stocks (NASDAQ -1.21%) all dipped. Oil tanked over -6% – President Biden suggested releasing 180 mln barrels from US Strategic Reserve & OPEC stand firm on no production increases. Euro & Yen continued recovery, Gold lifted on weaker USD. Yield curve extended it’s inversion. ADP in-line at 455K ahead of NFP tomorrow, but Final Q4 GDP slipped a tick to 6.9% and German Inflation much hotter (7.3%) than expected, the highest since 1981 when the German bank rate was 11.4% while the ECB hangs on to 0% currently. Asian markets traded cautiously at month-end following the weak lead from the US.

Overnight – Chinese PMIs sink in contraction for first time since 2020 – Manu. 49.5 vs. 49.9 & Services 48.4 vs. 53.2. AUD Building Approvals & JPY Housing Starts both big beats. German Retail Sales fell significantly (0.3% vs 1.4%) UK Final Q4 GDP beats at 1.3% vs 1.0% (2021 final reading 6.6%) House Price Inflation much higher than expected (1.1% vs 0.5%).

- USD (USDIndex 97.88). Dipped further to test 97.70 yesterday before recovering.

- US Yields 10-yr closed at 2.358% , now back to 2.349%.

- Equities – USA500 -29.15 (–0.63%) at 4602. US500 FUTS 4602 now too from 4622. APPLE (-0.66%) broke 11-day run looks to move into Fin. Services, use Chinese chips, HOOD –8.49% & AMC –12.77% continue meme stock volatility. Lululemon (+9.58%) following good Earnings this week.

- USOil – Touched $100.65 after Biden news broke, but has recovered to $102.40.

- Gold – rallied to $1937 yesterday, before falling back to $1922 now.

- Bitcoin holds onto gains over 45K to trade at 47.0k now.

- FX markets – EURUSD rallied to 1.1185 earlier, back to test 1.1165 now, USDJPY holds at 122.00 now from 121.30 lows yesterday as BOJ continue to defend JGB yield ceiling. Cable back to 1.3130 now.

European Open – The June 10-year Bund future is down -15 ticks at 157.01, US futures are little changed. DAX and FTSE 100 futures are fractionally higher.

Today – Month & Quarter End Balancing, German Unemployment, US Weekly Claims, PCE Price Index, OPEC+ Meeting, Speeches from Fed’s Williams, ECB’s Lane & de Guindos.

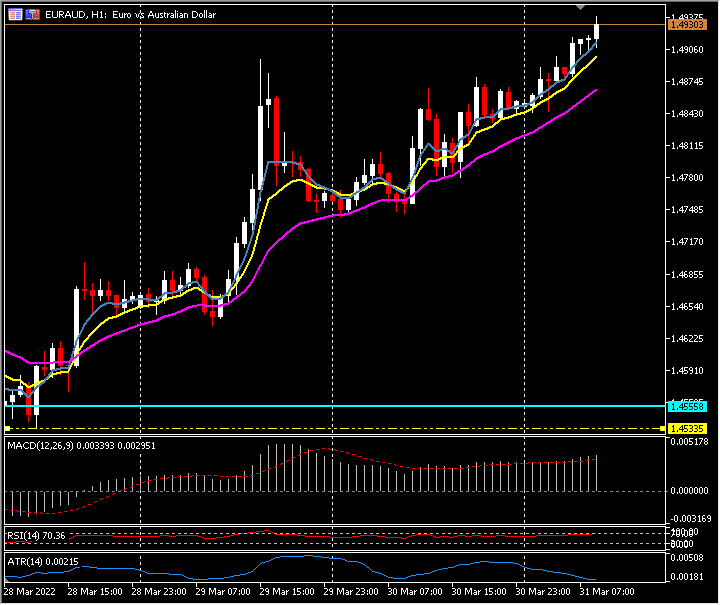

Biggest FX Mover @ (07:30 GMT) EURAUD (+0.44%) Continues to rally off 4.5 year lows at 1.4535 on Monday. Next resistance 1.5000. MAs aligned higher, MACD signal line & histogram higher but cooling, RSI 70 & rising, H1 ATR 0.0021, Daily ATR 0.152.

Click here to access our Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distribution.