The BOJ announced an unlimited Bond buying policy, but yields still rose and the YEN crashed, pulling down Asian stock & Oil markets, also hit by a strict 11-day lockdown in Shanghai (27 million). The US Treasury 5-to-30-Yr yield curve has inverted for the first time since 2006, history suggestions slowdown & possible recession. US 10-yr back over 2.5%. USD bid. APPLE talks of long-term subscription model moving away from selling product, as it reduces supply of iPhone SE & AirPods.

Biden & Blinkin “clarify” – “Putin cannot remain in power” comments, Zelensky talks of neutrality but insists on geographic integrity, walking back earlier comments. Russian & Ukrainian negotiators to meet in Istanbul later. Israel hosts 4-Arab states & Blinkin, NK tests more ICBM’s. Japan tightens FX laws and Crypto loopholes to sanction Russia.

Week Ahead – US NFP (380k), US, UK and Canada GDP and many central bankers’ speeches.

- USD (USDIndex 99.14). closed Friday 98.85. Friday’s US data weak (Pending Home Sales at 2-yr low & Consumer Sentiment at 11-yr low)

- US Yields 10-yr up to 2.53% currently & new 3-yr highs, from Friday’s close 2.492%

- Equities – USA500 +22.90 (+0.51%) 4543. US500 FUTS now at 4519 now. (close up 1.8% last week – Nasdaq best performer last week +2.0%.

- USOil – Fell to start the new week to $108.94 now – from Friday’s close at $112.50

- Gold – slipped to $1935 now, from Fridays close at $1955.

- Bitcoin breaks up 4.4% from the 42k-45K range to $46,800 now.

- FX markets – EURUSD back to test 1.0950, unable to hold breach of 1.1000, USDJPY over 123.00 & new 7-year highs and Cable back to 1.3130 now, from over 1.3200 on Friday.

European Open – The June 10-year Bund future is down -78 ticks at 157.87, underperforming versus Treasuries. A lockdown in Shanghai weighed on the CSI overnight and left oil prices lower, with the Ukraine war dragging on Europe’s energy costs are set to remain extremely high, with the resulting spike in the cost of living hitting consumers and consumption trends in many countries. In the UK that has already become apparent and last week’s budget offered not enough relief to soothe concerns. DAX and FTSE 100 are up 0.056% and 0.054% respectively at the moment. A cautious start for stocks then into a data heavy week that brings the final round of Eurozone confidence numbers for March and preliminary inflation reports that are likely to look ugly.

Today – ASEAN summit, US 2yr and 5yr supply, Trade Goods Balance & US Inventories. Speech from BoE Governor Bailey.

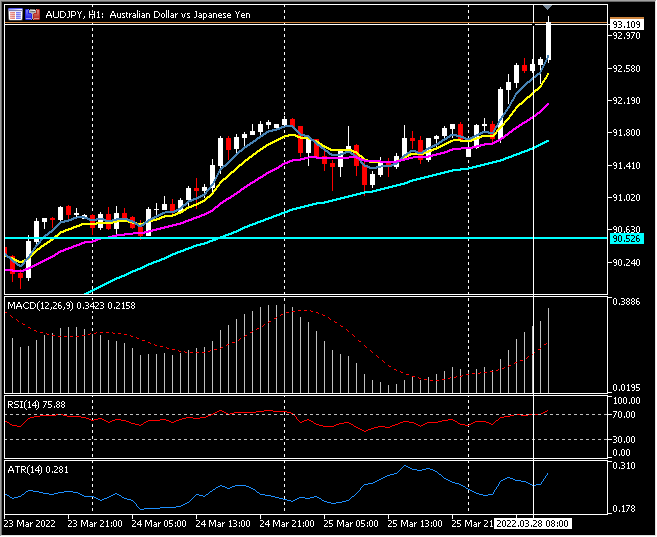

Biggest FX Mover @ (07:30 GMT) AUDJPY (-0.98%) Big move against JPY today, continues trend of weaker YEN. MAs aligned higher, MACD signal line & histogram strong but cooling, RSI 71, OB but rising, H1 ATR 0.281, Daily ATR 1.120.

Click here to access our Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distribution.