Confidence that the US economy will be able to cope with the series of rate hikes that are penciled in by the Fed has returned – at least for now. Markets are also positioning for another hike from the BoE next week, while the ECB is increasingly under pressure to justify the commitment to ongoing net asset purchases for much of the year.

- Geopolitics: The Biden Administration warned a Russian invasion of the Ukraine is imminent.

- Economic Data: The stronger than expected US GDP numbers helped to lift indexes out of negative territory. Australia’s PPI rate jumped to a whopping 3.7% y/y in Q4, which added to inflation concerns, but didn’t prevent local bonds from rallying after the sharp sell off yesterday.

- USDIndex gapped up to 97.35.

- 10-year rate has lifted 1.6 bp to 1.182%. JGB rates are up 0.7 bp at 0.16%.US 2-yr yield hit highest since Feb. 2020.

- Equities – GER40 and UK100 futures are mixed though, with the GER40 futures down -0.1%, and the UK100 future up 0.17%, after European markets managed to close with broad gains yesterday. By contrast Topix and Nikkei are up 1.9% and 2.6% respectively and the ASX rallied 2.2%. USA100 declined -1.4% but is currently back to the 14100 area, with the USA500 -0.54% lower but currently back to the 4350 area.

- China bourses underperforming ahead of the Lunar New Year holidays and with concern over China’s slowing growth, Covid policies and regulatory crackdowns weighing.

- Earnings: Apple posted record revenue of $123.9bn in Q4 of 2021, an 11% gain from a year before as its services business expanded and chip shortages were largely confined to iPad sales.

- USOil – steady at $86.00.

- Gold – extended losses below 200-DMA to $1791.

- FX markets – EUR has remained under pressure and EURUSD slipped to 1.1125, while GBP strengthened, with Cable at 1.3370, and EURGBP slipping to 0.8311. As risk appetite improves, USDJPY is at 115.66.

European Open – The March 10-year Bund future is fractionally higher, Treasury futures are underperforming slightly, while in cash markets the US 10-year rate has lifted 1.6 bp to 1.82%, as stock market sentiment continued to improve, also helped by positive earnings reports from Apple.

Today – Today’s data calendar has preliminary GDP readings for Germany, France and Spain, as well as Eurozone ESI economic confidence. In the US, the focus will be on Q4 ECI, personal income and Michigan consumer sentiment.

Earnings: Today’s earnings calendar features reports from Chevron, Caterpillar, Charter Communications, Colgate-Palmolive, Phillips 66, Weyerhaeuser, Synchrony Financial, and Booz Allen Hamilton.

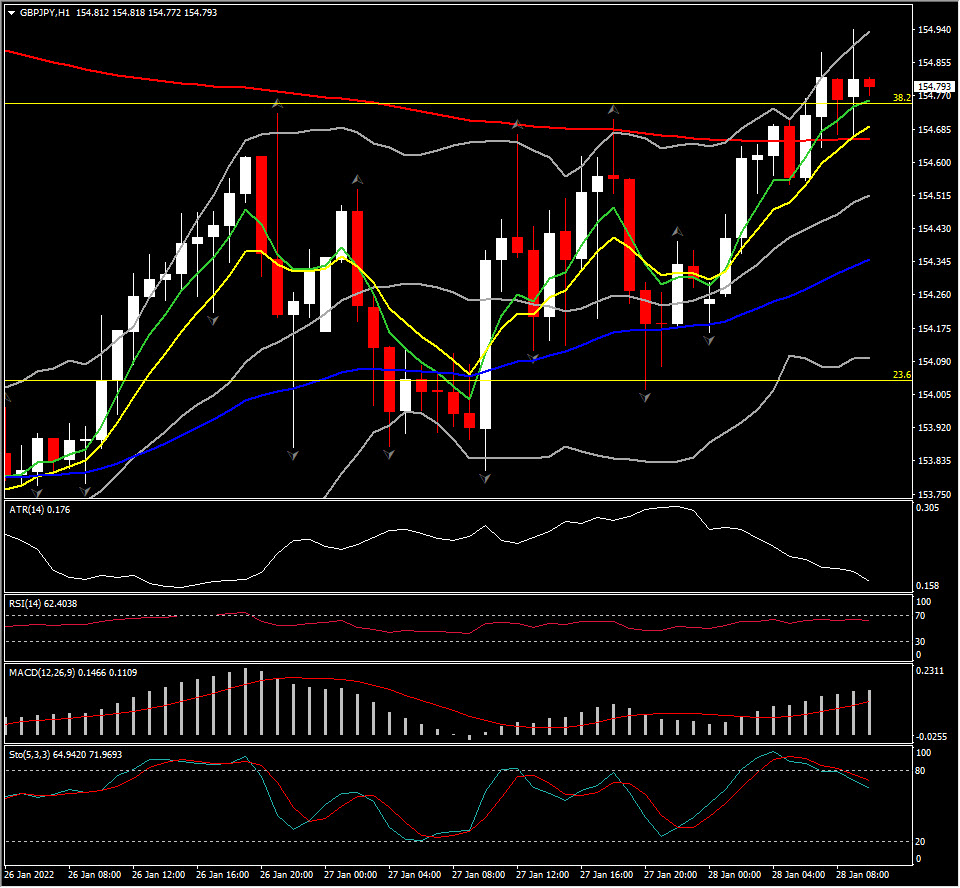

Biggest FX Mover @ (07:30 GMT) GBPJPY (+0.34%) – Breached 155 breaking 38.2% of December’s downleg. Fast MAs turn flat now with all momentum indicators still pointing further higher. ATR (H1) at 0.176 and ATR (D) at 1.064.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our written permission.