Treasuries continued under pressure as yields moved up supporting USD, Equities were mixed; Financials and Automaker’s (EV) rallied, US data (Jolts, & ISM Manu PMI’s) missed expectations, OPEC+ delivered production increase for February. Goldmans talked of $100k Bitcoin. US reported 1 million daily COVID cases, Israel says 4th dose effective at increasing antibodies, France discovers new variant with 46 mutations.

- USD (USDIndex 96.30) holds gains supported by higher yields – pressuring the YEN in particular. US stocks (Dow & S&P) hit new all-time highs but Nasdaq lost -1.33%.

- US Yields 10 yr rocked up to close at 1.668% trades at 1.64% now.

- Equities – USA500 -3 (+0.06%) at 4793 Ford (new 20-yr high) +11.67%, GM +7.47% TSLA -4.18%, USA500 FUTS now 4780.

- USOil – spiked over $77.00 trades at $76.75 now post OPEC+ big drawdown in private inventories –

- Gold – holds over $1800 significantly at 1813 now.

- Bitcoin holds over 45,000, trades at 46,400 now.

- FX markets – EURUSD recovered back to 1.1300, USDJPY new-5-yr high at 116.30 now 116.00, Cable back over 1.3500 at 1.3530.

Overnight – Tech stock in particular were under pressure in Asia from stronger USD & higher US yields.

European Open – The March 10-year Bund future is up 6 ticks, Treasury futures are outperforming, as stock markets started to correct from recent highs. Travel and tourism shares boosted indexes yesterday, but market sentiment started to turn overnight and DAX and FTSE 100 futures are down -0.2%.

Today – EZ & US Composite/Services PMI (Final), US ADP, FOMC minutes

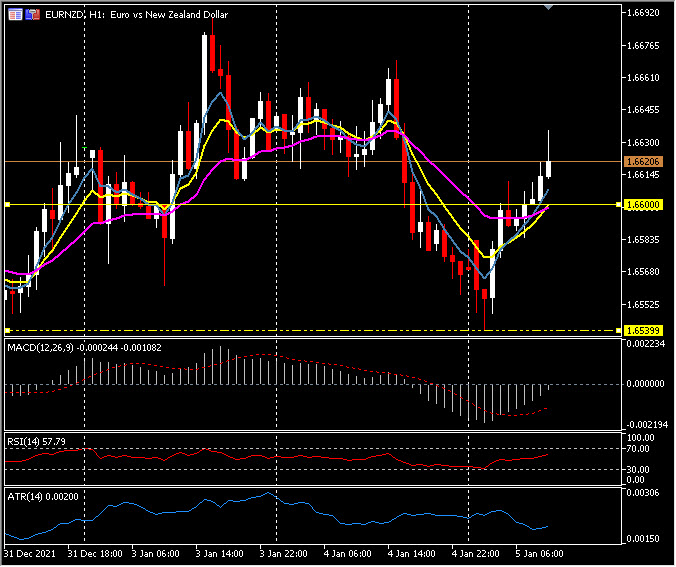

Biggest FX Mover @ (07:30 GMT) EURNZD (+0.33%) Sank to 1.6540 earlier and has rallied to 1.6620, yesterday’s high breached 1.6660. MAs aligned higher, MACD signal line & histogram higher, but below 0 line. RSI 57.80 & rising, H1 ATR 0.0020 Daily ATR 0.0120.

Click here to access our Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our written permission.