ConocoPhillips is scheduled to release its third-quarter 2021 earnings report on November 2, 2021 at 4:00 PM GMT.

ConocoPhillips

ConocoPhillips Corporation, headquartered in Houston, Texas, is an American company specialized in the field of energy, exploration, production and development of natural gas and oil in various parts of the world. ConocoPhillips emerged after the merger of Philips Petroleum Corporation and Conoco Corporation on August 30, 2002.

On August 3, 2021 ConocoPhillips announced its earnings report for the second quarter of 2021, which reported: earnings of $2.1 billion, or earnings per share of $ 1.55 per share, after the company’s earnings in the same quarter of the previous year were $0.3 billion, or $0.24 per share. Adjusted earnings for the second quarter of 2021 were $1.7 billion, or $1.27 per share, compared to a loss from the same quarter in the prior year of $1.0 billion, or $0.92 per share.

Cash provided by operating activities was $4.3 billion. An amount of $1.2 billion was distributed to shareholders, divided into dividends of $0.6 billion and stock buybacks of $0.6 billion. The second fiscal quarter also included short-term investments of $2.3 billion, total cash equivalents and restricted cash and cash flow of $ 7.0 billion.

Technical Analysis

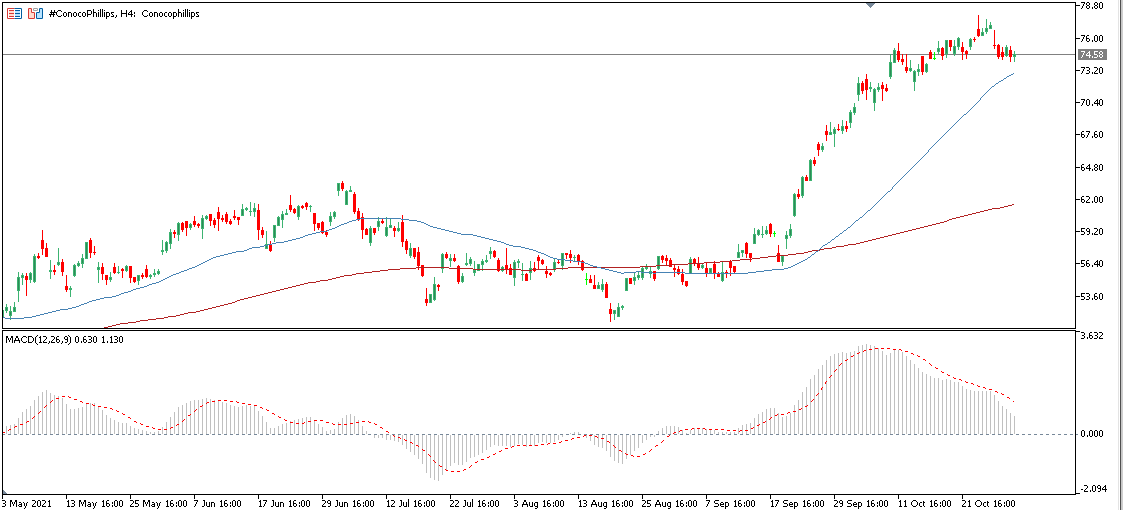

On the 4-hour time frame, the 50-period SMA (blue) is above the 200-period SMA (red) indicating the continuation of the bullish trend. The upward trend that began on September 13th continues. The highest reached was 77.10 and the lowest was 51.84. It is now trading at 74.58. MACD signal line and histogram are above the 0 line and continuing down.

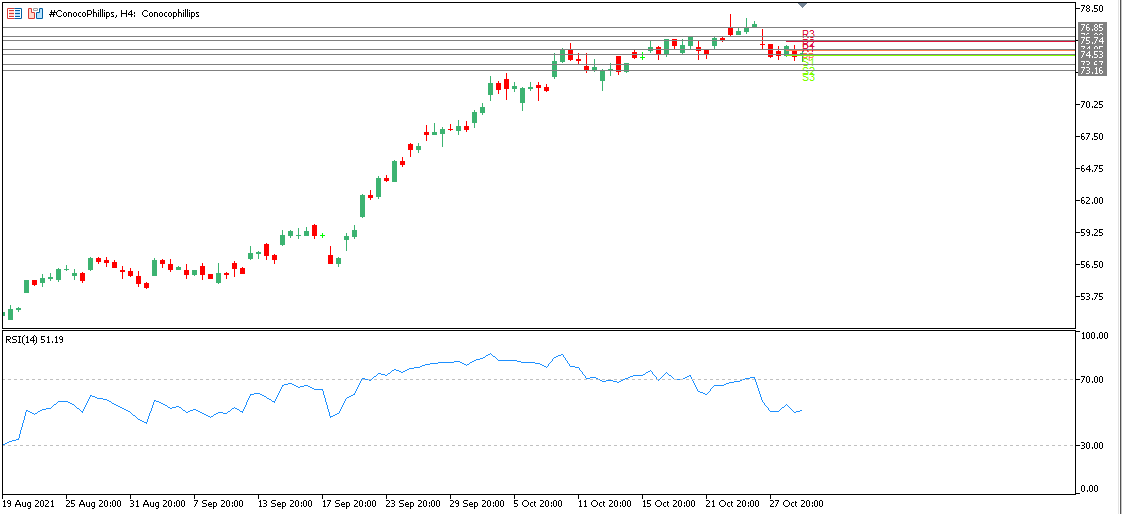

The main pivot point is located at 74.95, while the first, second and third resistances are at 75.74, 76.22 and 76.85 and the first, second and third supports are at 74.53, 73.67 and 73.16. RSI is at 51.19.

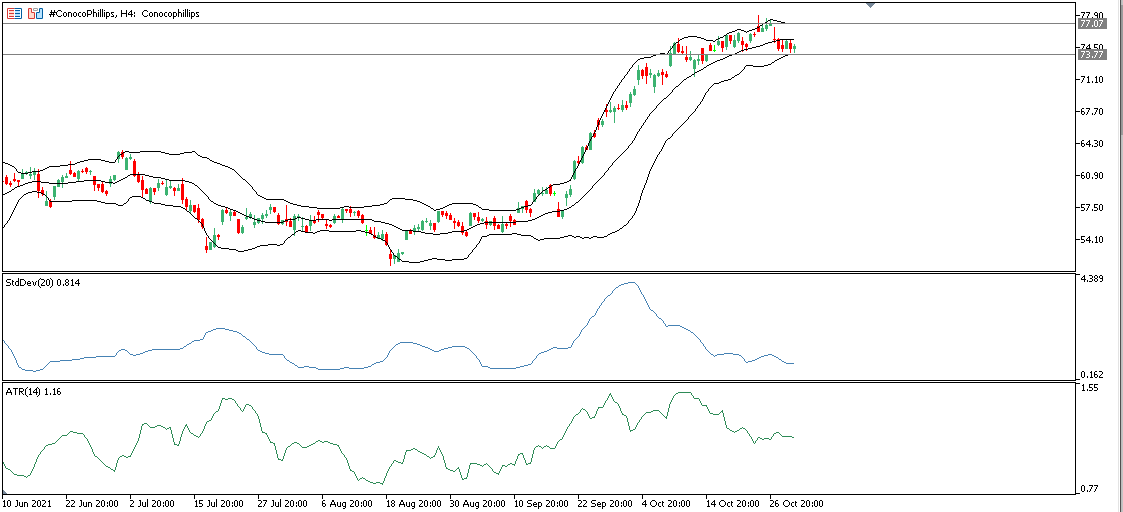

After using the Bollinger Bands indicator, we find that the upper band of the volatility channel is located at 77.07 and the lower band is located at 73.77. The 20-day simple moving average is at 75.43. We notice here that the upper, middle and lower bands are approaching each other, and this indicates a period of low volatility. We also find the Standard Deviation (20) at 0.814 in the oversold region and the Average True Range (14) at 1.16.

Hence the asset is showing an intraday increasing positive bias before earnings release, with major support at 74.36. The medium-term outlook remains positive as the asset is flat at 4-month highs with a bullish crossover from the 20- and 50-day simple moving averages and rising MACD lines suggesting that the bulls are still in control. A break below 74.36 could open the door to a lower 51.76 (August low), while a further rise above 77.07 could draw attention to the 82 area.

Click here to access economic calendar

Eslam Salman

Regional Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.