Gold continues to struggle, pushing the price higher. Despite the slight weakness of the US Dollar after the publication of CPI data, which gave room to the gold Bulls, it is still struggling to break above $1760.

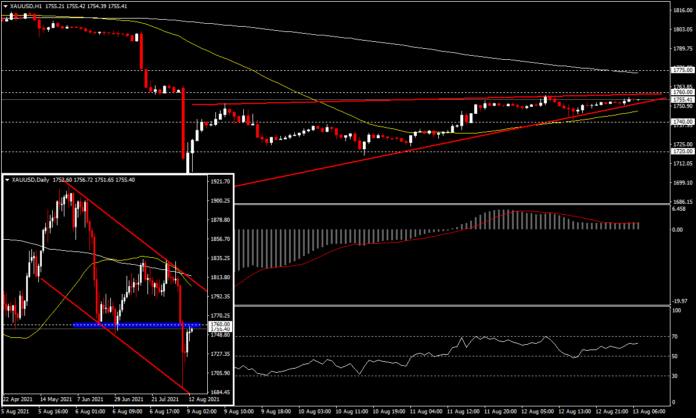

XAUUSD, H1 – The Gold price has recovered almost all of this week’s drop but is still under pressure from bond yields. The 10-year US Treasury remained fixed at 1.35% while market sentiment could push the US stock market to a new all-time high this week. This is partly due to the passing of the $1 trillion infrastructure bill by the US Senate this week.

As for the US Dollar, it was lower on Wednesday as the July inflation rate dropped to 0.5% m/m from the 0.9% seen in June. Meanwhile, the annual inflation rate was unchanged at 5.4%, above the 5.3% expected by the market and the highest level in 13 years, causing the USDIndex to drop from a multi-month high to below 93.00 again.

However, after the selling activity last Monday, gold trading in the market declined throughout this week. In the H1 timeframe, the price is in a narrow sideways frame, and has begun to pullback from the key resistance 1,760.00, while the MACD is moving down towards the 0 line, presenting a contrast between the price and the indicator momentum. This is indicative of a trend of a rising wedge reversal pattern that could lead to a drop in gold prices by the end of the week. The first support is at yesterday’s low at 1,740.00 and the next at 1,720.00, while if the price breaks above 1,760.00, the next resistance will be at the 200-hour SMA area at 1,775.00.

Current sentiment conditions are relatively mixed, while market liquidity is seen slightly reduced following the summer holidays, market slowdown due to Delta Covid-19 variant concerns and strict enforcement action by the Chinese government on financial regulation matters, all of which may give Gold room to strengthen. No key data is expected to be published in the London session or the New York session.

Click here to access our Economic Calendar

Chayut Vachirathanakit and Tunku Ishak Al-Irsyad

Market Analyst – HF Educational Office – Thailand and Malaysia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.