The outlook for US inflation and the Fed’s upcoming policy tightening is in the spotlight ahead of today’s consumer price data and Fed Chair Jerome Powell’s remarks on Wednesday and Thursday. Inflation rose 5% in May y/y and another sharp rise is expected for June, with a consensus of 4.9%. If the CPI matches expectations, the market will be looking for clues from the Fed regarding policy tightening, which could lead to a strengthening of the Dollar.

Concerns about the Delta variant are still a sentiment adding to the tension in the financial market. In tied trade, the USA500 is trading below its ATH 4,378.20 today as we enter the second-quarter earnings season in the US stock market this week. Meanwhile, the G20 countries agreed to a 15% global digital tax to end limited freedom and liability for large IT corporations such as Apple, Google, Amazon, Twitter and Facebook.

In Asia, Japan’s inflation has been at a low level for years and a massive stimulus program has failed to push inflation up. However, a surge in oil prices and increased vaccine launches may be of little help to higher wholesale prices. The Corporate Goods Price Index, which measures corporate inflation, jumped 5.0% in June y/y, after rising 5.1% in May, marking a 13-year high. Companies are expected to pass higher costs on to consumers, which will contribute to higher price pressures.

Technical Analysis

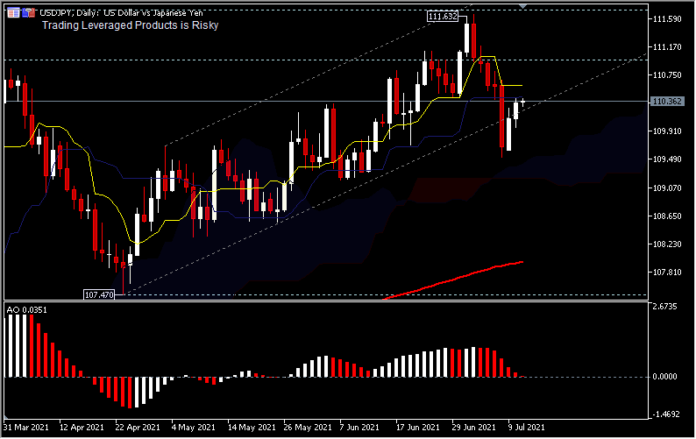

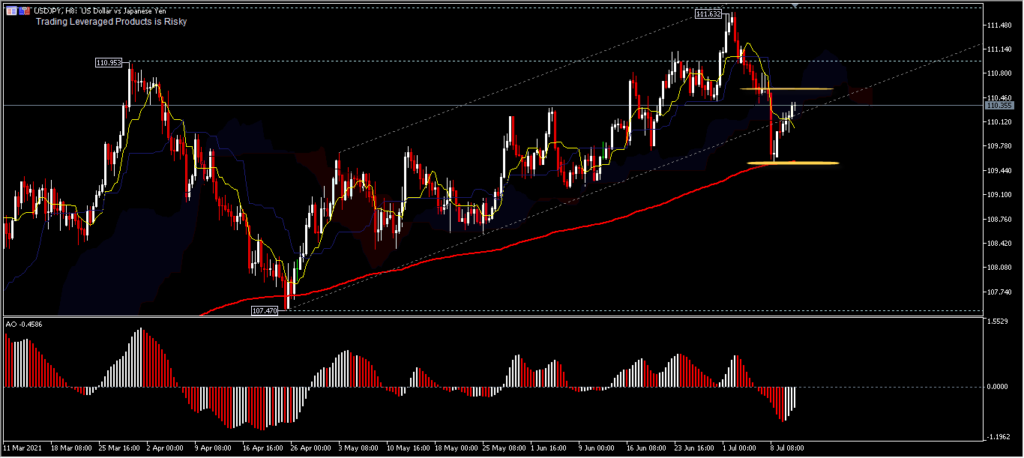

The Yen was relatively weak and the domestic economy faltered as the resurgence of Covid exacerbated the situation, causing the government to declare a state of emergency in Tokyo. USDJPY is starting to look like it is entering a correction phase after bouncing off the average yearly high, recording a peak of 111.63, but broadly the asset is still in a bullish trend.

Intraday bias is likely to the downside, after breaking the 110.41 structural support. However the 200-period EMA on H8 still stems last week’s decline, even though the price has broken the lower line of the ascending channel. However as long as the resistance at 111.63 remains intact, prospects for a deeper correction are possible, having crossed the new intraday support at 109.52. In this context, a deep correction will refer to the price levels of 109.19, 108.55 and 107.47.

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst – Educational Office – Indonesia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.