Wall Street was mixed on Friday, with the USA30 outperforming as reflation trades are back on. Supporting the rally was a blowout earnings report from Nike. The company saw record quarterly US sales, and beat on the bottom line as well, seeing the USA30 member surge to all-time highs, gaining over 15%. The USA500 closed at record highs, adding 0.34%, up 14 points to 4,281. Yields pushed higher last week, as growth optimism dominated, but investors are keeping a weary eye on virus developments amid the emergence of new more infectious strains.

Today: It was a very slow start to the week for equities, with markets across the Asia-Pacific region hardly moving as investors weighed Covid developments and the outlook for central bank policy. The 10-year Treasury yield is unchanged at 1.5%. Equity markets have traded narrowly mixed, as a new rise in Covid-19 infections across Asia and concern over more potent strains weighed on sentiment. In Malaysia the nationwide lockdown was extended, while Greater Sydney was put under stricter restrictions in a bid to contain outbreaks. In Hong Kong the morning session was cancelled thanks to a rain storm warning. BoJ was confident of recovery at June meeting the summary of discussions showed. The sense was that accelerating vaccination programs would prop up the economy. At the same time inflation pressures were still judged to be benign given the fragile recovery.

Forex Market: JPN225 is currently down -0.1%. GER30 and UK100 futures are up 0.1% at the moment and US futures are posting similar gains. The Australian Dollar and New Zealand Dollar drifted lower, USDJPY dropped to 110.61 while the EUR steadied between 1.1920-1.1970 for a 5th day. The Pound strengthened across the board and cable is off last week’s lows, currently at 1.3909. The USOIL topped tto $73.69. Gold prices slipped to a 1-week low on Monday, weighed down by a bounce in the dollar and mixed signals from the FED on monetary policy tightening despite tame inflation data.

Monday’s Calendar – Fed’s Williams, Quarles and ECB’s Panetta along with Labor data and Retail Trade fom Japan.

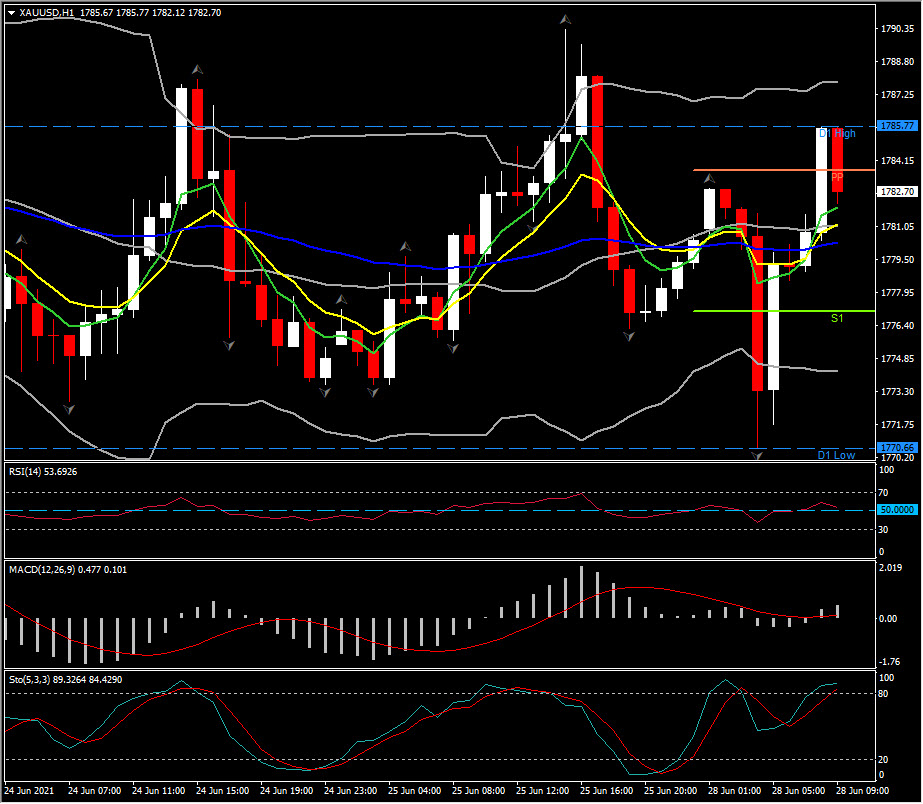

Significant FX Mover @ (06:30 GMT) XAUUSD (+0.34%) Rallied to the upper range level at 1785.77. Faster MAs currently flattened, RSI 54 and slipping, MACD signal line and histogram close to 0 line. Stochs rising and testing OB zone again. H1 ATR 3.4457, Daily ATR 27.3871.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.