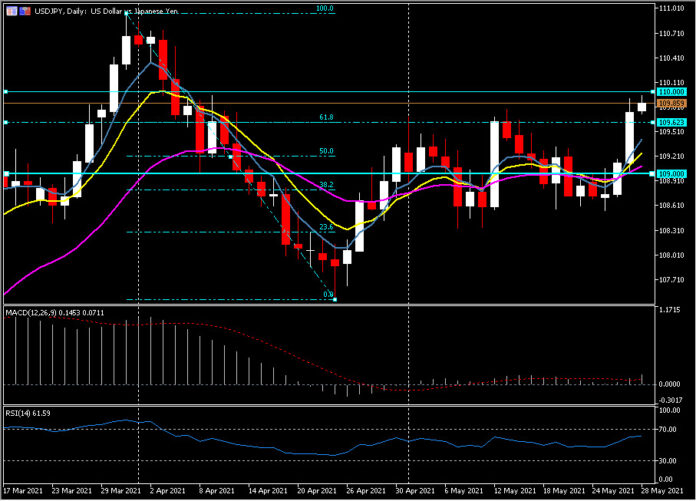

USDJPY, Daily

The Dollar has remained underpinned by a rise in longer-dated Treasury yields, with the 10-year T-note yield lifting above 1.62%, up about 7 bp from the midweek lows. News that US President Biden will present his $6 tln spending plan (which includes nearly $2 tln for pandemic relief, and $4 tln for a decade long infrastructure and social spending plan) lifted Treasury yields and gave stock markets a boost, despite Biden’s administration indicating that it is aiming to make a capital gains tax increase retroactive to April.

The USDIndex has posted an eight-day high at 90.40, with subsequent down ticks having remained shallow. EURUSD earlier pegged a one-week low at 1.2171 and USDJPY a six-week high at 109.95. Cable printed a one-week high yesterday at 1.4220 before turning lower to 1.4180 today.

A relatively big mover in terms of magnitude has been the New Zealand Dollar, which has corrected over half the gains seen following the RBNZ’s monetary policy statement on Wednesday, which indicated a possible OCR hike by the end of 2022. The correction has come despite the kiwi central bank governor, Orr, saying earlier that the downside risks to the economy have lessened. NZDUSD has seen a low at 0.7240, putting in some distance from the three-month high that was clocked on Wednesday at 0.7317. The approach of the weekend, coupled with the risk posed to the US Dollar by today’s US data, seem to have encouraged position trimming in NZDUSD.

The Australian Dollar has also traded softer versus the Greenback, despite speculation in some commentaries that the RBA will follow the RBNZ in staging a less-dovish turn, although positioning in ASX interbank cash rate futures as of today were in fact indicating a 77% expectation of an interest rate decrease to 0.0% from 0.10% at next Tuesday’s RBA policy meeting. In other news, the BoJ is reportedly close to extending its pandemic relief programme.

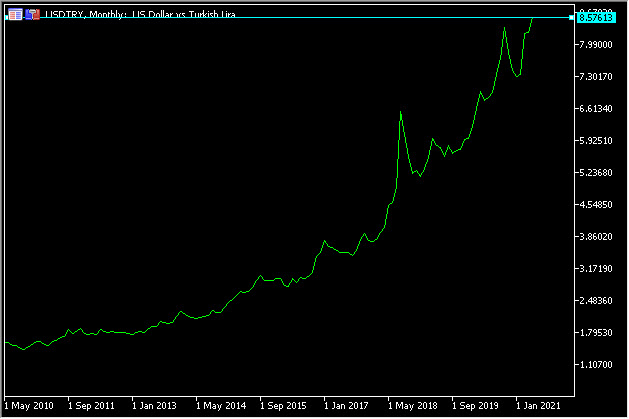

Elsewhere, the USDTRY hit an all time high north of 8.5760 as the stronger USD and rise in US yields impacts the EM currency complex.

In Europe, the Eurozone ESI economic confidence jumped to 114.5 in May – the highest reading since the beginning of 2018. The breakdown confirmed that the recovery broadened, with the services sector catching up and services sentiment jumping to 11.3, almost matching the 11.5 industrial sentiment reading. Consumer confidence remained in negative territory, but also improved, and once restrictions have been lifted further we expect consumer confidence will catch up. All in all a very strong report that confirms the strong rebound in overall activity. In addition, the ECB’s Schnabel argued that “rising yields are a natural development” at a turning point in the recovery – investors become more optimistic, inflation expectations rise and, as a result, nominal yields go up. The Executive Board member said in an interview with Reuters that “this is precisely what we would expect and what we want to see”. It seems then the ECB is done with trying to talk down rates and is starting to lay the ground for a pivot in policy as economic activity strengthens. Schnabel stressed that there hasn’t been a decision on asset purchases yet, but that “we always have to be willing to reduce or increase asset purchases in line” with the ECB’s “promise to keep euro area financing conditions favourable”. We expect that the ECB will as a first step scale back monthly purchase volumes again within an unchanged PEPP envelope. The ECB next meet on June 10.

In the US later, key inflation data looms in the form of the Fed’s preferred PCE deflator for April. Expectations are for a -14.0% drop in personal income in April, unwinding much of the 21.1% March surge thanks to the stimulus checks. Compensation should increase 1.2% after the 1.0% March gain. A -42.4% April drop in “current transfer receipts” after a 95.1% March surge, as this measure tracks stimulus spending, is also expected. Consumption should increase 0.9% after the 4.2% March jump. The savings rate is expected to drop to 13.0% in April from a 27.6% peak in March. Expectations are for a 0.6% increase in both the headline PCE chain price index and the core following respective gains of 0.5% and 0.4%. The data drops at 12:30 GMT, along with the latest on Wholesale Inventories and the Goods Trade Balance.

Click here to access our Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.