Market News Today – Consolidation generally ruled the day in bonds and stocks after some big swings in recent sessions. The focus remains on the robust recovery, the rise in inflation, virus spikes and widening distribution of vaccines, and the varying dimensions of all left the markets in limbo.

Traders kept a close eye on volatile cryptocurrencies as China reiterated its commitment to curb mining and trading. Bitcoin was savaged and is currently at $36.5k, after it was hurt in part by China’s crackdown on mining and trading of the largest cryptocurrency as part of ongoing efforts to prevent speculative and financial risks. China’s intensifying efforts to cool raw material prices were also in the mix, as were ongoing inflation concerns, which in turn fuelled lingering taper talk.

SHANGHAI, May 24 (Reuters) – Cryptocurrency miners, including HashCow and BTC.TOP, have halted their China operations after Beijing intensified a crackdown on bitcoin mining and trading, hammering digital currencies amid heightened global regulatory scrutiny of them. A State Council committee led by Vice Premier Liu He announced the crackdown late on Friday as part of efforts to fend off financial risks. It was the first time the council has targeted virtual currency mining, a big business in China that accounts for as much as 70% of the world’s crypto supply.

Treasuries traded narrowly around unchanged levels with the 10-year yield either side of 1.625%. Wall Street continued to meander in back-and-forth action as investors mulled growth versus value positions. GER30 and UK100 futures are up 0.2% and 0.3% respectively, and US futures are also fractionally higher, after a pretty steady session in Asia.

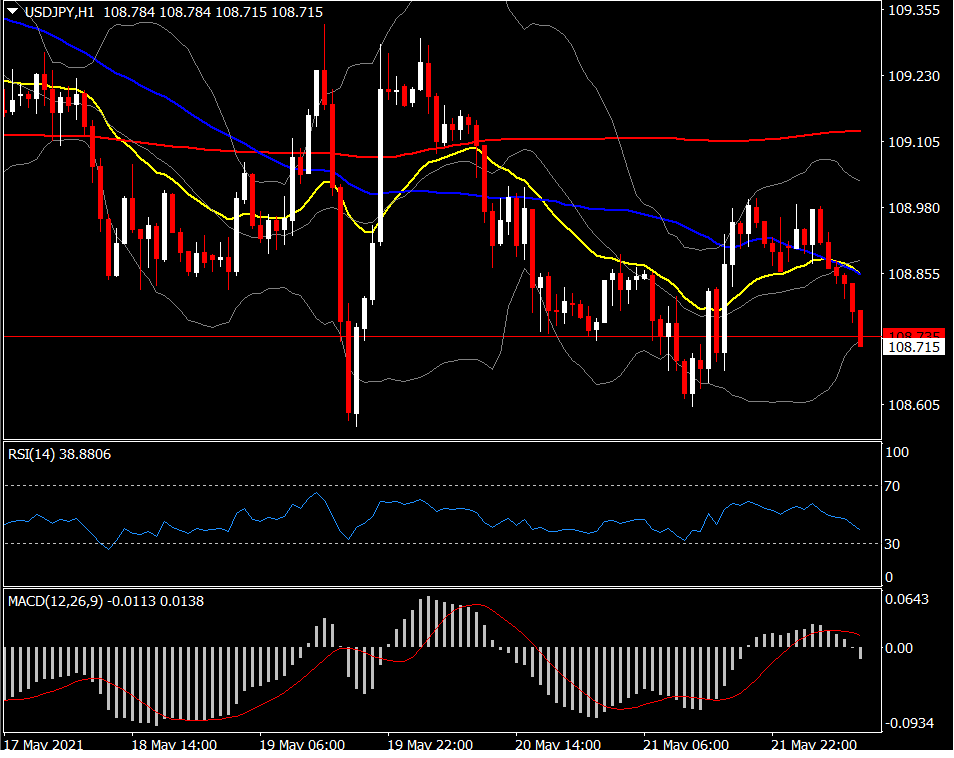

In FX markets the Yen strengthened and USDJPY dropped back to 108.70, while the Dollar was pretty steady against most other currencies. The EUR and GBP both steadied at 1.2190 and 1.4150. The AUD traded near the lower end of its 5-week range as the country’s central bank is seen lagging global peers in tightening monetary policy despite a strong economic recovery. It is currently at 0.7735. USOIL meanwhile is trading at USD 64.05 per barrel.

Today – Whit Monday/Pentecost holidays in parts of the continent will likely weigh on activity. The only key events of the day are Gov. Kuroda and Gov. Bailey speeches.

Biggest FX Mover @ (07:30 GMT) USDJPY (-0.51%) declined from 109.00 to 108.70. Faster MAs remain aligned lower, RSI 38 pointing lower, MACD histogram turned negative but signal line holds positive, suggesting that there is still some negative bias in the near term. H1 ATR 0.0665, Daily ATR 0.5566.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.