The US Dollar has posted fresh highs in a continued divergence from US Treasury yields, which have remained broadly stable over the last day. Global stock and commodity markets remain in turbulent waters, which has been maintaining a safe haven bid for the Greenback.

The souring in relations between China and western nations this week remains a concern, the latest development being news that the US securities regulator is taking measures that would de-list foreign companies from US exchanges if they fail to comply with US auditing standards, alongside a requirement to disclose any government affiliations. It is widely understood that such a move would single out Chinese companies the most. Also on the worry list are the new lockdown measures being taken in much of Europe, disruptions in vaccination supplies, and a possible US tax hike. There are also concerns about new SARS-Cov2 variants that are both more transmissible and resistant to current vaccines, and although there is a lack of hard evidence that this is becoming a major problem as yet, it is the principal justification behind the UK and other governments’ decisions to greatly limit international travel.

Against this backdrop, the USDIndex hits its highest level since November 2020, at 92.69.

As safe-haven trades amid another wave of virus cases and more restrictive lockdowns have kept demand underpinned, especially with central banks pledging ongoing stimulus, the key asset to be closely watched today will be the USDIndex but especially EURUSD.

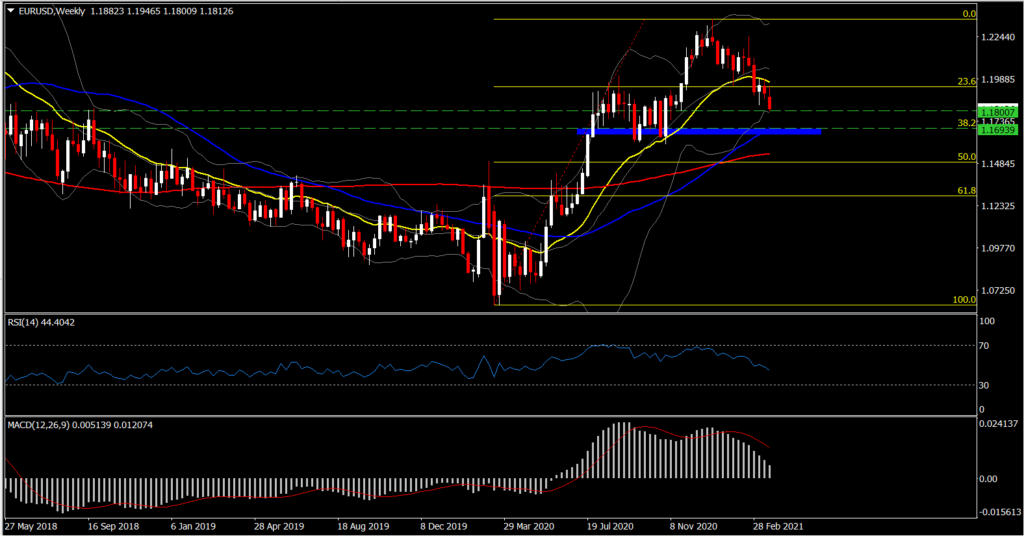

The US Dollar momentum may be pausing for breath now but it could quickly resume if EURUSD breaks below the 1.1800 level. In general Euro and European stocks are still struggling after a mixed session in Asia overnight. A break of 1.1800 could turn crucial for the asset as it could strengthen buying pressure as it is a key psychological level, but on the other hand, markets’ agenda are not in the favour of the Eurozone, while we are just a day before the end of the week and only 4 working days prior to the end of the month and the end of the Quarter.

That said, the choppy trading so far today reveals the unwillingness of the bulls to leave the 1.1800 unguarded, however this along with the end of month and end of quarter flows might find large stops below it. Hence if the bearish bias strengthens drifting the asset below this key level then we could see EURUSD drifting further down, with next Support at 1.1740 and 1.1700. Because of this we might see the US Dollar rally richen to ride the current wave of risk aversion ahead of the weekend.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.