GBPCAD,H1

Progress on the NAFTA front, with the U.S. last week dropping its contentious auto-content proposal, along with firmer oil prices, have given the Loonie a footing of late. The Canadian calendar livens up today after a quiet period. The January average weekly earnings expected to rise 0.2% (m/m, sa) which would match the print seen in the month prior. The BoC has been of the view that some slack remains in the labour market while the economy is operating at full capacity. Tomorrow brings January GDP, where a 0.1% rise is expected after the 0.1% gain in December. Real GDP is on track for a 2.0% pace in Q1, which would undershoot the BoC’s 2.5% estimate in the January MPR, which highlights the slowing growth outlook that underpins our base-case policy scenario for no change in rates until a 25 bp hike in July.

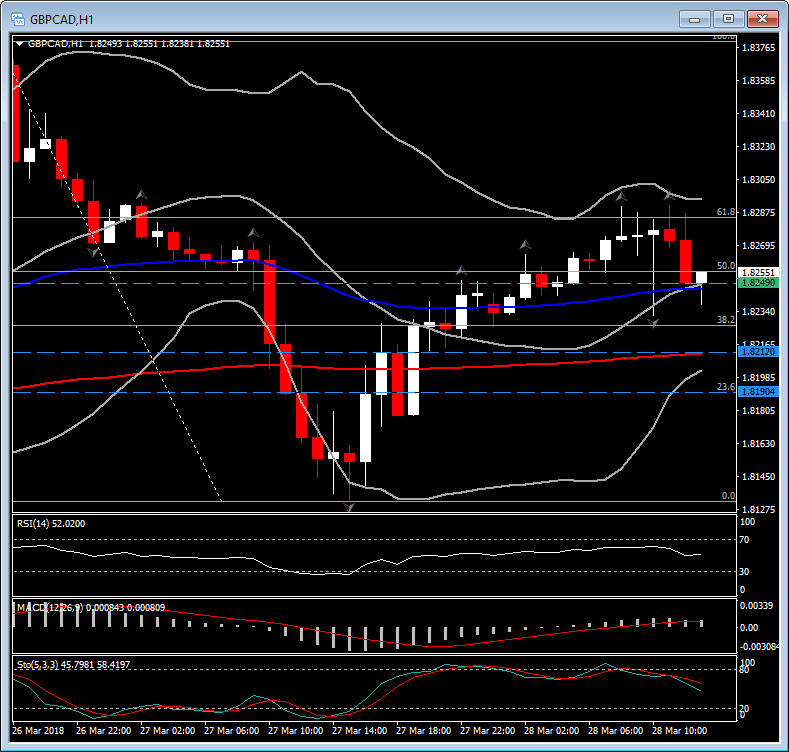

GBPCAD has settled today within the 50.0 and 61.8 Fibonacci retracement levels, near 1.8250 after Monday’s high at 1.8379. In general the pair is in a mix mode this week, with the pair drifting down 1.8133 yesterday morning, and rebounding on US open up to 1.8290, recovering more than 61.8% of the loss seen this week. The Daily technical indicators, though, continue to send bullish signals, suggesting the consolidation seen this week is just temporary. MACD is strongly positive while RSI has flattened below overbought area at 66, indicating that there is further space up to the overbought area.

However, the shorter timeframe picture presents weakness so far, with GBPCAD failing to break above the 61.8 Fibonacci level and with the latest hourly candle moving southwards and closing below the 50.0 Fibonacci level. The pair is currently traded at the confluence of 20-period SMA and the 50 period EMA. The break of the 50.0 Fibonacci level at 1.8255, triggered a short intra-day position , with targets at 200-period EMA at 1.8212, and 23.6 Fibo at 1.8190. Support comes at 1.8292.

In the hourly chart, the RSI is at neutral zone, has near oversold levels, Stochastic lines movign downwards below 50 and are negatively aligned, while the MACD is mixed since remains to the positive terittory, with positive momentum however to decreasing below its red-signal line.

Further more in the longterm, only a break below latest swing low at 1.8130 could suggest a reversal to the downside for the GBPCAD rally since January.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2018/03/28 11:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.