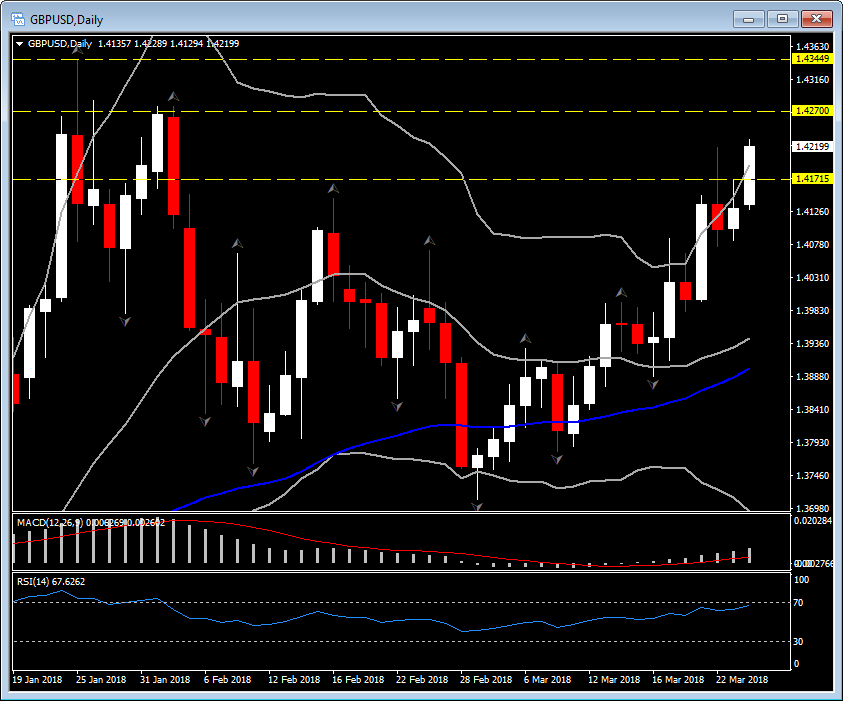

GBPUSD, Daily

Sterling has outperformed so far today, racking up a 1% intraday gain versus the yen, and rising by 0.7% against the dollar and gaining, too, on most other currencies. This saw Her Majesty’s currency smash through the highs it posted in the immediate wake of the BoE policy announcement last Thursday, which delivered the widely expected no-change decision with the unexpected twist of there being two of the nine MPC members having voted for a quarter point hike. It seems that trend-following will continue for now, though concurrently entreat some wariness given Brexit-related risks and expected continuation of relative underperformance of the UK economy relative to its major peers.

Cableis looking as being in process of establishing a range above the 1.4000s, after rising from early-March levels near 1.3700, and after breaking to last Thursday’s peak at 1.4220. Hence next resistance levels come at 2-years highs, at 1.4270 and 1.4344. Every technical tool is looking to a continuation of the uptrend , with pair extending its upper Daily Bollinger Bands, and moving for 10th consecutive day above all 3 MAs. The Daily Movementum indicators confirm the postive momentum as well, with MACD consolidating in the positive terittory, while RSI is at 67, suggesting that there is further upside steam. Daily support is at 1.4150.

Intra-day picture is similar to Daily one, however if any weakness is notices within the day, then it is likely to be faced as a correction to the sharp upside trend, with immediate support at 1.4170.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2018/03/27 11:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.