FX News Today

European Fixed Income Outlook: The global stock market sell off that was led by tech stocks started to ease in Asia, although, Nikkei and Topix still closed with losses of -0.47% and -0.21% respectively and the ASX was down -0.39% at the close. Markets started to pare losses though in the later part of the session and Hang Seng and CSI 300 are up -0.04% and 0.02%. Long yields declined across Asia, but are mostly up from earlier lows and while the 10 year JGB yield is down -0.1 bp at 0.032%, the 10-year Treasury yield is up 0.7 bp at 2.863%. U.s. stock futures are also up from lows and Dow Jones mini and S&P mini are moving higher in tandem with the FTSE 100 future. Risks of growing protectionism and the Fed meeting continue to hang over markets, although it seems after the week session yesterday investors are taking a breather. Oil prices are also higher and the front end Nymex future is trading at USD 62.57 per barrel. Fed and BoE meetings continue to hang over markets, but the calendar is also picking up today, with German ZEW investor confidence and U.K. inflation numbers both able to move markets.

FX Update: The yen has traded softer so far today. USD-JPY has lifted to a three-session high of 106.86, and EUR-JPY and other yen crosses have similarly lifted. Good yen selling was seen at the Tokyo fix (today is a “gotobi” day, date multiple of 5, which is netted out Japanese importers’ demand for foreign currencies), and the currency subsequently maintained a modest downside ebb. Asian stock markets have been mixed, with Japan’s Nikkei closing 0.6% for the worse, but Chinese indexes and U.S. equity futures managing gains. On the trade war front Chinese premier, Li, pledged that it will lower import tariffs and better protect intellectual property rights, and also noted that the WTO has already ruled against tariffs directed at itself. Japan’s trade minister said that there was a “high possibility” that Japan would be exempted from the U.S. tariffs on steel and aluminium. Bloomberg reported a Japanese MoF official complaining that recent yen movements have been too volatile and trading too strongly. Japanese data today included the March Tankan business survey, which fell 1.0% m/m for large manufacturers while rising 2.0% for services.

Charts of the Day

Main Macro Events Today

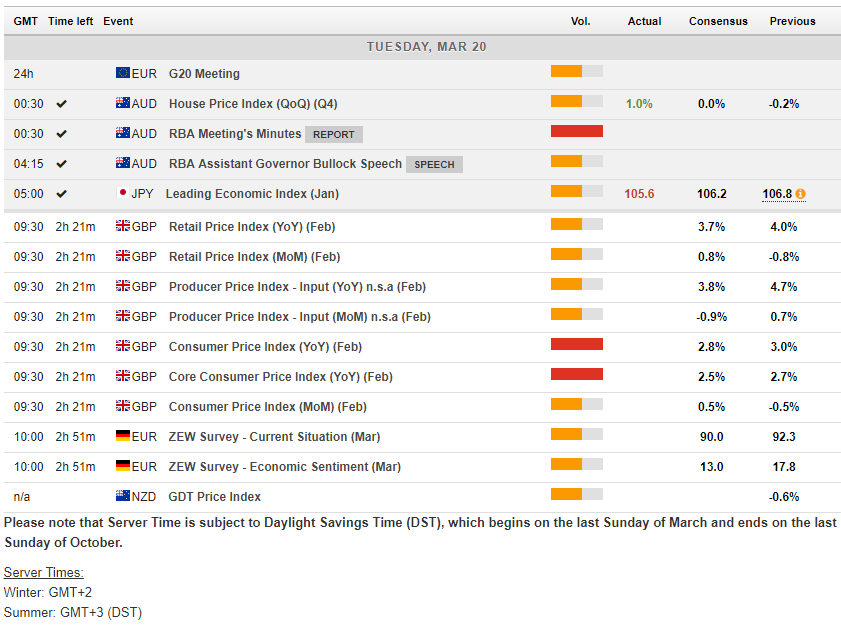

- UK CPI – headline CPI expected to ebb to 2.8% y/y from 3.0% , and core CPI to also decline by 0.2 of a percentage point, to 2.5%. A steadying in the pound’s trade-weighted value on the year-on-year comparison should have imparted an abatement in sterling-induced price pressures.

- German ZEW – is the most forward looking, but also least reliable of Eurozone confidence indicators. And with stock market sentiment remaining shaky amid concerns of a global trade war, a dip to 13.0 from 17.8 is expected.

Support and Resistance levels

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2018/03/20 11:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.